A significant majority of enterprises report that IT spending grew during 2023, although not at the rates they anticipated a year ago. A similar proportion expect IT spending to grow again in 2024, with most of those expecting spending to grow by less than one-quarter. Most organizations say the bulk of that spending will go toward ongoing business operation, rather than initiatives focused on growth and transformation, although almost all organizations have some of the latter. Most organizations say they are driven by productivity and operational efficiency, and limited by budgets and the cost of technology. AI has moved to the top of the list of technologies targeted for increased investment. These trends are reflected in the response to the Digital Pulse, IT Budgets & Drivers 2024 survey. Fielded Nov. 2–Dec. 20, 2023, with separate panels of 1,370 and 560 respondents, this survey focuses on drivers, inhibitors and expectations for organizational IT spending in 2024.

The Take

Organizations continued to report growth in IT budgets during 2023, but in a year marked by macroeconomic challenges, businesses were less inclined to increase IT spending than they had anticipated. Times of economic pressure don’t necessarily result in cuts to IT spending, but they may shift focus from growth and innovation to productivity and operational efficiency, as technology becomes a means of reducing operating costs in leaner times.

Technology’s potential to contribute to efficiency is a key factor in respondents’ broadly expressed view that IT spending has a strong return on investment. Most organizations expect IT spending to grow again in 2024. However, IT spending is not immune to cuts, and most organizations also say they might cut back on budgeted IT spending in the face of strong economic pressures.

Summary of findings

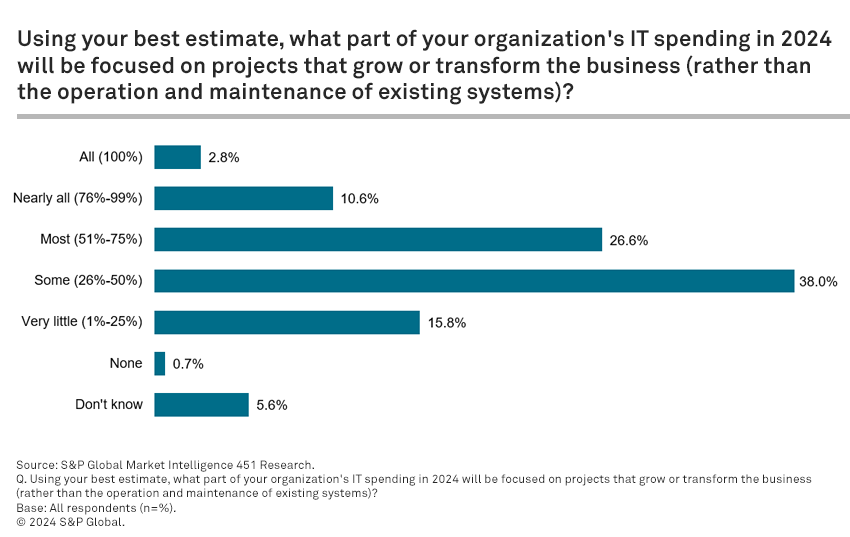

While almost all organizations are spending on IT projects that grow and transform the business, the greater emphasis is on keeping the organization running. A small majority of respondents (57%) say that initiatives that drive growth or transformation will make up less than half of their 2024 IT spending (with the bulk of those landing in the 26%-50% range), whereas 42% say more than half of IT spending will be focused on growth and transformation projects. Hardly any businesses (1%) indicate that none of their IT spending will drive growth and transformation. Software and IT services businesses are unique among vertical markets in that more than half (55%) say most of their IT spending drives growth and transformation. Midsize businesses (by headcount or by revenue) are more likely than the smallest or largest businesses to be committing more of their IT spending to transformation or growth, versus running the business.

IT spending is almost universally viewed as having a positive ROI. Nearly all organizations surveyed (89%) agree that, in general, their organization’s IT spending demonstrates a clear ROI, with 37% indicating they strongly agree.

Most organizations report IT spending growth in 2023, but often at lesser rates than they originally anticipated. Roughly three-quarters (77%) of organizations surveyed report that their IT budgets increased in 2023, with the largest portion of those (47% of the total sample) increasing in the 1%- 25% range. When asked one year ago about their expectations for 2023, almost the same proportion (76%) predicted IT spending increases, but fewer (36%) expected that growth to land in that lowest range, with larger proportions expecting higher growth rates than were ultimately reported. Among respondent categories, leaders in new technology adoption and digital transformation strategy are more likely than their slower-adopting counterparts to say they increased their IT spending during 2023.

Most enterprises expect IT spending to grow in 2024. While businesses overall expect bigger increases than they saw in 2023, expectations are tempered compared with a year ago. The proportion anticipating IT spending growth in 2024 is once again just over three-quarters (78%). While the segment that expect growth in the lowest range (1%-25%) is smaller than the segment that reported 2023 growth in that range (42% compared with 47%), it is larger than the segment that expected lowest-band growth in 2023 (36%).

Following the mainstream emergence of generative AI, AI tops of the list of technologies expected to see increased IT budget in the coming year. AI and machine-learning technology moved to the top of the list of targets for new spending, with 41% of businesses saying they expect to spend more in 2024 compared with 2023. This is compared with 23% that expected to spend more on AI/ML in 2023 versus the previous year. Other technologies high on the list for 2024 include information security tools (cited by 38% of respondents), analytics and data tools (33%), IT services (33%), and IT infrastructure hardware and software (31%).

Prioritization of productivity and efficiency hint at the re-emergence of cost as a primary factor in IT spending decisions. When respondents are asked what objectives will drive IT investment in 2024, several of the top responses point to organizations trying to accomplish more with less. Employee productivity (cited by 44% of respondents) and operational efficiency (44%) land at the top of the list. These are followed by information security (42%) and business agility (31%).

Cost-related factors are the most-cited IT pain points. When asked to identify IT pain points at their organization, respondents most frequently cite budget limitations (36%), the cost of required technology (34%), shortage of IT staff (29%), data privacy concerns (27%), and difficulty acquiring or retaining technology skills (21%). This is only slightly different from the previous year’s results, when budgets landed in the fourth position, cited by 30% of organizations.

Economic pressures impacted 2024 budgeting and could change the course of 2024 spending for many organizations. More than three-quarters (78%) of respondents agree with the premise that economic conditions are having a larger than usual influence on budget planning for 2024. Additionally, more than half (58%) of respondents agree with the notion that their organization would cut or delay budgeted IT spending during 2024 in response to strong economic pressures.

Do you have your finger on the pulse of tech trends? Join the 451 Alliance for exclusive research content on industry-wide IT advancements. Do I qualify?