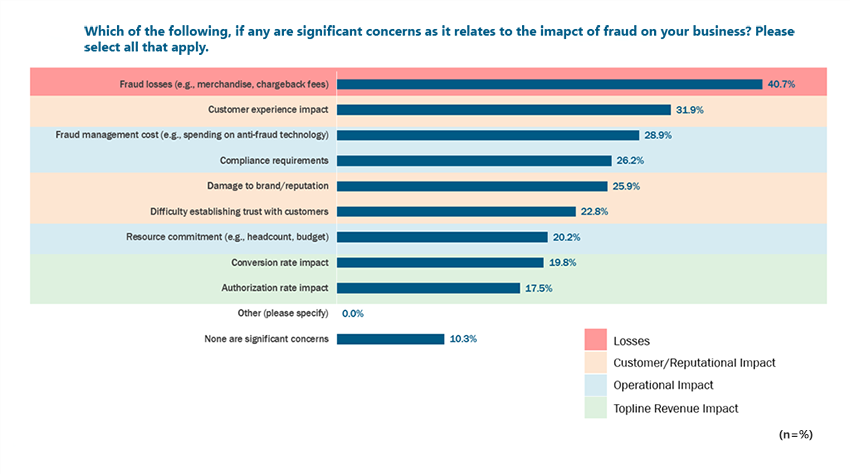

When we think of fraud, we tend to think of it simplistically: a situation where a nefarious player bilks you out of money under false pretenses. While monetary losses are a major impact of fraud, a singular focus on loss neglects many of its other negative impacts.

Fraud bears many far-reaching consequences that can jeopardize all areas of a business. To effectively mitigate these consequences, we first must fully understand them.

Successful fraud-prevention strategies require a holistic approach targeting not only loss, but also customer experience and operational impacts.

The good news is that fraud is already top-of-mind. For merchants, fraud reduction is one of their most significant concerns with regards to both commerce and payments. Driven by the fear of financial loss, 29% of merchants have already purchased fraud management technology for their businesses.

Customer Experience Impact

Fraud – and more specifically, fraud prevention measures – can greatly impact customer experience. Overly aggressive fraud-prevention measures can cause friction for legitimate customers, impeding their path to purchase and resulting in cart abandonment.

Similarly, fraud controls that are too strict can result in false-positive transaction declines. Erring on the side of overly lax measures can be equally detrimental. Finding the right balance is a perennial challenge for online merchants, with less than one in four stating that their approach to fraud effectively balances prevention with customer experience.

Merchants failing to adequately protect their customers can face difficultly in establishing trust. 51% of respondents in a 451 Alliance study indicated ‘trust in the merchant’s reputation’ influences their decision to save their payment information with an online merchant.

‘Avoiding organizations or services I don’t trust’ was the top answer choice amongst respondents. This tells us that not only will a consumer avoid saving their payment information with a merchant if they deem that organization or service vendor untrustworthy, the consumer will also avoid the organization or service vendor altogether.

Operational Impact

Preventing and remedying fraud is extensive and costly. At the top of the list are the costs associated with antifraud technology. Traditionally, organizations have taken a piecemeal approach, layering independent fraud-prevention tools and systems on top of one other. The result is a disjointed fraud stack, often characterized by redundancies and cost inefficiencies.

On top of that, compliance requirements present an additional operational burden. The Strong Customer Authentication (SCA) regulations necessitated by the revised payment services directive (PSD2) in Europe, for instance, have resulted in a complete upheaval of the checkout flow for most online merchants.

Merchants have historically employed sizeable teams of risk analysts to write and adjust fraud rules and investigate chargebacks. Fraud platforms rooted in AI and machine learning, along with chargeback automation offerings, can help alleviate headcount requirements or allow staff to be reallocated toward more strategic initiatives.

As you can see, while the monetary losses associated with fraud are hugely detrimental to affected businesses, they’re only part of the story. When grappling with the ever-present challenge of fraud prevention, it’s important to keep the myriad of other challenges at top-of-mind, as well.

Want insights on consumer tech trends delivered to your inbox? Join the 451 Alliance.