While 2023 was all about inflation and interest rates, 2024 is expected to more directly concern the economy as concerns linger despite slowing inflation. Our Macroeconomic Outlook, Business Trends 2024 Outlook shows that economic challenges are far from over, and while the economy is expected to make a soft landing, not everyone is expecting to land on their feet.

The Take

Inflation is down and the economy is expected to make a soft landing, and yet a significant proportion of businesses remain worried over rising prices; three in five respondents believe that economic conditions in 2024 will be the same as or worse than those in 2023. Much may depend on the US Federal Reserve’s decision on interest rates. Record high interest rates continue to make borrowing difficult, and it will likely boil down to how soon rate cuts will be implemented for businesses to regain a more positive outlook toward the economy. Software and IT services companies are particularly affected by high interest rates and are more likely to reduce capital budget in 2024 than those in most other industries. Another wave of job cuts cannot be discounted, as the survey data suggests software and IT services respondents (20%) are more likely to cut employee count in 2024 than any other industry. On the other hand, it could prove to be an ideal time for cash-flush companies to go bargain hunting in the M&A market.

Summary of findings

Many US businesses are concerned that the economy in 2024 will be the same as 2023, or worse. About 62% of US businesses believe that the economy in 2024 will be the same (24%) or worse (38%) than in 2023, which was an underwhelming year in terms of sales, according to our Business Trends survey. The level of pessimism is slightly higher among small and medium-sized enterprises (SMEs) (68%) versus large enterprises (58%). Expectations of improvement in the economy in the first quarter (17%) are lower than for the full year (28%).

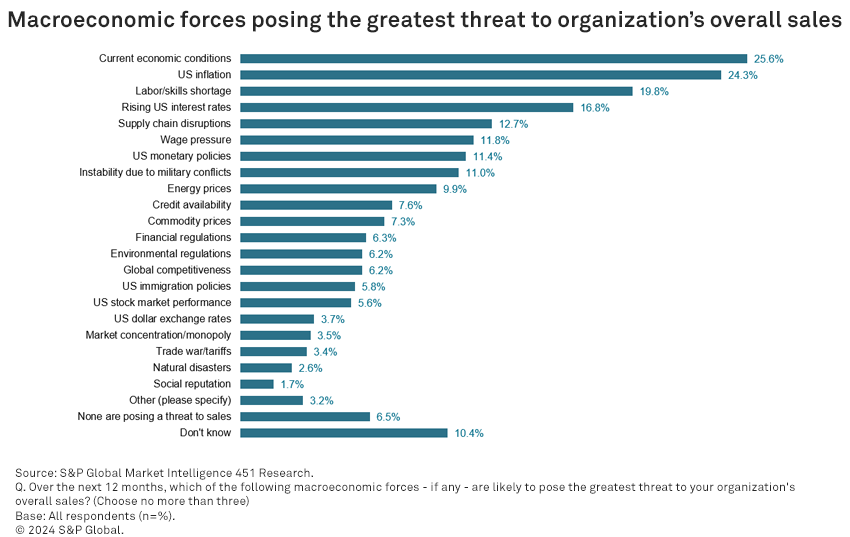

Inflation and the economy lead among businesses’ top concerns in 2024. US inflation and current economic conditions (both 27%) are the top macroeconomic concerns among US businesses, followed by labor/skills shortage (20%) and rising interest rates (18%). Concerns over wages (13%) and supply chain disruptions (13%) are also high. Notably, labor/skills shortages (26%), the economy (22%) and supply chain disruptions (20%) are top macroeconomic threats reported by large enterprises.

Software and IT services companies expect threats from the economy, interest rates and military conflicts. Inflation is the greatest threat among healthcare (33%) and retail (32%) industries in 2024, while economic challenges are the greatest concern among software and IT services (37%) and finance (29%) industries. Labor/skills shortages are among the top concerns for manufacturing (30%) and retail (32%), while lowest among finance (4%). Supply chain disruptions are the biggest concern among manufacturers (30%). Interest rates and instability due to potential military conflicts pose an outsized concern among software and IT services compared to other industries. In fact, software and IT services companies are most likely to see high interest rates as an existential threat to their organization (45%).

Large enterprises may drive the bulk of capital spending in 2024. Slightly more US businesses plan to increase (22%) 2024 capital budget than decrease (20%), driven primarily by large enterprises’ lower likelihood to decrease (15%) capital budget in 2024. Industries most likely to reduce capital budget in 2024 are retail (32%) and software and IT services (25%). Those with a positive economic outlook going into 2024 are significantly more like to increase capital budget (40%) than decrease (6%).

M&A and digital transformation are top priorities among businesses raising capital budget. Among those increasing capital budgets, inorganic business expansion activities such as M&A (40%), digital transformation of operations (38%), and hiring and wages (38%) are the top priorities for 2024. Among those decreasing capital budget, returning capital to shareholders (37%) and debt repayment (35%) are top priorities for 2024.

The hiring sentiment for 2024 is a mixed bag. SMEs with a revenue of more than $1 million are significantly more likely to show a strong intent toward hiring in 2024 than large enterprises. About 26% of SMEs report plans to increase their total number of employees compared with 10% planning to decrease. Interestingly, 32% of large enterprises plan to increase employee count, but 25% plan to decrease; software and IT services (20%) and healthcare (19%) have the highest proportion of organizations planning to decrease employee count, while manufacturing (38%) and retail (32%) are most likely to increase employee count.

SMEs will hire for customer experience, while large enterprises will for IT and product development. Most likely areas of hiring will be in customer service and support and IT (32% each), followed by product development (29%) and sales (28%). While SMEs are most likely to focus their hiring on customer experience — customer service and support (38%), sales (35%), and marketing (22%) — large enterprises will focus hiring on IT (42%) and product development (36%).

Despite a stop in rate hikes, borrowing remains hard for US businesses. Difficulty in borrowing eased slightly to +16, with the proportion of respondents finding it harder to borrow dropping from 24% to 19% — still at a worryingly high level. In fact, before 2023, this high level of difficulty in borrowing was last recorded about 13 years ago, in June 2010. SMEs find it significantly more difficult to borrow (+18) than larger enterprises (+10). Among industries, software and IT services companies are most likely to experience difficulties in borrowing (+23), while manufacturing companies are the least likely (+9). The pessimism over the economy seems to have a strong correlation with borrowing difficulties, with those believing the economy will get worse in Q1 2024 and throughout 2024 reporting an outsized degree of difficulty in borrowing at +31 and +26, respectively. Additionally, about 22% of respondents are either deferring plans to borrow (9%) or reevaluating borrowing plans (13%), and while only 4% report struggling to repay debt, the risk is significantly higher among retail (11%) by nearly three times the average.

Sentiment around sales expectations remains negative, but steady. The Q4 2023 sales expectations and Q1 2024 pipeline for organizations are both negative at -14 and -5, respectively. The sentiment is calculated as the difference between above-plan and below-plan sentiments. While the net sales sentiment value for Q4 2023 is flat quarter over quarter, it has dropped 7 points to -14 from -7 a year ago. The sentiment is worse among SMEs (-18) than at large enterprises (-7). The next quarter pipeline outlook is flat, but negative for the seventh consecutive quarter. However, large enterprises report a positive sales pipeline (+6).

Want to participate in future research studies on macroeconomic trends and get the results delivered to your inbox? Join the 451 Alliance.