Autonomous vehicles have offered a tantalizing promise of what the future of consumer transportation could be: a hands-free, driverless experience in which vehicles communicate with road infrastructure to optimize travel and safely transport riders. As the auto original equipment manufacturers of the world build up their robotaxi arsenals and capacities, cities and states have begun planning to update road infrastructure with the technology that AVs would need to communicate with one another and their surroundings.

While 2022 saw billions in proposed funding for U.S. infrastructure upgrades to support these vehicle-to-everything (V2X) communications, it also saw several high-profile industry players exit the space entirely, including Ford Motor Co.- and Volkswagen AG-backed Argo AI. So what is next for the tumultuous AV market? Should cities and states continue to build up their V2X infrastructure? And when can we expect AVs to make it to the road at scale?

The Take

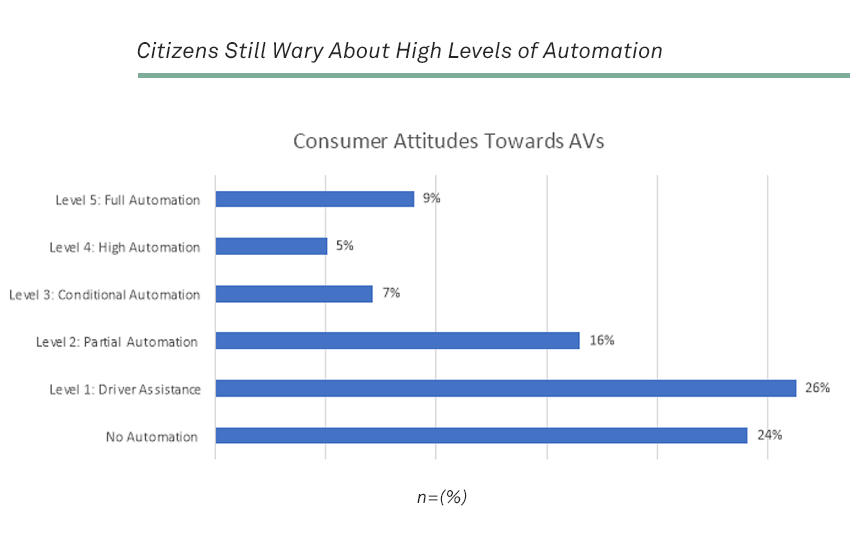

What was once seen as the inevitable evolution of transportation, the AV industry has faced a zigzag of accelerations and setbacks. Coming off an optimistic peak of strong market sentiment around 2017-18, the hype around AVs has since dissipated. Facing a market-wide economic downturn and supply-chain issues, the market has seen compounding challenges in overcoming weak consumer sentiment, tackling technological woes, and addressing a lack of public infrastructure necessary for self-driving vehicles to safely operate on a wide scale. As the target date for widescale AV adoption gets delayed again, OEMs, consumers and cities are grappling with just how tangible the promise of AVs might be.

While these delays have cast doubt on the sector, as the old adage goes: Better late than never. It is likely that fully driverless vehicles will make it to a widescale market by 2025, shoring up opportunities for not only OEMs and AV vendors, but also IT infrastructure providers that will equip roadways with the communications needed to support low-latency data demands. With just two years to go, IT providers can work with individual cities or states on pilot projects to gauge interest and demand.

Primer on AV tech

Autonomous vehicle technology must perform four basic functions to be successful. Representing the “V” in the host of V2X communications, connected vehicles communicate with their surroundings through onboard units that are equipped with GPS and transmit and collect data from various applications.

Localization. The vehicle must know where it is in the world. This is typically done using various localization sensors and software on the vehicle — GPS devices, inertial measurement units and wheel encoders, and onboard mapping software.

Perception. An autonomous vehicle must know what is around it. On-vehicle perception sensors include cameras, radar and LiDAR. These devices capture data about the environment around the vehicle, both close by and far away. Perception sensors can also inform localization at a micro-scale, such as whether a vehicle is centered in a lane or drifting to one side.

Planning. First, an AV must have some sense of where it is going and how to get there. Whether it is a Class 8 long-haul truck, a city shuttle, or a sidewalk robot delivering pizza to college kids, the vehicle must have a plan for getting from point A to point B, and a means to dynamically update that plan depending on its other functions. This planning function also includes the ingestion of localization and perception data combined with high-performance, onboard compute to determine the best course of action, multiple times per second. Oftentimes, this planning function must determine which of several options is the best.

Actuation. Finally, an autonomous vehicle must have a drive-by-wire system that translates computer instructions into driving actions. Once the planning system decides that the AV must brake hard, the drive-by-wire system turns those instructions into action so that the vehicle slows down quickly.

Off-vehicle information can also be used by autonomous vehicles to improve their operation. This is often referred to as vehicle-to-everything, or V2X, technology, and includes vehicle-to-vehicle, vehicle-to-infrastructure, vehicle-to-pedestrian, and others. V2X data does not necessarily need to communicate with vehicles on a sub-second basis to be useful. Updated mapping and traffic information that sits in a near-edge datacenter or even in the cloud can help inform AV operation. For example, there could be updated information about a lane closure or traffic accident 20 miles away from where an autonomous vehicle is operating. By downloading that information when it has connectivity, that vehicle can adjust which lane it should drive in or alter its route altogether. Data for these V2X capabilities could come from in-road sensors, roadside cameras or traffic signals, among many other locations.

Rise and fall of AV vendors

The challenge facing vendors in the autonomous vehicle space is multidimensional — the technology problem is more complex than they thought, especially on busy streets, and the commercial viability is questionable. As research and development costs rise, vendors will still be up against years of losses before seeing any meaningful revenue out of AV projects.

Deals in the sector reflect a meaningful slowdown of M&A and investment in the sector. Since the first AV transaction was tracked in 2007, the segment has seen a total of 157 acquisitions valued at $49.5 billion, according to 451 Research. Deals have steadily decreased in frequency and value since a peak around 2017-18. Last year saw just 15 transactions valued at $1.5 billion, compared with 2017’s high of 30 deals valued at $16 billion.

Argo AI’s exit from the space in October offers insight into some of the tumult that vendors are facing. After raising $4.6 billion in combined investment from Ford and Volkswagen since 2017, Ford CEO announced that the OEM would renew focus on L2/L3 vehicles, citing a lack of commercialization prospects for L4 advanced driver-assistance system vehicles. Nuro, an autonomous delivery services provider, fired 20% of its workforce in November citing lack of funding optimism, and Hyundai Motor Company and Aptiv PLC’s joint venture — Motional — announced layoffs in early December.

Apple Inc. announced that its ambitious plans for developing a fully autonomous L5 vehicle would be delayed by a year as the company retreats to more conservative goals. Whereas the company had planned for its original $120,000 vehicle to support fully driverless operations, Apple slashed the price by 20%, and reported that the vehicle would still need a steering wheel and brakes for driver intervention on non-highway routes.

Despite these hardships, OEMs are not yet ready to call it quits on AVs by any means. While Intel Corp.’s sale of Mobileye Global Inc. in October reflects another notable exit, Mobileye is doing fine on its own. Its stock has risen to $34 from its IPO price of $21 per share, and the company anticipates fiscal year revenue of $1.8 billion in 2022. General Motors Co. remains committed to expanding its robotaxi unit, while Cruise reportedly is in a “large number” of cities in 2023. Motional, Hyundai and Aptiv’s JV, inked partnerships with Uber Technologies Inc. and Lyft Inc. to support robotaxi services in a handful of major U.S. cities this year.

A path forward for cities and public infrastructure

There is significant debate in the industry about whether driverless, autonomous vehicles need V2X capabilities to be successful. In many ways, V2X capabilities can be considered just another source of data insight: They can enhance operations but AV driving won’t fail without them and it many cases they can be replaced by other on-vehicle localization and perception sensors.

The infrastructure upgrades required to support city-wide intelligent transportation system (ITS) deployments can be significant. They typically require the installation of secure, scalable wide-area connectivity, including current 4G/LTE and IoT variants like NT-IoT or LTE-M and emerging 5G services. This allows cellular V2X (C-V2X) and dedicated short-range communication radios embedded with roadside units and on existing infrastructure to communicate back and forth with onboard units in vehicles in real time.

V2X systems can also be connected to the cloud, where select historical data can be stored and analyzed for better prediction and benchmarking. A host of ITS vendors, including Iteris Inc. and Econolite, provide full-stack offerings to help cities deploy this ITS infrastructure. With underlying ITS network infrastructure, cities can layer applications supporting a variety of use cases such as transit signal preemption for emergency vehicles, connected crosswalks, and intelligent intersections.

The tumult in the AV industry has stirred confusion in cities, which are becoming increasingly split in their approach to updating roadside infrastructure for AV applications. According to the U.S.-based National Conference of State Legislatures, 23 states have passed a total of 69 AV-related bills since 2017 addressing issues like cybersecurity, infrastructure and vehicle testing. While policy is preceding deployments in cities, some city leaders have praised AVs’ ability to overcome a key challenge in public transit and city operations — driver shortages. As demand for drivers grows, public-sector positions can’t compete with private-sector salaries. Partially autonomous vehicles such as buses that operate on predetermined routes provide a unique opportunity for AV or shuttle services to fill a gap in services, while also offering increased efficiency and reduced congestion.

Such fixed-route AV shuttles might be the easiest path forward for cities eying autonomy. Whether they are deployed as city-wide public transit shuttles or utilized in a more limited way (such as a school bus replacement), starting small should allow cities to modulate AV supply as consumers become more comfortable with the technology. Several cities have robotaxis or AVs in operation via local partnerships for ride-hailing or on-demand mobility. For example, through a partnership with Via, the city of Arlington, Texas, has integrated self-driving shuttles into public busing operations around one-square mile at The University of Texas at Austin. The Colorado School of Mines also operates a free autonomous shuttle for students and faculty that operates on a fixed route around campus.

Want insights on smart car technology and automotive industry trends delivered to your inbox? Join the 451 Alliance.