“Retail’s Big Show,” put on by the National Retail Federation (NRF), was held in January in New York, drawing over 35,000 attendees and at least 1,000 exhibitors to discuss the latest in retail technology innovation. The state of retail has been in transition over the past decade, leading to industry caution mixed with optimism. Retailers are still spending on their customer experience (CX) strategies, with a noticeable shift in dollars being funneled into digital experiences to compete in the experience economy. Our data shows e-commerce transactions are expected to increase at a compound annual growth rate of 16.8% from 2022 through 2030.

Predictive versus generative AI

Major breakthroughs in AI took much of the world by storm in 2023. While concerns around generative AI span data security, customer data privacy and output accuracy, most of the discussion at the event was fairly positive as retailers search for practical use cases to incorporate AI. Our data shows that retailers are using generative and predictive AI tools for synthesizing data, generating content, automating workflows, and engaging in conversations across sales, marketing and customer service.

These use cases are a combination of both generative and predictive approaches to recommend audiences and to improve creativity and operational efficiency. Many use cases discussed were around text generation for marketing content, predictive insight to guide campaigns or for overall CX improvements. We met with many companies that have advanced the use of large language models (LLMs) and prompt-based interfaces specifically for customer experience use cases, including “phygital” (blending physical and digital experiences) adtech startup Adpaka, live shopping early entrant Bloo Kanoo and AI-led creative platform Avataar.

At NRF, Google showcased a number of retail use cases across the customer journey. These included adding digital commerce enhancements using LLMs built into its machine-learning platform Vertex AI to support search for retail, conversational commerce with multimodal conversations, prompt-based marketing studio for guided campaigns and customer service for improved operations. Adobe Inc. continued its path on GenStudio for its generative AI-fueled content creation and content supply chain use cases. In an increasingly digital world, businesses face a huge surge of content types and formats that must be managed across departments, ecosystem partners and customer touchpoints. Salesforce Inc. also announced extended generative AI capabilities specifically for retail within its new Einstein 1 platform to process real-time customer behavior and preference-related insight that is also backed by LLMs to create a more connected experience.

The use of generative AI is also adding to the volume and velocity of content, as well as raising expectations that content will be dynamic and optimized. About two-thirds (68%) of digitally driven organizations place high importance on creating and delivering immersive digital content (e.g., rich photo and video assets), according to our 2024 Trends in Customer Experience and Commerce preview. Businesses must ensure a content supply chain feedback loop from ideation and creation to activation and measurement, with strong orchestration and a data-driven foundation.

Data-driven experience economy

At NRF for the last few years, we have seen much discussion around the use of customer data. Growth in customer data drove the demand for new ways to unify customer data and activate it across different channels of engagement. Requirements for a modern 360-degree view of the customer and real-time customer profile to improve CX across the entire journey will likely accelerate investments in customer intelligence platforms. These platforms provide more than just a data repository for unstructured and structured data — their capabilities allow for a real-time customer profile graph that is actionable across multiple teams and stakeholders, from marketing to product development to customer service. Adobe, Salesforce, Microsoft Corp. and Twilio Inc. showcased their advances with their own approaches to a data platform. There were also vendors such as Treasure Data and Amperity offering their own approaches to unifying and activating customer data.

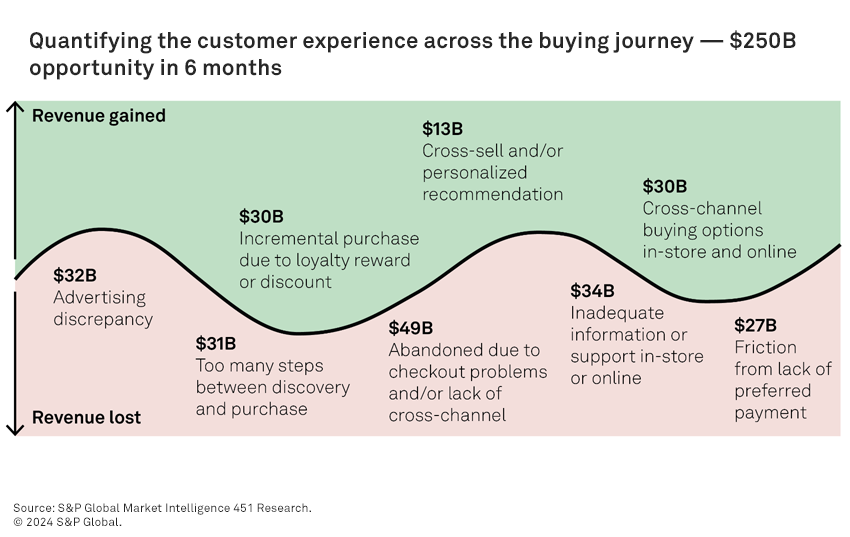

Understanding customer data is essential to improving the experience both in physical and digital stores. Our research shows that quantifying the customer experience across the buying journey reveals that addressing points of friction using technology advances represents at least a $250 billion opportunity over a six-month period. This would include gains such as incremental revenue opportunities due to a relevant loyalty reward or discount, personalized cross-sell opportunities and available omnichannel experiences.

However, revenue lost is also substantial by advertising discrepancies, too many steps between discovery and purchase, and even the lack of preferred payment options at checkout. One-third (33%) of consumers surveyed abandoned a purchase at least once in the previous six months due to their preferred payment method not being offered. This jumps to over half of Gen Z (54%) that have abandoned a purchase for the same reason, according to 451 Research’s Connected Customer, Quantifying the Customer Experience 2023 survey.

The future of in-store shopping will focus on digital enablement such as internet of things touchpoints

One area in particular that is of growing interest both inside and outside NRF is advancing the capabilities of retail stores beyond traditional methods. In recent years, we have seen increased efforts across the industry (which has been notorious for being somewhat of a blackout area for businesses) when it comes to digital CX, experiences integrated with IoT technology, and beyond. Vendors such as Verizon Communications Inc., Lenovo Group Ltd. and Cooler Screens are examples, working to make a case for stronger retail ecosystems by bringing in-store shopping into a more modern experience. Smarter stores will mean more seamless experiences for shoppers while allowing retailers to bolster their datasets and customer profiles — IoT efforts coupled with improved connectivity will create the store of the future through digital mirrors and kiosks to improve the in-store buying experience. They use smart sensors to assess foot traffic, change digital ads and provide content via screens. We expect that growing efforts to create more immersive in-store customer experiences and to improve operational efficiencies will likely take what has been in proof of concept for at least five years and accelerate adoption over the next two to three years.

Other vendors present at NRF include BRData, which seeks to help stores connect with customers before, during and after they shop using data, as well as Amazon.com Inc. and its Just Walk Out technology. There were plenty of startups present at the event, including RetailAI, which seeks to match customers with products, and NeuRetail, which offers a retail platform during an in-store shopping session such as carts and self-service kiosks. The retail store experience as a whole has largely remained stagnant in terms of technological adoption outside of things such as inventory management, checkouts and location data, so seeing a push toward more advanced experiences by way of things such as IoT holds great promise for the next iteration of the industry. It is poised for change, given recent leaps in innovation. According to 451 Research’s Customer Experience & Commerce, Digital Maturity 2023 survey, AI (53%), IoT (31%) and cloud native (31%) are the top three disruptive technologies that the retail industry is planning to adopt over the next 24 months.

Composability from digital experience to payments

Keeping up with the sheer velocity of digital experiences amid growing consumer appetites is driving businesses toward a more flexible and iterative technology stack. As the world transitions to a “digital by default” mode, serving customers that expect dynamic yet consistent experiences across a wide array of emerging devices and channels is an ongoing and increasingly pressing challenge. According to our Digital Maturity 2023 survey, 42% of retailers are hamstrung with legacy technology that is monolithic and rigid, inhibiting agility and innovation and resulting in IT staff struggling to keep up with line-of-business demands.

As a result, retailers are investing in more composability to reduce complexity, create manageable components and drive operational enhancements. However, it is not about headless. If anything, it is about a combination of composability with easier-to-use templates for their nontechnical users. Only 10% of retailers want truly headless tools. There could also be some waning of interest from businesses that have tried and struggled with headless deployments. The general retail segment showed higher interest in past years; there is a need to understand that headless might not be suitable for all deployments. While it provides IT staff with technical agility and advances in powering data-driven experiences, it is also a blank canvas that can add barriers without a clear vision. Since the front and back ends are separate, it could be complex to ensure a consistent experience across all channels.

Platforms might also not all necessarily function out of the box compared with other commerce platforms. At the show, many of the large incumbent commerce technology vendors with broad suites have demonstrated more composability into their offerings as more businesses require microservices, including API-first architectures from the likes of Adobe, Salesforce and Shopify Inc. There is also pressure from specialists such as commercetools and Elastic Path gaining momentum in the market.

One area that is important for composability and components is in the digital payment ecosystem to provide a streamlined checkout process and payment flexibility with an embedded buy button. For example, Salesforce allows for embedded commerce experiences with a partnership with Stripe. Shopify has Shop Pay, which enables buyers to check out with one tap using their securely stored payment credentials. Shopify also works with Affirm to power Shop Pay Installments. One-click checkout and buy now, pay later (BNPL) are examples of embedded purchase experiences driving conversions at the point of sale. Our research shows that over one in four consumers (28%) say they are highly likely to complete a purchase with a business that offers one-click payments on a store’s application.

Similarly, 70% of consumers that have used BNPL in the past six months say they made at least one purchase they were not intending to make due to BNPL being offered as a payment method at checkout, according to our Connected Customer, Quantifying the Customer Experience 2023 survey. We see a parallel story on the merchant front, where nearly three in four (72%) merchants that offer BNPL at checkout strongly agree that it has helped to increase their conversion rates, according to our Customer Experience & Commerce, Merchant Study 2023 report. Embedding one-click checkout and installments at the point of sale showcases how an integrated and composable tech stack can meet consumer demand for expedient and flexible checkout experiences.

Livestream shopping and shoppable media gain steam

As tech adoption often goes, livestream shopping and shoppable media have started to become strong commerce forces in Asia-Pacific. Usually, the US follows suit in about three to five years, with this being no exception. The transition to American shoppable media has occurred swiftly and at a variety of levels from major entertainment platforms, such as NBCUniversal and Disney, and smaller startups, such as Shoppable and Bonsai.

According to our 2023 Digital Maturity survey, 29% of businesses see embedded commerce (e.g., shoppable ads, shoppable TV, livestream shopping) as a disruptive technology they plan to adopt over the next 24 months. The list of vendors in this space has remained rather short for some time. However, there were a handful at NRF such as Firework, which has been long established, plus smaller operators including Bloo Kanoo, Caast.TV, Estreamly, SiteVibes and Buywith, with four of the aforementioned being founded in 2020. It was a pleasant surprise to see so many new vendors making appearances, and we look forward to seeing what developments will occur in the space in the coming years.

Want insights on consumer tech trends delivered to your inbox? Join the 451 Alliance.