An introduction to the metaverse

We describe the metaverse as a vision of the next iteration of the internet: a single, shared, immersive, persistent, 3D virtual space where humans and machines interact with one another and with data, enhancing the physical world as much as replacing it. Real-time interaction between people and data, mediated through the internet, can cover many types of application. Most approaches claiming to be on the way to a metaverse include users represented by avatars that can navigate a 3D model of a real-world or imaginary place.

Currently, the large number of virtual worlds, games and online hubs operate in silos. But the concept of the metaverse relates to the ability for those types of experiences to interoperate and allow users and data to flow between them as needed, as with the internet and web. By our definition, there would only be one metaverse, though it will power many types of experiences. In considering these experiences, we should not only think of 3D worlds and avatars, but of how digital interactions become part of our physical world, as in augmented reality, light field displays, holography or haptic feedback. The metaverse also needs to be accessible to people in any form — not restricted to VR headsets or AR glasses, just as it is not restricted to a PC screen, television, tablet, smartphone or set of spatial headphones. We make this distinction in our definition: “enhancing the physical world as much as replacing it.”

That said, the use of avatars and virtual spaces, with the social and business implications and the complexity of interoperability and standards, will likely be the main driver toward the metaverse, in the same way websites had to become prevalent before e-commerce could evolve. Recall that the mid-1990s web went from a basic and often derided information system to being central to many business and social activities, albeit via the dotcom bubble and subsequent crash. The web also morphed into mobile applications on newly created smartphones, into the world of social media and into a medium for massive multiplayer gaming and esports. At the turn of the century, streaming content was synonymous with piracy, but two decades later streaming of music and of video has become the norm. Online banking and online shopping have had a similar shift from wary approach to widespread adoption. The pandemic and subsequent hybrid office/home working has rapidly advanced the use of collaboration technology, making video calls a primary expectation for remote workers. Gradual evolutions such as these are laying a foundation for the fully fledged metaverse that our definition describes.

Exploring metaverse use cases

We expect the metaverse ecosystem to impact all digital activity. At this level of abstraction, the concept of the metaverse may create confusion, but we can unpack applications in various sectors and highlight key cross-sector use cases. The scale of the question, “How big will the metaverse be?” is not a new problem. When considering the question “What is the web used for today?” the answer will have similarly disorienting layers of nuance and obfuscation. Such a breadth of use cases can lead to hyperbole and confusion, especially if one particular use case is reported as failing.

Metaverse ecosystem and sector influence

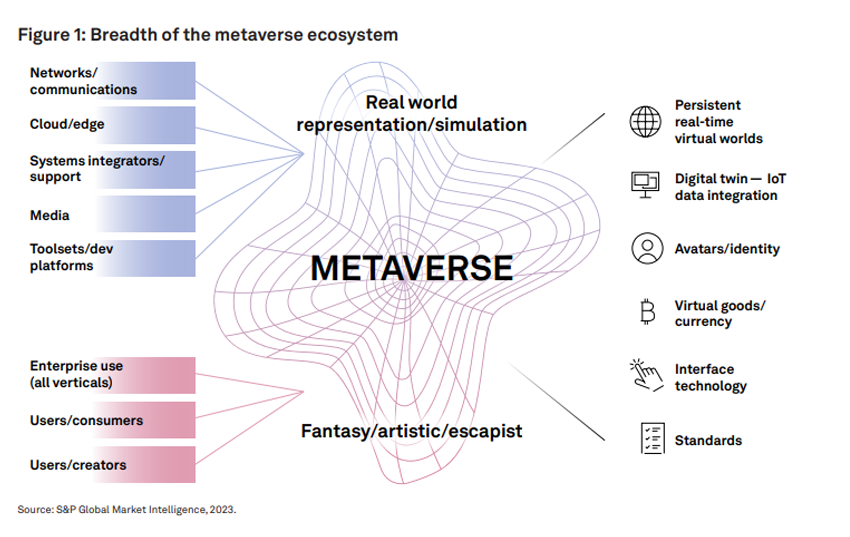

To start to understand the landscape, we take the high-level view seen in Figure 1. At the heart is the metaverse concept, which represents a continuum of digital interaction from high-end industrial simulation, such as digital twins of working plants, all the way to the quirkiest of community art installation or fantasy experience. Between those extremes are the areas of enterprise human collaboration in the workplace and B2B applications, as well as enterprise use of metaverse for marketing, digital content and experiences, and virtual products of all types in a B2C context.

Metaverse-specific development

For the metaverse to reach its latent potential, it needs technology and services developed for it, represented by companies on the right side of Figure 1. Some companies will build their own version of every discrete component, but most won’t, and new components will evolve over time. Much of the metaverse development today has emerged from a model of virtual worlds, avatars and virtual goods (including NFTs). That is one approach to creating spatial interactions, but as we have described the metaverse “enhancing the physical world as much as replacing it,” there is more whitespace to instrument virtual environments with real-world data (e.g., digital twins/threads) and to overlay digital information on physical environments such as with augmented reality (AR).

Existing technology-focused enterprises

The top-left of our ecosystem image represents companies in the technology and services segments that either design and operate systems for supporting and carrying metaverse content or that help to create it. Public cloud service providers and global telecom operators are two such entities. Many of these companies are already engaged in metaverse development or considering which use cases are likely to impact them. It is also worth noting that all enterprises have experienced versions of the same internal communication challenges caused by hybrid working environments, which can be largely eased by metaverse approaches.

General enterprise use and user personas

The bottom-left section of Figure 1 represents all other enterprises that are actively considering how, when, with whom and where they will be putting content and experiences for virtual worlds in the metaverse, in the same way they put things on the web or social media today. It also represents all users and personas (worker, traveler, gamer, concert goer), and in some cases creators of content, which, as with the web, are at a global scale.

Metaverse value chain

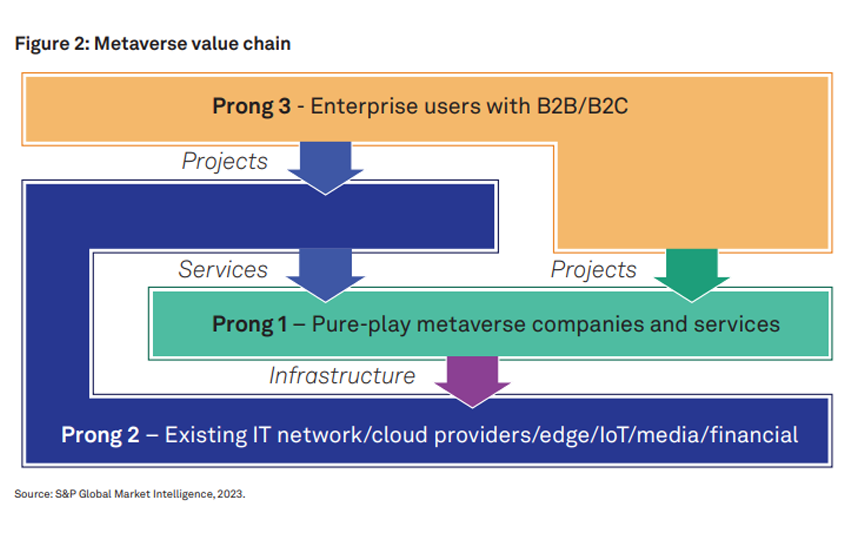

A further relationship between the three groups in Figure 1 we can represent in the value chain in Figure 2.

At the core are prong 1 companies (right-hand side of Figure 1); these are the top 195 “pure play” core metaverse companies that mostly exist to support metaverse development and/or dedicate significant R&D investment to metaverse products and services (e.g., Meta Platforms Inc., Roblox Corp., Ready Player Me, Epic Games Inc., Virbela). Prong 2 companies (top-left of Figure 1) are those that provide infrastructure, tools and services that directly support the new metaverse companies and metaverse experiences, as well as those companies that engage with and deliver projects to their clients with prong 1 companies. Prong 3 represents the firms that will use infinite potential combinations of products and services from prong 2 and prong 1 companies to support their own metaverse products, services or experiences. For instance, Nike, L’Oréal and Walmart are members of Prong 3 by our definitions.

Do you have your finger on the pulse of tech trends? Join the 451 Alliance for exclusive research content on industry-wide IT advancements. Do I qualify?