While strong US job numbers have somewhat shrugged off fears of a recession, job cuts at banks and technology companies signal that certain sectors are disproportionately affected. A hiring winter is setting in for the tech industry as organizations commit to a leaner workforce, according to Malav Parekh, analyst at 451 Research, a part of S&P Global Market Intelligence.

Cautious of economic conditions

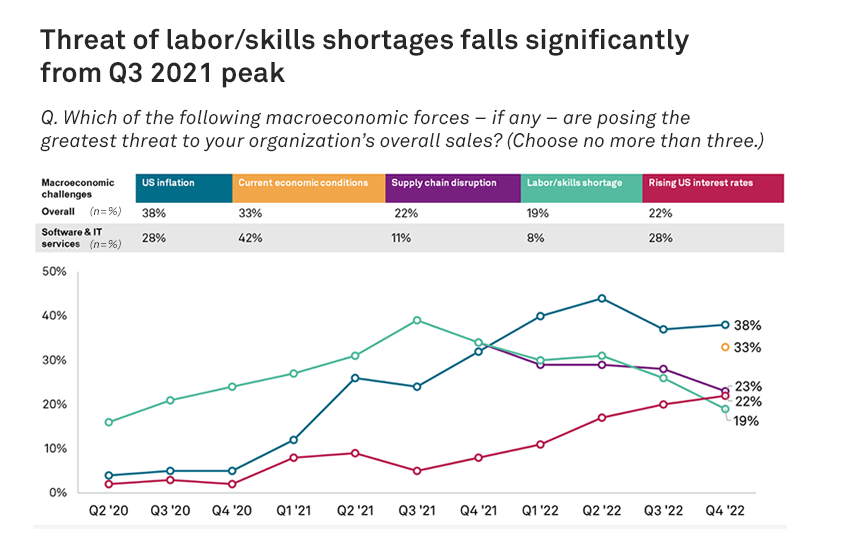

Respondents to a 451 Alliance survey who report labor/skill shortages as one of the three greatest threats to their organization’s overall sales have nearly halved compared to a year ago. This suggests that robust hiring could just be due to pent-up demand for talent. Employment data typically tends to be a lagging indicator.

Regarding the US economic outlook, a large proportion of US respondents (87%) believe that the economy will either worsen (62%) or remain the same as it was in the first quarter of 2023.

Are organizations running lean?

Large organizations, comprised of more than 1,000 full-time employees, are four times more likely to let go workers (21%) in 2023, compared with small to medium-sized enterprises (SMEs), comprised of less than 1,000 full-time employees, (5%). Yet nearly 37% of large organizations also expect to expand hiring in the next 12 months, suggesting that the layoff exercises are being carried out to reduce bloat.

A tech winter

Sentiment in the technology industry has sharply dropped following several high-profile layoffs by some of the tech giants. Respondents in the Software and IT industry (19%) are less likely to increase their workforce, compared to 29% of the overall US respondent base, according to the survey. Additionally, only 19% of technology respondents intend to focus on employee retention.

Strategic priorities in technology organizations have taken a hit as well with only 22% of tech respondents citing hiring and wages as a top priority for their organization in 2023. The tech sector also turns out to have the lowest proportion of respondents (28%) who agree that their organization currently focuses on data security and privacy.

Manufacturing in, technology out

Survey respondents from the manufacturing sector (34%) are still impacted today by the labor market challenges and could be among the top hirers in the months to come.

Want insights on AI trends delivered to your inbox? Join the 451 Alliance.