In-vehicle payments presents a whole new channel of e-commerce, where the integration of digital wallets and built-in connected features enables the technology for a seamless transaction, according to Brian Partridge, Research Director, Jordan McKee, Principal Research Analyst, and McKayla Woolridge, Associate Analyst, at 451 Research.

Skipping the queue

Picture this scenario: You embark on a road trip listening to travel tips from your vehicle’s infotainment system on the dashboard. Halfway through the journey, your children in the backseat are getting bored. You order and pay for some snacks using the voice command, before making a detour to pick up the items at a nearby drive-through.

In this instance, your dashboard has become an e-commerce platform. The use cases go beyond placating cranky passengers to other day-to-day transactions, such as payments for gas, electrical vehicle charging, and parking. More stakeholders, including mobile app developers and fintech startups, are joining the market. BlackBerry, for example, is working with Car IQ to develop its cloud-connected, in-vehicle platform, following the former phone maker’s pivot to the software business.

Likewise, in-vehicle payment creates a new revenue stream for automotive manufacturers. Several legacy car brands that arguably came late to electric vehicles have embraced this field, and entered partnerships with digital payment providers and merchants. It’s a win-win for all parties involved: merchants having better engagement with consumers, increased transaction volume for payment processors, and potentially better deals for consumers when competition heats up.

Cash is no longer king

In-car payment technology remains a relatively nascent field, with the potential for further growth. A survey conducted with the 451 Alliance found that among respondents who lease or own a vehicle, 28% have connected car services. This rises to 45% of Gen Z, and 33% of Millennials.

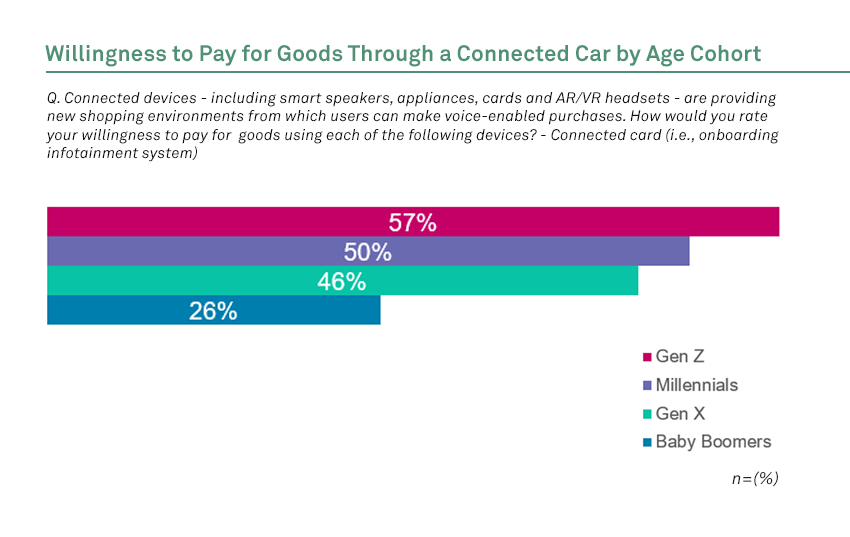

Another recent study conducted with the 451 Alliance had similar findings, where 37% of respondents indicated they would be willing to pay for goods and services via connected vehicle, rising to 57% of Gen Z and 50% of Millennials.

A seamless user experience will fuel the adoption of in-car payment technology. Its delivery could take shape through the vehicle’s infotainment system, which might be further integrated with smartphone apps through in-car interfaces such as Android Auto and Apple CarPlay. Ultimately, in-car shopping may become more mainstream when drivers have more idle time to shop as autonomous driving takes hold.

Safety first

That said, safety is top on consumers’ minds, especially in ridesharing and vehicle leasing settings. Carmakers are addressing this concern, but they are likely to be hit with extra costs and delayed time to market.

Biometric and voice recognition are the two most common authentication methods, although that brings additional integration challenges for developers. Mercedes is planning to use facial recognition in its S-class cars to verify the account holder’s identity.

Meanwhile, the global semiconductor chip shortage is yet another hurdle that will scupper in-vehicle payment, since fewer connected cars will be produced. It remains a fragmented market with many moving parts, from infrastructure and payment providers, to OEMs and retailers.

A long ride ahead

In-vehicle payment goes beyond touchscreens and voice commands. A viable and sticky ecosystem that places user experience at its core is what it takes to displace cash for transactions behind the wheel.

Want insights on consumer tech trends delivered to your inbox? Join the 451 Alliance.