Enterprises are increasingly using cloud-native technologies and practices — including containers, microservices, observability and serverless functions — for application development, migration and modernization. Organizations broadly expect to accelerate deployment of cloud-native technologies in their applications portfolios, with benefits spanning a range of economic and operational outcomes. To implement these changes, businesses are using foundational technologies and processes including “lift and shift,” platform engineering and site reliability engineering (SRE). These issues are reflected in the responses to 451 Research’s Cloud Native, Development, Migration and Modernization 2024 survey.

Fielded Nov. 7 through Dec. 30, 2023 with a panel of IT decision-makers, 300 of which were using or implementing cloud-native technologies and methodologies, this survey examines how enterprise adoption of cloud-native technologies and practices is affecting operational efficiency, cost, resilience and security. The value of cloud-native technologies and processes ultimately depends on their ability to support organizations’ overall transformation efforts which encompass development, migration and modernization.

The Take

As organizations mature in their use of cloud and take better advantage of cloud-native services and architectures, the benefits of updating legacy applications start to outweigh the risks. With IT environments becoming more distributed and diverse, application portfolios need to adapt via migration and modernization to take advantage of new services and consumption models. Organizational priorities and expected returns on investment demand appropriate responses, and these are increasingly based upon cloud-native architectures. Our survey shows that cloud-native technologies and processes are becoming increasingly important to organizations as they seek economic and operational benefits from developing, migrating and modernizing application estates.

The desired outcomes from their use support the priorities of CEOs (organizational effectiveness), CFOs (alignment of IT spending with budget), chief information officers (better application performance and security), customers and employees (improved satisfaction) and operations teams (fewer incidents, quicker time to repair). The big picture here is that enterprise IT customers and vendors alike are focused on moving ahead with modernization, taking advantage of cloud-native flexibility while shedding technical debt from years past. The opportunity to serve these needs is multi-year and substantial.

Summary of findings

Use of cloud-native application architectures is widespread, with a strong pipeline for continued adoption. About two in five surveyed organizations (42%) are currently using cloud-native technologies (e.g., containers, microservices, observability) for their applications; another 32% are planning to implement these technologies within the next two years.

Respondents expect the majority of applications to incorporate cloud-native technologies within two years. Currently, 41% of organizations are using cloud-native techniques for more than half of their applications, but this figure is expected to rise to 61% within two years, reflecting an acceleration in the use of cloud-native application architectures. In addition, prior surveys have found cloud-native adoption to be strongest at organizations with more than $1 billion in revenue and among digital transformation leaders. This survey finds the use of cloud-native application architectures to be strong across organizations of all sizes, industries and digital maturity, confirming that cloud “nativity” is the default platform for software deployment.

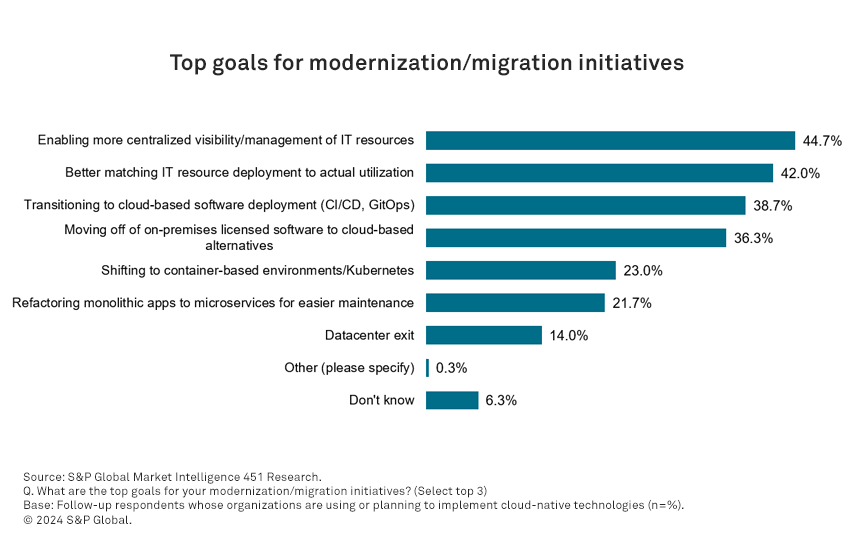

Improving the ability to see and manage IT resources centrally is the most important desired outcome for modernization and migration initiatives. Enabling greater visibility and management of IT resources is the top-cited goal (45%), followed by optimization of resource deployment to match actual need (42%), transitioning to cloud-based software deployment techniques (39%) and migration from on-premises licensed software to cloud-based alternatives (36%).

Cloud providers are the main beneficiaries of demand for help with application modernization. Organizations expect to turn first to their primary cloud provider for help with assessing and modernizing their application portfolios (26%), but cloud-focused migration and modernization specialists (24%) have an almost equivalent opportunity here.

Coming in on budget is the key success measure of modernization and migration projects. More than two-fifths (43%) of organizations say alignment of IT spending to budget/plan is among their main key performance indicators (KPIs) for modernization and migration projects. Application performance (37%), customer satisfaction (35%), employee satisfaction (34%) and the number of IT incidents/time to repair (34%) are also top KPIs.

Organizational priorities are the key driver in deciding whether to modernize existing applications. Most respondents (53%) say organizational priorities play a major role in deciding to modernize (versus maintaining) existing applications. Expected return on investment (49%) and dependencies with other systems or databases (45%) are also key considerations.

Lift-and-shift migration (as opposed to refactoring or replatforming) has been used by a significant share of organizations and yields a number of benefits. While 35% of organizations say they used a lift-and-shift strategy for migrating legacy applications to the cloud, 56% have not. Organizations that have lifted and shifted report improvements across a range of operational and economic metrics, including better reliability, cost, performance, availability and security.

Platform engineering and site reliability engineering initiatives aim to improve scalability to handle growing cloud-native workloads. Respondents cite more scalable environments (43%) and faster software releases (42%) as the top goals of platform engineering. For site reliability engineering (SRE), the top goals are to enable more scalable environments (46%) and to achieve better reliability when using cloud-native pipelines to deploy applications (40%). The top pain points in establishing platform engineering and SRE practices are the considerable effort and discipline required (49%) and the need for hard-to-find skills that aren’t available within the organization (42%).

Want insights on cloud computing trends delivered to your inbox? Join the 451 Alliance.