Across a broad range of consumer technology trends, younger generations report being more engaged with new technology and digital experiences compared to older generations. Not only do they upgrade their smartphones and other devices sooner, but they identify as “tech leaders” by being the first to try out new products, willing to pay more for cutting-edge tech, and seeking out digital experiences more often compared to their elders.

This report presents the findings of 451 Research’s Q1 2023 Digital Endpoint Tracker, which asked US consumers about their technology adoption habits and their attitudes toward embracing digital experiences.

Key takeaways from the survey

Smartphones are the most frequently upgraded devices. We asked respondents how frequently they replace their various consumer tech devices, and found smartphones had the shortest replacement cycle with 32% saying they upgrade theirs every two years or less. At the other end of the spectrum, just 6% said they upgrade their desktop computers with the same frequency.

Across all device categories, higher income households (>$100,000 per year) upgrade more frequently than lower income ones (<$50,000 per year). Interestingly, across all device categories, Millennials are the generation upgrading most frequently, especially when it comes to smartphones, tablets and wearables.

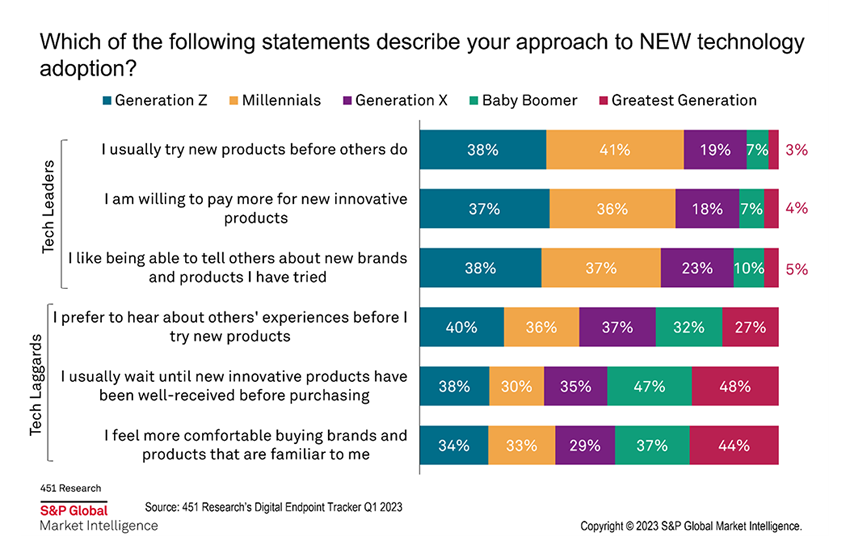

New tech adoption varies by age. Overall, a large number of respondents identify as tech laggards with 41% waiting until new products have been well received before purchasing. One third (33%) say they prefer to hear about the experiences of others before trying new products. Only 16% say they usually try new products before others.

Generation Z and Millennials are most likely to say they are tech leaders who try new products first, are willing to pay more for them and tell others about them compared to other age groups. Baby Boomers and the Greatest Generation are the least likely to do so. Being a tech leader is in some ways a luxury, given higher income households are more than twice as likely to try new products or pay more for new innovations compared to lower income ones.

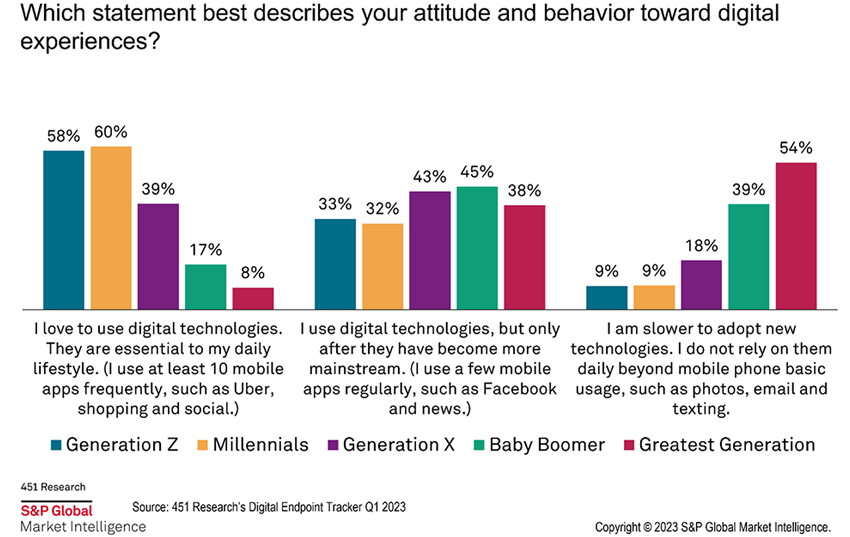

Digital experiences sought more often by younger generations. The survey found 29% of respondents saying digital experiences are essential to their daily lives. Another 41% said they start using digital technologies only as they become more mainstream. Meanwhile, more than half of Gen Z (58%) and Millennials (60%) say digital experiences are essential. while Baby Boomers and the Greatest Generation are much further behind on the adoption curve.

Brand vs. price — largely determined by income. While 40% of respondents say they prefer the lowest prices possible regardless of brand, 35% affirm they are willing to pay more for the brand they prefer. Although not an even split, the sizes of these groups are fairly close all things considered. Household income, however, appears to play a large role here as well. Nearly half 47%) of lower income households ($50,000 or less) say they favor the lowest price regardless of brand, while just 25% of higher income ones (over $100,000) say the same. Likewise, higher income households (52%) are almost twice as likely to say they’ll pay extra for the brand they prefer compared to lower income ones (28%).

Privacy and data protection matter most when choosing brands. We asked respondents which policies or practices matter in their decision to do business with a particular brand. The results show consumers care most about privacy and data protection (89%), an area that directly impacts them as customers. Consumers also care about a brand’s employee welfare, such as fair wages/benefits (78%) and health, safety and labor practices (76%). Further down the list are other social and environmental topics such as support for human rights/social justice (68%), workplace diversity (56%) and minimizing carbon footprint (50%).

Do you have your finger on the pulse of tech trends? Join the 451 Alliance for exclusive research content on industry-wide IT advancements. Do I qualify?