Real-time payments (RTP) are commonplace in markets like India and Australia, but the U.S. has been slower to adopt. However, RTP initiatives in the U.S. are underway, and will increasingly compete for payments market share. The Clearing House launched the first real-time payment system in the U.S. in 2017, aptly named the RTP network, and the Federal Reserve plans to launch its own RTP infrastructure, dubbed FedNow Service, in 2023.

The take

U.S. consumers that prefer debit as their primary payment card show the strongest appetite for real-time payments, suggesting that this type of payment could threaten debit volume and, subsequentially, banks’ debit interchange revenue. Ignoring the trend is not an option, as many consumers have indicated they will simply open new accounts with financial institutions that grant them access to real-time payment capabilities.

Banks will want to lean into RTP tactfully, placing significant emphasis on education and use cases that don’t cannibalize debit volume, in an effort to retain and attract customers. In order for real-time payments to scale, prioritizing fraud prevention, trust and privacy will be essential, given debit users place a high emphasis on capabilities such as push notifications and SMS alerts.

Context

RTP facilitates instant bank account transfers with 24/7 real-time clearing and settlement, compared to the traditional one- to three-day settlement time offered by most banks. RTP grants consumers faster access to their funds and enables businesses to better manage their cash flows.

451 Research surveys (Trust and Privacy 2022 and Fintech and Holiday 2022) that U.S. consumer interest in RTP is strong: nearly one in two consumers (48%) is extremely interested in RTP, and nearly one in two consumers (47%) is likely or very likely to open a new account with a banking service provider in order to access real-time payment capabilities,.

Consumers with debit cards as their primary card were even more likely to open a new account to access RTP capabilities: 52% of consumers that prefer debit cards said they were likely to open a new account, compared to 40% of consumers that prefer credit cards. In this report, we explore debit card holders’ appetite for RTP, and the implications for financial institutions, card networks and payment infrastructure providers.

Debit-centric consumers show strong interest

This year, we saw debit far exceed credit as consumers’ primary payment card (which we explored in more detail in a previous report): 56.2% of consumers preferred debit as their primary payment card. And just last year, 40.2% of consumers preferred debit according to our Trust and Privacy Q2 2021 and Trust and Privacy Q2 2022 surveys (we will refer to these consumers as debit-centric and credit-centric throughout this report).

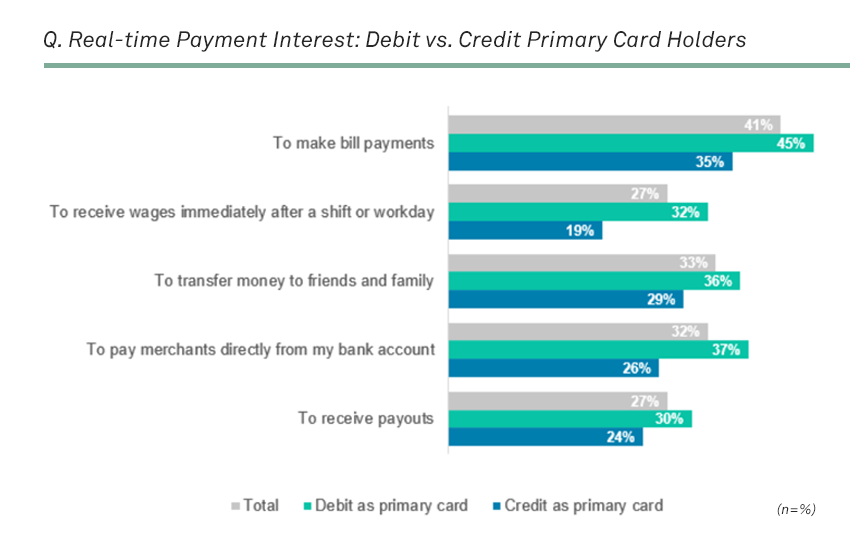

Further analysis revealed that debit-centric consumers had a much stronger appetite for real-time payments than credit-centric consumers. Top use cases were making instant bill payments (45% versus 35% of credit-centric consumers), receiving wages immediately after a shift/workday (32% versus 19% of credit-centric consumers), P2P transfers (36% versus 29% of credit-centric consumers), paying merchants directly from a bank account (37% versus 26% of credit-centric consumers), and receiving payouts (30% versus 24% of credit-centric consumers).

We hypothesize that consumers who prefer debit have a stronger appetite for RTP because they are more accustomed to having funds pulled from their bank account through debit card transactions, and RTP enhances this experience. Consumers that prefer credit, on the other hand, are more accustomed to the flexibility and accessibility credit provides and may not view instant transfers as an immediate need.

Consumers that prefer credit may also be more reluctant to transition from a rewards-based system to RTP, which does not currently offer the ability to earn rewards akin to credit cards. Consider the fact that the number one reason consumers use credit cards as their primary card is because it offers better rewards points than debit, as indicated by 55.4% of credit-centric users, according to our Fintech and Holiday Experience, Q4 2022 survey.

Security and privacy features

Our research shows that certain privacy/security features are significantly more influential for debit-centric consumers when deciding on a payment card than they are for credit-centric consumers, including SMS/email alerts for suspicious activity (53% versus 47% of credit-centric consumers), and push notifications for every transaction (33% versus 25% of credit-centric consumers), according to our Trust and Privacy, Q2 2022 survey.

RTP providers should ensure these types of capabilities are part of their RTP rollouts to secure consumer confidence. Since RTP transfers are irrevocable, ensuring multifactor authentication and identity verification checks are in place before transactions take place will be crucial for RTP adoption. Ultimately, RTP providers should build a strategy around security and help educate consumers on how their information and transfers are being protected. For example, one strategy could be to ask for additional verification if transactions exceed a certain amount, or are flagged as high risk.

Implications and opportunities

There are various implications that financial institutions, card networks and payments infrastructure providers must plan for should debit-centric consumers migrate to transacting over RTP rails.

Financial institutions. Perhaps the largest risk for financial institutions is losing out on debit interchange volume. A loss in debit volume could more adversely impact financial institutions, especially neobanks, where interchange revenue makes up a significant portion of their revenue share.

Financial institutions can help combat debit interchange cannibalization by tactfully promoting the advantages of debit over RTP, such as the convenience of carrying a card that can be used at POS and to withdraw cash, and the ability to set up recurring pull payments. Some banks offer rewards for debit card usage, such as Bank of America’s BankAmeriDeals cash-back program, which can help incentivize usage.

Banks may also want to consider emphasizing RTP use cases that don’t pose a significant threat to debit volume, such as insurance claim disbursement, payroll and peer-to-peer (P2P) transfers. Since RTP transfers are irrevocable, banks will want to educate consumers on the mechanics of RTP, offer multiple verification steps, and invest in enhanced fraud protection capabilities.

Banks may also consider offering RTP, which can help retain and enhance experiences for their customers, as well as working with a third-party vendor such as FIS, ACI Worldwide, Fiserv or Jack Henry to help streamline integration into a domestic RTP scheme (e.g., Zelle and TCH RTP).

Card networks. For card networks, RTP presents a threat to debit revenue and real-time payment services based on debit rails (Visa Direct, Mastercard Send). Card networks should emphasize key differentiators of their real-time payment services, such as global reach and payments to both cards and accounts. Card networks should continue diversifying beyond cards and investing in value-added services, such as tokenization and fraud prevention, to further grow revenue. They could also explore opportunities to orchestrate and connect various RTP systems, which will become increasingly important as more geographies implement RTP.

Payment infrastructure providers. RTP presents a growing revenue opportunity for payment infrastructure providers to serve as RTP on-ramps for financial institutions. To promote RTP adoption, these providers should help educate banks and enterprises on the value and use cases of RTP, such as instant bill payments and disbursements. They also have an opportunity to provide fraud protection, technology and professional services for banks offering RTP. Payment infrastructure providers looking to facilitate RTP should focus on building a diverse partner ecosystem of financial institutions, and offer a wide variety of payment capabilities.

Want insights on fintech trends delivered to your inbox? Join the 451 Alliance.