Not long ago, consumers and businesses had to go directly to banks for their funding needs. While banks remain an important part of the lending process, financial technology companies are providing the infrastructure for nonfinancial companies to offer lending services, a concept known as embedded lending. More broadly, embedded lending builds off embedded finance, integrating financial services into a nonfinancial business’s software and applications, which we explored in a previous report.

Embedded lending offers businesses and consumers convenient access to funding at the moment of need (e.g., working capital, credit cards, point-of-sale financing) while giving enterprises the opportunity to earn additional revenue, elevate the customer experience and create a stickier value proposition. We explore embedded lending and its value propositions for stakeholders, and highlight several vendors offering embedded lending services.

The Take

Banks were once the primary lenders. Now, through bank and fintech partnerships, nearly any company can offer lending services under their own brand, a concept known as “embedded lending.” Embedded lending is broadening the playing field for financial services. As more nonfinancial brands launch lending services, fintechs and banks can increase their distribution and revenue, and brands can better engage with their customers, increase product stickiness and gain valuable insight into consumers’ financial needs. We anticipate that the embedded lending market will grow as businesses and financial services providers look for new ways to drive revenue growth, scale and enhance the customer experience.

Context

Lending has traditionally been a cumbersome process in which an applicant applies for a loan; a financial institution reviews and processes the application, and evaluates the customer’s risk; and then approves, denies or modifies the loan terms. Meanwhile, the applicant could wait weeks or months before receiving funds. Many financial institutions have automated their loan origination processes, but customers still need to choose a loan type, shop for the best rates, choose a lender and gather their application data before the application process can even start.

Fintechs are making it easier for consumers and businesses to apply for and access funds by streamlining the end-to-end application process. Furthermore, they’re making loans more personalized so customers can access the funds they need when needed (or before) by serving up preapproved offers. Fintechs can leverage digital channels, AI/ML, customer data insight and multi-lender partnerships to expedite applications and quickly underwrite customers.

However, many embedded lending fintechs don’t target end customers themselves and instead leverage APIs and SDKs to extend their infrastructure to nonfinancial companies looking to offer their own branded lending products such as buy now, pay later (BNPL), working capital, microloans and credit cards.

Value propositions

For B2B and B2C companies, the potential benefits of offering adjacent lending products under their own brands are many. Merchants can earn per-transaction revenue or a revenue share to help drive revenue growth, but must consider if customer demand is substantial enough to warrant the cost of implementing lending services. Next, offering customers access to capital through credit cards or other loans can help serve as a customer engagement tool, which can increase product stickiness. Offering customers a streamlined lending experience in a singular platform can enhance the customer experience and deepen loyalty.

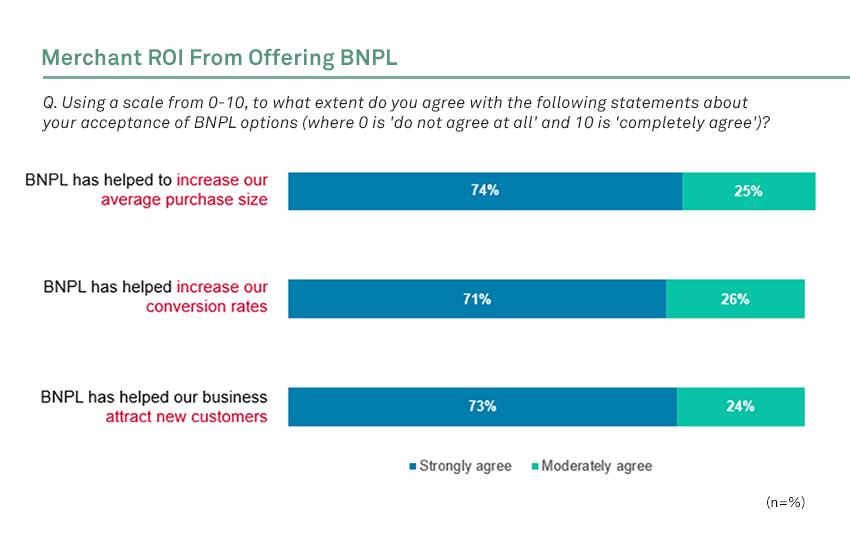

Lending can also provide deeper insight into customers’ financial needs, which can be used to provide more personalized offers. When financing is offered at the point of sale, merchants can attract new customers, increase conversions and boost average order value. Consider that over 70% of merchants that offer BNPL strongly agreed that it helped to attract new customers, increase average purchase size and increase conversion rates, according to our 2022 Merchant Study. (The merchants surveyed may have offered BNPL under their own brand or through a BNPL provider.)

For customers, accessing lending services from their desired brands can create a more streamlined experience since it eliminates the need to go to third-party lenders. As a result, customers can more easily apply for loans and receive faster approval than if they had gone directly through a third-party lender.

Furthermore, bringing lending closer to the point of sale can create a more integrated and personalized experience.

For fintechs and banks, providing embedded lending services can increase distribution, scale and revenue. By providing the capital behind embedded lending services, banks can remain a key player in the lending process.

Common use cases for embedded lending include:

- Platform lending — Software platforms offer businesses capital. For example, Mindbody works with Parafin to extend financing to the health and wellness businesses that use its software.

- BNPL — BNPL providers white-label their services to businesses looking to offer a BNPL service under their own brand. One example of this is Ikea’s branded BNPL service, which it partners with Jifiti to offer in select markets.

- Credit cards — Fintechs provide “credit cards as a service” to businesses looking to offer their own branded credit cards. For example, the cryptocurrency trading platform BlockFi works with Deserve to offer customers a cryptocurrency rewards credit card.

Want insights on fintech trends delivered to your inbox? Join the 451 Alliance.