As storage and data management concerns continue to rise, more organizations are looking to leverage public cloud and other alternatives such as storage as a service (STaaS) to alleviate operational burdens. Expansion to new environments comes at the cost of additional complexity while highlighting the need for enhanced management and optimization, according to our Storage, Budgets & Optimization 2024 survey.

The Take

Data growth continues to be the top storage pain point for organizations, but because data is essential for running all applications, including next-generation workloads such as generative AI, storage spending is an unavoidable cost of doing business. Although respondents claim on-premises storage budgets are expected to increase by 24% in the next 12 months, much of that additional budget will be needed to handle the significant price increases that organizations are facing for their on-premises storage arrays and public cloud storage services. Optimization technologies such as automated tiering in public cloud storage environments have become essential in recent years, and nearly two-thirds of respondents are already using these capabilities to help rein in their cloud storage spending. Operational expenses and storage management continue to be a major pain point for organizations, which could lead to more momentum for STaaS offerings as a replacement for capital expenditure (capex) storage array purchases, although in the study fewer respondents are confident about the prospect of this replacement happening anytime soon.

Summary of findings

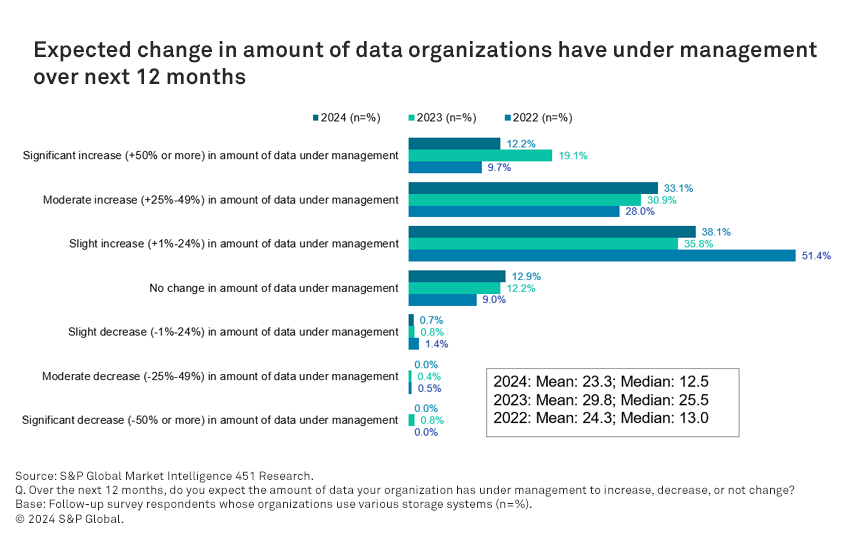

Data growth is the top storage pain point and this issue shows no sign of going away. Respondents expect to see their data under management growing by 23% over the next 12 months. Twelve percent of organizations expect to see significant data growth of more than 50%, while less than 1% of respondents are expecting a decrease in their data under management. Just 13% of respondents expect no change in the size of their data next year.

Cloud data management and storage migrations have risen to become top concerns. The rise of hybrid and multicloud environments has become ubiquitous, and managing these environments has become a challenge for 28% of respondents, making it the second-highest-ranked problem behind data growth. Storage migrations have risen to third place on the list with 23% of respondents identifying it as a top pain point.

Many storage systems and cloud storage customers are dealing with significant price increases. Forty-three percent of respondents purchasing storage systems experience a price increase of 10% or higher, while an additional 25% say their vendor informed them of future price increases. Cloud storage customers had similar experiences with 41% reporting a increase and 24% saying a future price increase was announced for them.

Enthusiasm for the future of STaaS is cooling down. The percentage of respondents that strongly agreed with the statement “STaaS will replace existing storage systems” has dropped from 43% in 2021 to 29% in the latest survey. Elasticity is often touted as an advantage for STaaS compared with traditional capex storage appliance purchases, but in the latest study, only 36% of respondents strongly agree with the statement that STaaS can more rapidly deploy new storage resources over capex, which was down from 61% of respondents in the 2021 study.

Cloud storage consumes a significant portion of public cloud services budgets. Respondents spend 38% of their budgets on cloud storage services. In the study, 65% of respondents claim they are already using the tiering capabilities of public cloud storage providers to optimize their spending on cloud storage, which highlights these capabilities’ importance.

Want insights on cloud computing trends delivered to your inbox? Join the 451 Alliance.