PayPal is launching a stablecoin, PayPal USD. Stablecoins are digital currencies where value is tied to financial instruments, and are designed to have lower volatility than cryptocurrencies such as bitcoin, ether or binance coin. The stablecoin will be issued by Paxos Trust Company, and availability will be rolled out gradually to US customers. PayPal’s stablecoin is the first announced by a major financial technology institution that would not be considered blockchain-native. Cryptocurrency exchange Huobi was the first exchange to announce that it would be listing PayPal USD.

The Take

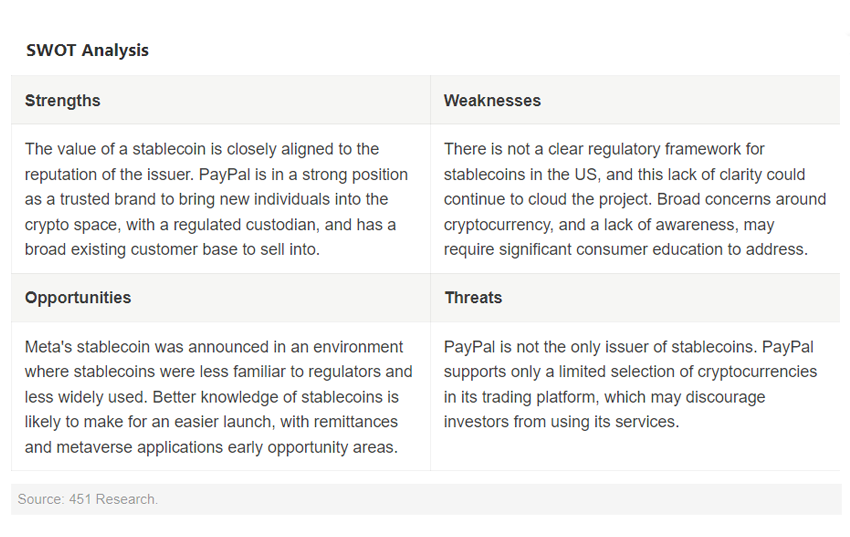

PayPal sees significant opportunity in launching a stablecoin. The company has presented a range of use areas, including remittance sending and payments in virtual worlds, although with its initial rollout in the US, the principal use will likely center on buying or selling cryptocurrency assets through PayPal’s existing trading platform. Stablecoins can be a major earner, dealing interest income from the issuer. The elephant in the room is the regulatory response. Meta Platforms Inc.’s Diem stablecoin project was derailed by fierce opposition from regulators, and a fog of regulatory uncertainty clings to the launch. Paxos presents the launch as the start of a trend toward “white label” stablecoins, and the response to PayPal USD will likely be seen as a valuable test for any companies keen to engage in such projects.

Context

Stablecoins were developed to address the market volatility associated with cryptocurrency. Price stability is valuable in the context of payments, and within the cryptocurrency market stablecoins have often been used as a means of storing value, and consequently a way of hedging risk. Stablecoins play an important role as a bridge between fiat and crypto assets. Stablecoins require pegging to a currency — in the PayPal USD instance this is US dollars — or a commodity, such as gold as with Paxos Gold or Tether Gold. Pegging methodologies differ, with some using backing portfolios of liquid assets and others algorithmic supply generation. The value of a stablecoin then is closely associated with the credibility of the issuer, and how credible the backing portfolio is — important in a space where some notable stablecoins have cryptocurrency backings. Importantly, PayPal has announced that reserves for PayPal USD are fully backed by US dollar deposits, US Treasuries and similar cash equivalents.

The value to PayPal of launching a stablecoin, which can be bought or sold through PayPal at a rate of $1 per PayPal USD, may take a few forms. The first is more deeply inserting the payments technology provider into on-chain activity, an area the business has some role in already with its existing crypto exchange. PayPal has supported cryptocurrency trading since 2020, albeit a very limited selection of major cryptocurrencies. Stablecoins can also generate interest income for the issuer, with US dollars invested in yield-bearing securities. The stablecoin may also provide an opportunity to reduce PayPal’s dependencies on third parties, particularly around cross-border payments. PayPal has suggested that its monetization opportunity will extend beyond interest from the reserve.

Price stability and regulatory concerns

Price stability, critical to the utility of using stablecoins as payment, is an issue that has emerged with a number of stablecoins. TerraUSD was a popular algorithmic stablecoin that saw its value crash in May 2022, at one point sitting at a market cap of more than $18.5 billion. The temporary depegging of two stablecoins, USD Coin (USDC) and DAI, following the collapse of Silicon Valley Bank in March 2023, also made national news. S&P Global Inc. calculations suggest that between 2018 and 2022, stablecoins demonstrated more price volatility than the exchange rates for Hong Kong dollar to USD, a pegged fiat currency, although volatility over this period for stablecoin assets had trended downward.

Cryptocurrency regulatory scrutiny has been pronounced in the US. Reports appeared in February suggesting that PayPal had paused its stablecoin efforts allegedly due to a probe from the New York Department of Financial Services (NYDFS) into partner Paxos. Meta’s Diem stablecoin project was reportedly brought down by regulatory pressure, having faced a congressional probe and a European operating ban. PayPal was briefly a member of the Diem Association, advising on the project.

Paxos, as a company regulated by the NYDFS, is positioning the regulated nature of the token, with oversight into reserve management, for example, as an advantage of the project. Customer asset protections deriving from NYDFS regulation play an important role in how the project is being positioned. A challenge to this narrative appeared shortly after the initial announcement, with congresswoman Maxine Waters, who sits on the House Financial Services Committee, suggesting the company should have awaited federal regulatory approval before launching its stablecoin. Regulatory issues around cryptocurrency have already had an impact on PayPal — most recently the company announced it would be pausing all crypto sales through its platform in the UK until 2024 due to new rules enacted by Financial Conduct Authority.

The remittance use case

PayPal has mentioned remittance senders as a target audience for its stablecoin. There has been a groundswell of interest in stablecoins as a cross-border payment solution in the fintech world in recent years. The reason is that stablecoins can, in theory, address two major pain points that remitters face when trying to send money to friends and family in their home countries: high transfer fees and long processing times.

Transfer fees take a large bite out of the money that remitters send home to friends and family, with the World Bank estimating in 2022 that a reduction of just 2% in transaction charges could save remitters from low- and middle-income countries a combined total of $12 billion per year. PayPal USD purports to offer a more cost-effective option for making cross-border payments, circumventing traditional banks and money transfer operators.

The fact that PayPal USD transacts on the blockchain means that payments can settle almost instantly, which addresses the issue of speed (or lack thereof). Traditional international bank transfers can take as long as five days to clear and settle, which is inconvenient for senders and recipients of remittances, and leaves them exposed to exchange rate fluctuations.

There are a number of fintechs already offering stablecoin-backed cross-border payment solutions, primarily marketed at remittance senders or SMBs. For example, Nigerian money transfer app Afriex allows users to send payments in USDC and NGNT (backed by the Nigerian Naira), while US-based startup Higlobe offers stablecoin-backed payment for workers in the US wanting to send money to Mexico, Brazil and the Philippines. Singaporean-regulated Telcoin, a mobile remittance network based on Ethereum, offers a stablecoin-backed cross-border payment solution. Stablecoins are still very much a niche payment method in the global remittance market, but the advent of PayPal USD could be the catalyst for more mainstream adoption. The brand recognition of PayPal combined with what should be a very accessible user experience could be key to mass market appeal. However, PayPal will have considerable work to do on the consumer education piece if its stablecoin is going to be anything more than a curiosity in the world of payments. It will also have to make sure that it has thoroughly addressed the question of price volatility to ensure that it does not put remitters’ money at risk.

PayPal already made a play in the cross-border payments space in 2015 with its acquisition of San Francisco-based Xoom, which allows users to send money from the US and Canada to over 100 countries, as well as to pay bills and top up phones. There could be a potential intersection point between Xoom and PayPal’s stablecoin initiative further down the line.

A currency for digital worlds?

PayPal says that its stablecoin could “reduce friction for in-experience payments in virtual environments” and “enable direct flows to developers and creators.” It could also help to “foster the continued expansion into digital assets by the largest brands in the world.” This suggests that PayPal is positioning PayPal USD as a payment method for gaming, the creator economy and the metaverse. These are emerging areas that currently lack a mature payments infrastructure. At the moment, immersive games and the metaverse are served by a patchwork of cryptocurrency payment options, fiat wallets and tokens.

A stablecoin could be well-suited to these environments, acting as a bridge between the fiat and crypto worlds. It would also be interoperable between different metaverses. Use cases could range from enabling content creators to monetize their work in gaming or metaverse environments, and helping gamers to make microtransactions in order to purchase in-game items for small sums of money.

A number of major global brands have invested in digital experiences in metaverses such as Decentraland and The Sandbox, and PayPal’s statement regarding its stablecoin suggests that it wants to build on the momentum that they have created by becoming the payment method of choice for these virtual worlds. However, there is an ongoing debate about how many regular users metaverses actually have, and it remains to be seen whether they will become sites of meaningful commercial activity, or merely expensive digital shop windows. PayPal appears to be playing a long game with PayPal USD, should e-commerce in the metaverse take off.

Competition

PayPal faces competition from a handful of large, established stablecoin issuers such as Circle, which manages the popular USDC stablecoin, and Tether Limited, which mints Tether (both of which are fiat-backed). Binance USD, US dollar-backed and issued by the Binance crypto exchange, is another.

PayPal stands in a class of its own among payment service providers in having created its own stablecoin. Stripe launched a stablecoin initiative in 2022 that facilitates payments via stablecoins, but it did not go as far as to create its own stablecoin.

Want insights on fintech trends delivered to your inbox? Join the 451 Alliance.