The changes brought to daily life by the onset of the COVID-19 pandemic afforded consumers an opportunity to try new ways of conducting transactions within the altered retail landscape. 451 Research’s Q1 2021 population representative survey looked at some of these digital experiences and the impact they are having on consumer behavior.

All of the services we asked respondents about either facilitate commerce with retail or food establishments that doesn’t require going into the physical building, or they expediate payment or ordering options for those who still visited physical locations.

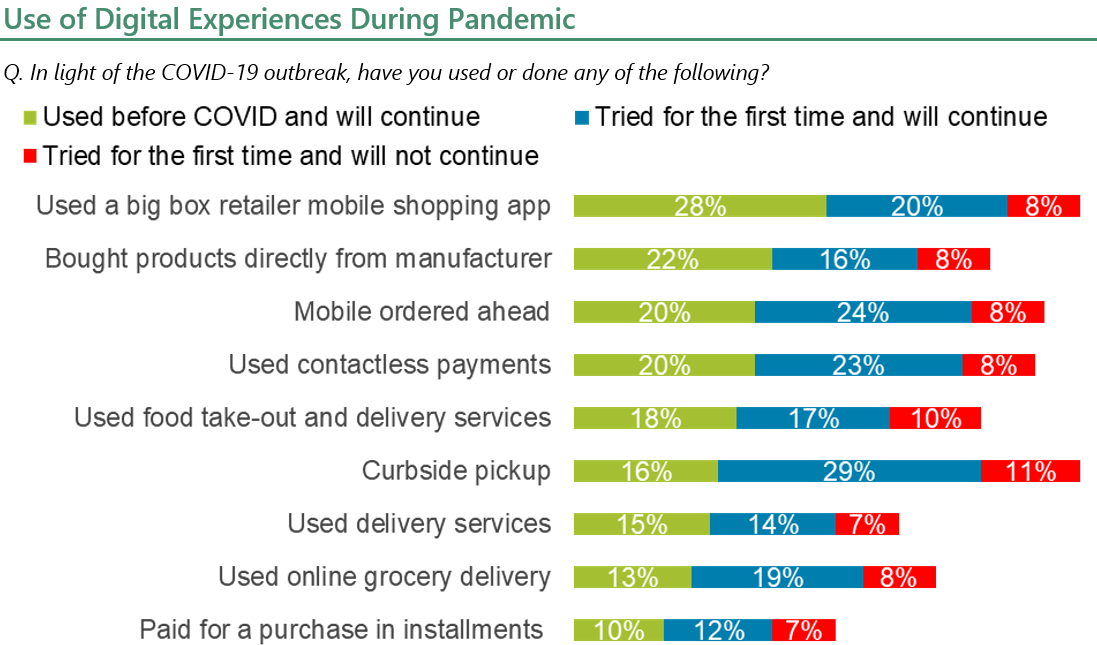

There are two groups of respondents we want to focus on: those who used one of these services before the pandemic and will continue to do so afterwards, and those who tried one of these services for the first time because of the pandemic and will continue to do so afterwards.

Among the former group, consumers were most commonly using big-box retailer mobile apps (28%) and buying products directly from manufacturers (22%) before the pandemic. Taking a look at the latter group, consumers started using curbside pickup (29%), mobile order ahead (24%) and contactless payments (23%) as a result of the pandemic.

When we combine both groups, the data shows that retailer mobile apps (48%), curbside pickup (45%), mobile order ahead (44%) and contactless payments (43%) are most used among respondents who plan to continue to use these services after the pandemic recedes.

At the other end of the spectrum, paying for a purchase in installments was used the least before the pandemic (10%) and added the fewest new users as a result of the pandemic (12%). Thus, it also has the lowest combined total.

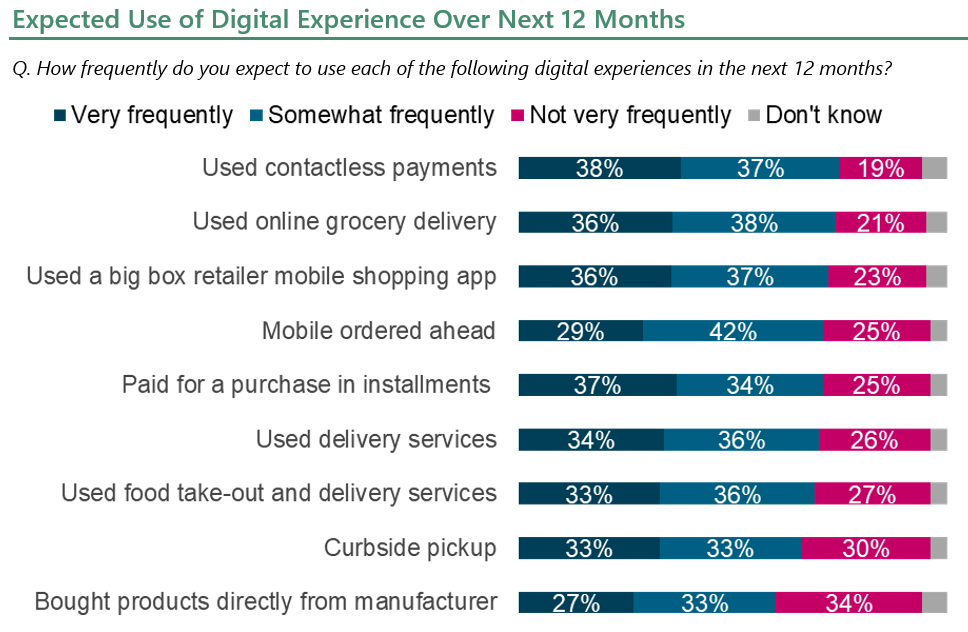

The key to behavioral change is the stickiness of a new service. Since both these groups of respondents indicated they would continue using these services after the pandemic, we asked a series of follow-up questions about how frequently they planned to use them over the next 12 months.

Contactless payments (75% very or somewhat frequently), retailer mobile apps (73%), and mobile order ahead (71%) appear to be the stickiest of these services. Not only do they rank highly in terms of future use, but also in current use. As such, these experiences are poised to continue as integral parts of the new norm for retail and important pieces to providing an outstanding customer experience.

Among this group, online grocery delivery (74%) and paying in installments (71%) are poised to continue with high usage, but the number of consumers utilizing those experiences is lower, so the overall impact on retailers is lessened as a result compared with the stickier service options.

Curbside pickup (66%), one of the most used services currently, is likely to see lessening use in the future as increasingly more consumers regain the confidence to go back into physical establishments to eat or shop. While there will always be some portion of consumers who use this service, the broad increase seen over the last year is purely a byproduct of the pandemic and the efforts to reduce contact during transactions.

Notably, curbside pickup also had the highest number of respondents who said they tried it for the first time because of the pandemic, but will not continue to use it in the future. Yet another sign that curbside pickup only has broad appeal within certain specific circumstances.

Want insights on consumer tech trends delivered to your inbox? Join the 451 Alliance.