The shift toward total experience (TX) will be enabled by connecting the dots between data-driven experiences for customers, employees and products. This will impact vendor approaches, organizational roles and responsibilities, and software budgets, but has massive potential for delivering new value. Businesses are vying for supremacy in an experience economy, with success gauged by the ability to cultivate and capitalize on enduring emotional connections with consumers. Where data threads through business realms, more cohesive strategies will harmonize employee experience (EX), product experience (PX) and customer experience (CX).

This merging of strategy and execution, anchored in predictable and data-driven associations, is the new frontier for digital transformation. It is needed to bridge the divide between customer anticipation and reality, and paves the way for deeper personalization and more accurate measurement of the entire experience.

The Take

TX is a new paradigm whereby customer, employee and product experiences will be measured and correlated to ensure the most effective business outcomes across the spectrum of a single experience. The maturing of data-driven strategies that power these previously separate experiences has set the stage for their overlap and interconnectivity. The evolution of CX, EX and PX was partly due to each growing to include the same outcomes, such as being designed for a journey, being personalized, and having a focus on measurement and attribution. Data-driven TX aims to connect these outcomes at strategic points, for deeper measurement of impact. This paradigm could reshape how businesses view their data analytic investments and strategy, and create new roles at the intersection of IT, HR, marketing and beyond. It will likely widen the stakeholders in data-driven measurement, technology buying cycles and implementation. Beyond this, advances like generative AI will further move the needle for how TX is defined and pursued.

Measuring the data-driven TX

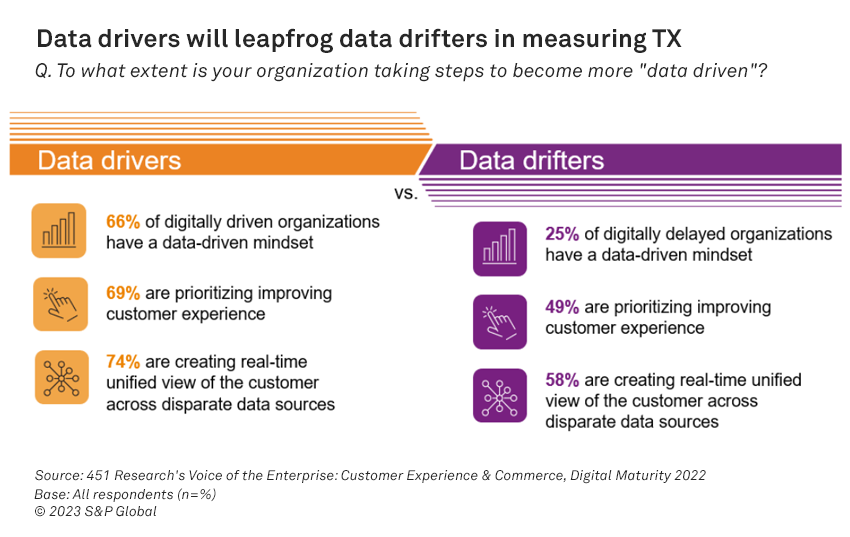

Data-driven approaches to CX have long been key strategies in advertising, marketing and service. Investing in and leveraging this approach has been easier to justify because it more immediately connects to revenue generation. Their strategies vary, but data-driven organizations will likely leapfrog the competition in building and optimizing the CX. In our Digital Maturity 2022 survey, we evaluated the differences between early adopters — which have a formal digital transformation strategy, and make most CX decisions using real-time data and insight — and data drifters, which are digitally delayed and make few CX decisions using real-time data.

Data drivers focus on creating a view of the customer across disparate data sources. These companies are almost twice as likely to use technology to identify moments of influence in the customer life cycle, for better targeting/personalization. Scaling real-time insight across departments is a growing requirement for measuring the TX, from employee interactions to the product experience, related to customer loyalty.

EX investment has moved toward data-driven experiences with the convergence of HR and employee engagement. The demand for more insight into the drivers of employee satisfaction increased during the pandemic, as organizations fought to maintain productivity and retention during the mass shifts to remote working. The Great Resignation solidified this demand, forcing HR and business leaders alike to consider methods for capturing and analyzing relevant data.

According to our Employee Life Cycle & HR 2023 survey, 41% cited an increased need for data literacy as one way the required skill set for HR professionals has changed over the past three years. Data literacy is also reflected in how respondents defined the top roles in their organization: provide employees with the tools and environment they need to excel in their role (53%), connect corporate strategy to employee execution (49%), and keep employees engaged and build a supportive company culture (46%).

These data-driven experiences evolved separately toward parallel outcomes. Data-driven CX is fighting customer churn, while its EX counterpart is trying to shrink employee attrition rates. Both are designed with journeys in mind, and to be measurable and attributable to improve their development. As companies look to become product-centric, product teams are increasingly consequential, and the tools to support them are growing in popularity. Product groups are at the nexus of business and technical teams, and can be pivotal in facilitating collaboration between software engineering teams, designers, marketers and portfolio management teams.

TX is realized when CX, PX and EX are linked. This is just starting to broadly happen with the maturing of data platforms and SaaS application integration, and with leadership realizating that their tools and strategy often have impact beyond what is currently defined as CX, PX or EX. Leaders and vendors are connecting the dots between the data powering the separate experience, as well as widening the lens for understanding ROI.

Market impacts

The move to a TX strategy takes separate data-driven experiences and unifies them into a singular, experience-driven data ecosystem. Even organizations that have mature data strategies will need to consider aligning their KPIs with how they define total experience. In our Digital Maturity 2022 survey, two-thirds of respondents were planning their data-driven strategy, or had a formal strategy in place. We define data-driven as “embedding data-driven decision-making at the heart of the business.” While some industries’ data strategies are more mature than others, few have no plans at all to become more data-driven.

Centralizing an organization’s data-driven decision-making around TX may mean that various department heads and stakeholders will participate in designing and implementing the strategy. Different industries will likely have individual cultural and market influences, but their TX strategy should seek to unify stakeholder priorities to target strategy and execution. This may mean greater data literacy from leaders, and a change in how teams are structured and corporate goals are defined and communicated. It will also influence buying decisions.

Data architecture is even more critical to a vendor’s go-to-market narrative. We expect trends like composable architecture and no-code options for building integrations to grow in tandem with the maturity of TX. Buyers will be looking for TX use cases with outcomes that address all stakeholders, which vendors must be ready to speak to.

One of the biggest challenges is that the experience life cycle (how EX data informs CX, and vice versa) is not one size fits all. Initially, there will be buyer confusion and a demand for clarity around TX use cases. Vertical tools may have an easier time addressing this, but broader data integration and API management vendors like MuleSoft and Boomi may consider a templated approach to on-ramp customers, without specific vertical or industry use cases in mind. Those companies, along with iPaaS vendors, are likely already feeling pressure to centralize and unify data, and this could reshape how some interact within the broader customer tech stack, acting as a central data repository and analysis engine to power the CX, EX and PX elements of other applications and platforms.

Contact center tools are a great example of this, where customer data is collected to streamline the support or sales process. Employees can find the data they need more easily, and customers get a more contextual, personalized experience. In the DAP (digital adoption platform) market, content they create can help customers adopt new features, employees adopt a process, or sales prospects get faster time to value with less vendor help. The data from how individuals use a web application or software can inform the design of the process or future product development.

Chatbot providers will also benefit from access to new data sources that help steer requests in the right direction, providing an opportunity for generative AI to upend TX strategies. Natural language inputs will help chatbots and related tools navigate the data relevant to these experiences. It could also help document critical elements of a TX strategy, or detail the overlap points for better understanding.

The future

With a monumental shift in strategy like TX, organizations need to know the potential ripple effects. New roles will likely emerge to manage TX, and we can envision a TX or experience lead that CX, EX and PX leads report to, or formerly siloed leads becoming TX practitioners, with responsibilities shared equally.

Existing roles are already showing new elements of convergence and collaboration in their responsibilities. HR has become more data-driven, and works more closely with IT — 36% of respondents to our Employee Life Cycle & HR 2023 survey said they collaborate most frequently with the IT department. Nearly half say IT is either directly involved with or leads their organization’s EX strategy. Similarly, almost 60% of Budgets & Organizational Dynamics 2023 respondents said IT is primarily responsible for CX technology investments. Ultimately, the growth of data-driven TX will force all departments to become more data literate, invest in analysis tools and integration, and work more closely with technical departments like IT.

Supporting new roles and responsibilities often raises the question of expanded budgets — a skills gap will likely require new headcount or upskilling that focuses on data literacy and analysis. Market consolidation is already happening among software and platform vendors like Appian Corp. and Qualtrics. This may soften the licensing budgetary blows, but custom integrations and new data sets could add cost. Organizations without a legacy of separate EX and CX approaches could be uniquely positioned to engage TX without the challenge of data silos, but may need support from providers of professional services, managed services or systems integration.

TX adoption will not be a cake walk. Disjointed budgets and siloed software will create friction, as will the disparate nature of data-driven decision-making at some organizations.

According to our Work Execution Goals & Challenges 2023 survey, only about 14% of respondents say nearly all their organization’s decisions are data-driven, while 38% say most are. Nearly 43% said that only some, or even few, of these decisions are data-driven.

Lacking a data-centric culture could hold organizations back from adopting TX. There is also the challenge of alignment, and ensuring executive leadership agrees on how to pursue TX and communicate their strategy. Organizations that overcome these friction points could benefit greatly from TX investment. This is critical because data drivers are allocating a larger percentage of the overall IT budget toward digital transformation, according to our Digital Maturity 2022 survey. They are almost four times more likely to allocate strategic versus tactical spending to digital transformation, and twice as likely to say they deliver exceptional experiences relative to industry peers.

Want insights on consumer tech trends delivered to your inbox? Join the 451 Alliance.