451 Research’s inaugural Macroeconomic Outlook, SME Tech Trends, Fintech 2022 survey, fielded late last year, took the pulse of approximately 400 IT end-user decision-makers in North America on a range of financial services and digital transformation topics. In this report, we draw on select findings from the survey to discuss the readiness of SMBs to embrace financial services that are embedded within business software, a trend widely referred to as embedded finance.

The Take

As software becomes more deeply enmeshed in SMBs’ day-to-day operations, financial services are fast becoming a latent opportunity for SMB SaaS vendors. Aside from the monetization potential, financial services provide SaaS vendors with an avenue to further enrich their software by enhancing the user experience, delivering more business-critical capabilities and unlocking new business outcomes for their customers.

Our research reveals that two of the biggest financial challenges confronting SMBs are streamlining their financial processes and optimizing their cash flow — areas we think SaaS specialists are well placed to deliver on. While payment processing is a sound starting point, this creates a beachhead for SaaS vendors to move into adjacent areas such as business banking and payroll services, further deepening their role in their customers’ operations.

SMBs show readiness for embedded finance

As software continues to permeate the SMB segment, it is evolving into something of an operating system for the companies that use it. According to our Macroeconomic Outlook: SME Tech Trends, Fintech 2022 survey, among companies with fewer than 1,000 employees (which we refer to as SMBs in this report):

- Four in five agree that software is critical (41%) or important (39%) to their organization’s operations.

- Nearly half are leveraging either commercial off-the-shelf (28%) or custom (20%) software that is specialized for their industry vertical (e.g., restaurant, retail).

The prevalence of and emphasis on software among SMBs puts SaaS providers in a strong position to offer embedded financial services. A near-term move into financial services may be especially well-timed considering that over half of SMBs indicate a yellow light (downsized spending) or red light (spending on hold) when it comes to the current willingness of their organization to spend money on IT products and services.

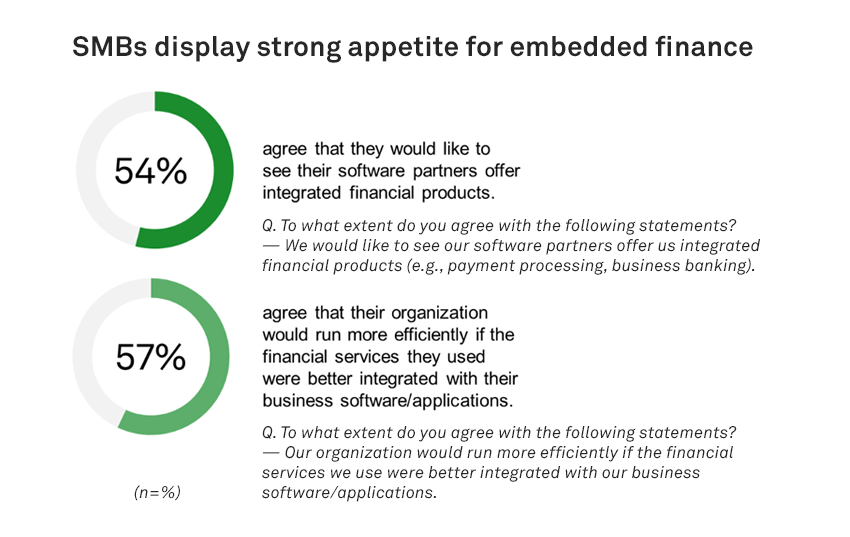

Our survey shows that the demand for embedded financial services is apparent among SMBs, revealing that the majority want their software partners to offer integrated financial services and believe that their organization would run more efficiently if the financial services they used were better integrated with their business software/applications. In fact, among SMBs that view software as mission critical to their organizations, 32% are already using a payment-processing service offered by their organization’s primary software supplier and another 29% are interested in doing so if the service was offered.

The demand for embedded financial services can be traced back to a fundamental challenge confronting SMBs: constrained resources. This is apparent in two key areas:

- Streamlining financial processes. Forty-six percent of SMBs agree that their business relies too much on manual, non-automated processes for managing financial tasks (e.g., payments, accounts payable). Services that decrease the time needed to manage finances translates into more time for essential tasks, which may run the gamut from addressing customer inquiries to repairing a faulty oven.

- Optimizing cash flow. Forty-one percent of SMBs agree that managing cash flow is a challenge for their organization. Services that provide faster access to funds — be it capital or sales earnings — and better visibility into the real-time financial position of the business can be the difference for making payroll or retaining preferential payment terms from a supplier.

As providers like Toast Inc. and Shopify Inc. have demonstrated, embedded finance offers an avenue to address these areas by streamlining reporting and reconciliation, improving payout speed and access to sales earnings, and making capital easier to attain. Longer term, we see opportunities for vertical SaaS vendors across a wide range of financial services. After payment processing, business banking, working capital/loans and payroll ranked as the financial services that SMBs that deploy software critical to their operations expressed the greatest interest in accessing from their primary software suppliers.

Building an embedded finance value proposition

While SaaS providers have a latent opportunity in financial services, they must overcome the inertia created by incumbent financial institutions. Consider that 80% of SMBs agree that changing financial services providers (e.g., banks, insurance) requires too much time and paperwork. SaaS vendors shouldn’t underestimate the criticality of ease of onboarding in their embedded finance strategies. We recommend leveraging open banking APIs wherever possible to streamline enrollment and ensure that there is ample messaging that emphasizes onboarding speed.

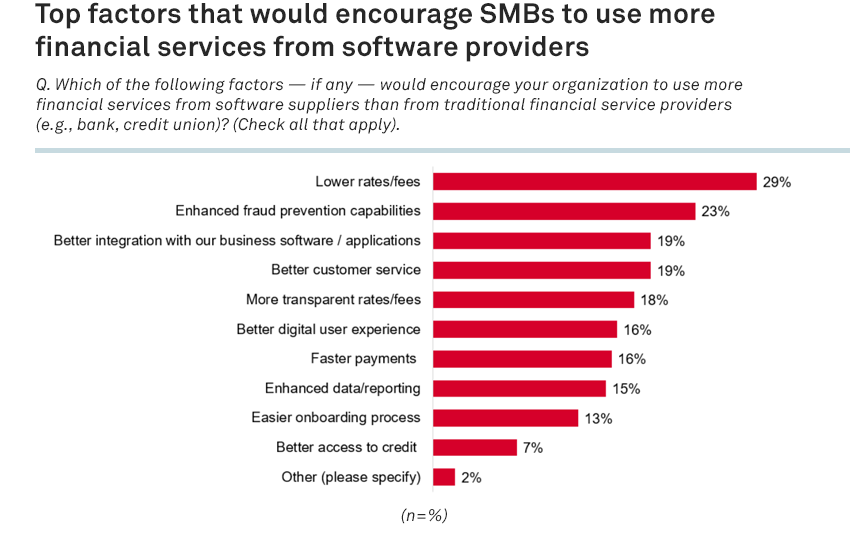

Unsurprisingly, the top factor that would encourage SMBs to utilize more financial services from software vendors over traditional financial service providers is lower rates/fees, cited by 29% of respondents. This is likely not the value proposition that SaaS vendors want to lead with, although it nevertheless is an important consideration. We believe that emphasizing transparency in rates/fees — cited by roughly one-fifth of respondents — is a sound strategy, particularly given the pricing ambiguity associated with many financial products. Predictability in cost/fees has become an especially strong selling point in a challenging economy.

Further, we would advise a value proposition that touches on modern fraud prevention capabilities (e.g., automation, data networks), deep software integration (e.g., reporting, usability) and strong customer service (e.g., multichannel, availability outside of banking hours), given the emphasis thar SMBs are placing on these areas. In light of Silicon Valley Bank, we would also recommend that SaaS providers pursuing embedded finance models ensure that trust is front and center in their strategy and messaging, considering that 43% of SMBs say reputation/trustworthiness is a top factor when selecting a financial services provider for their organization.

Want insights on fintech trends delivered to your inbox? Join the 451 Alliance.