Earlier this month, we reported on large-scale automotive trends including electrification, automation and ride sharing. Now, let’s take a step back and examine one of the more fundamental aspects of the automotive industry – vehicle ownership trends – according to 451 Research’s Q2 2021 connected customer survey.

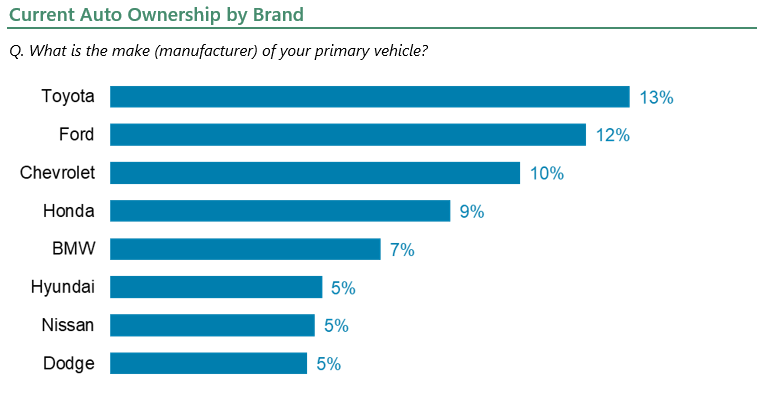

Focusing on respondents who currently own or lease a vehicle, the survey reveals a very competitive automotive industry. Toyota (13%), Ford (12%), Chevrolet (10%) and Honda (9%) remain the most popular auto brands, followed by BMW. Yet, after them is a second tier of manufactures clustered together: Hyundai, Nissan and Dodge.

Digging a little deeper into the data, we see Toyota is most popular among Generation X and the Greatest Generation, while Baby Boomers favor Ford. Millennials prefer BMW the most while Generation Z chooses Honda. Outside of the top choices, each generational group has three to four manufacturers that stand out from the rest in terms of vehicle ownership.

Just over half (55%) of respondents say their primary vehicle is from model year 2015 or newer. This number has gone up since the last survey, which indicates recent churn within the market. At the same time, 71% of respondents say they’ve owned their vehicle for five years or less. This correlates with the healthy market for used vehicles that was heightened due to the pandemic. This is further confirmed when looking at the entire sample of car owners, where 31% of respondents indicated that they acquired a used vehicle from either the dealership or a used-car lot.

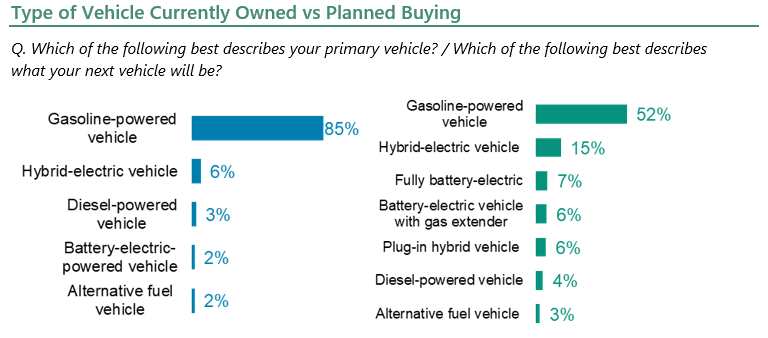

The vast majority of vehicles on the road according to survey respondents are gasoline-powered (86%), but as covered in the report from earlier this month, this number is slowly ticking downward as more consumers buy hybrid-electric, battery-electric and alternative-fuel vehicles. This trend is further supported by future purchasing plans.

Among respondents who plan to buy/lease a vehicle within the next two years, 15% say they will get a hybrid-electric vehicle, while another 22% say they will get a battery-electric, plug-in hybrid or alternative-fuel vehicle. This supports not only an increase in demand for electric vehicles, but also a dramatic expansion in the quality and quantity of the options available to consumers who no longer want to use traditional gasoline-powered vehicles.

Toyota and BMW are the leaders in customer satisfaction with 76% of owners saying they are very satisfied with their vehicles. Chevrolet (71%) and Ford (70%) owners are also highly satisfied. They are followed by Honda bringing up the rear among the most-owned brands.

Satisfaction is a very important key to customer retention.

Looking at planned purchasing over the next two years, the survey shows BMW (12%) as the top choice, followed by Toyota (11%) and Ford (11%). This is surprising until we look at who is most likely to buy/lease a new car. The largest group of future buyers are Millennials. Since they currently prefer BMW more than any other age group, it makes sense that their interest in these vehicles would be enough to shift the whole market. Chevrolet (9%) and Honda (9%) round out the top five. The top five brands consumers plan to purchase are also the top five brands currently owned.

Customer retention has always been at the core of building a strong brand. Yet in current survey results, we see a slight decline in customer loyalty. We suspect this to be a short-term response to the current environment in the industry due to the pandemic. With consumers buying more used cars, it’s possible they’re less driven by brand loyalty and more concerned with ownership costs for the time being.