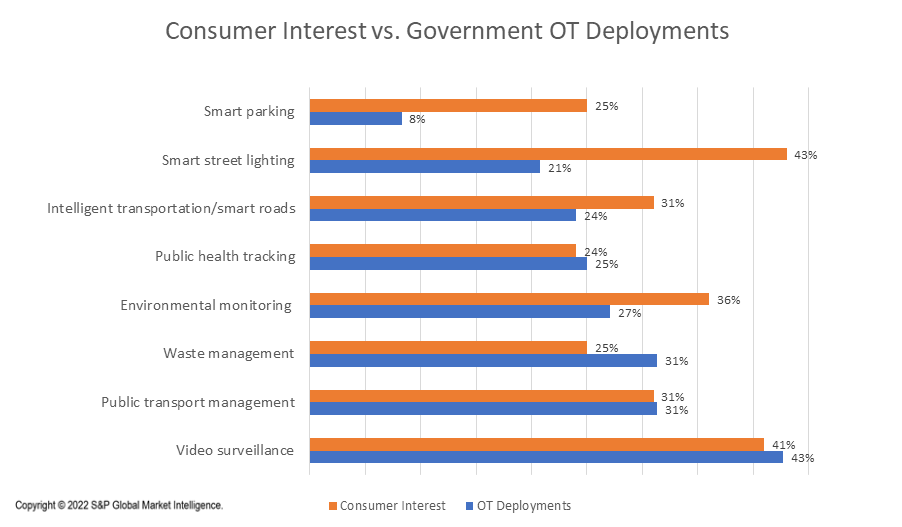

Understanding consumer interest in smart-city initiatives is critical to help cities achieve return on investment for their deployments. In this post, we compare the smart-city deployments reported from government respondents in a 451 Alliance survey with consumer interest in those deployments as captured in a 451 Alliance consumer survey. While current smart-city deployments mirrored consumer interest in some areas, other smart-city use cases generated outsized interest from respondents, presenting an opportunity for cities and vendors to concentrate efforts in these areas.

High-Deployment/Low-Interest: Smart Waste Management

The single use case where deployment outstripped interest was smart waste management. While optimizing trash pickup and minimizing truck rolling is a valuable cost-saving measure for cities (31% have deployed waste management), citizens expressed slightly less interest in the initiative, with just one in four finding it appealing. Use cases that optimize city operations, like citywide data or timely removal of waste, are often deployed at a higher rate than consumers are necessarily interested in.

Low-Deployment/High-Interest

Areas in which consumers expressed more interest than current levels of deployment represent the sweet spot for cities or vendors in the space looking to “level up” in their deployments of smart technology.

Smart street lighting, a common first deployment for cities, led all other use cases in terms of appeal with 43% of consumers expressing interest. However, only 21% of government respondents reported deploying it: the highest disparity between supply and demand in the survey.

Smart parking and intelligent transportation/smart roads also enjoyed higher interest than current supply. Smart parking, or the ability to find and pay for parking spots, was of interest to 25% of respondents, yet deployed by only 8% of cities. More flexible parking options have gained increased focus as cities look to manage their curbs in the wake of pandemic impact on curbside dining and delivery.

Intelligent transportation/smart roads, meanwhile, refers to a breadth of technologies that optimize vehicle experiences by predicting traffic flows and reducing downtime. While a quarter of cities had reported deploying technologies around transportation, 30% of consumers expressed interest in smart transportation, especially its ability to save time and reduce emissions.

Finally, respondents expressed relatively high interest in environmental monitoring (36%), while just 27% of cities reported deploying projects in that area.

Equilibrium

Consumer interest and city deployments roughly matched for three use cases:

- Video surveillance

- Public transport management

- Public health tracking

Video surveillance (deployed by 43% of cities) topped all other use cases for government deployments while generating the second-greatest appeal among citizens (41%). Most often used for public safety or traffic monitoring today, video surveillance has gained a certain amount of notoriety in cities but will likely remain widely deployed due to its relatively cheap and replicable nature.

Public transport management was of interest to about one-third of respondents and deployed by about one-third of cities surveyed. As cities aim to lure riders back onto public transit and shift away from car dependence to reduce emissions, investing in efficient public transportation is a trend we expect to increase in coming years.

Finally, public health tracking was selected by about one in four respondents. While public health tracking can be valuable to help reduce the spread of disease and promote public safety, consumers appeared to be not as interested in its use, perhaps due to the often-invasive nature of public health tracking that can involve temperature screening and other measures.

Want insights on IoT trends delivered to your inbox? Join the 451 Alliance.