After years of momentum, the dust has yet to settle in the “buy now, pay later” market. Apple Inc. recently launched Apple Pay Later, which enables Apple Pay users to split payments into four interest-free installments over six weeks (it is still in its prerelease phase for select users, with a wider rollout planned). Apple’s entrance into BNPL signifies the maturity of the market and a potentially widening opportunity for large financial technology companies to play a more prominent role in providing BNPL. On the other hand, rising interest rates are compressing BNPL providers’ margins, and a lack of consumer ability to make repayments remains a concern across the industry. Despite its recent statements and studies on BNPL, the Consumer Financial Protection Bureau has yet to establish any clear regulatory guidance. In this report, we highlight the current state of the BNPL market, where we think it is heading, and opportunities for fintechs and banks to capitalize on this continuously evolving market.

The Take

BNPL is here to stay and, like most disruptive technologies, will continue to evolve. Consumer and merchant BNPL adoption remains strong, but macroeconomic pressures continue to burden the industry. Despite industry headwinds, there are plenty of opportunities for stakeholders to capitalize on the turbulence in the BNPL market. BNPL providers that emerge as winners will ultimately have strong cash flow management, insight into customer needs and financial health, and an ability to leverage multiple revenue streams to drive growth. BNPL may be better suited as a complementary product rather than a stand-alone business model. For this reason, financial institutions and large, established fintechs have strong potential to become prominent BNPL players in the market.

Context

The BNPL market has accelerated in a short amount of time. In 2022 we took a deep dive into the evolution of buy now, pay later — from its retail origins to burgeoning opportunities like business-to-business financing. We estimate that there are over 100 BNPL providers in the market globally. In some respects, the BNPL market is flourishing, but macroeconomic pressures continue to threaten the industry. News of mass layoffs from major firms like Klarna and Affirm has called the resilience of BNPL into question, as have financial reports from BNPL companies that appeared to be on a positive trajectory, demonstrating customer growth but not profitability. Consumer and merchant adoption continue to push the industry forward, but navigating BNPL will require access to capital, cash flow management and a refined underwriting process. BNPL is ultimately sensitive to macroeconomic conditions like rising interest rates and consumer discretionary spending, and may be better suited as a complementary product rather than a stand-alone business model.

BNPL consumer, merchant adoption remains strong

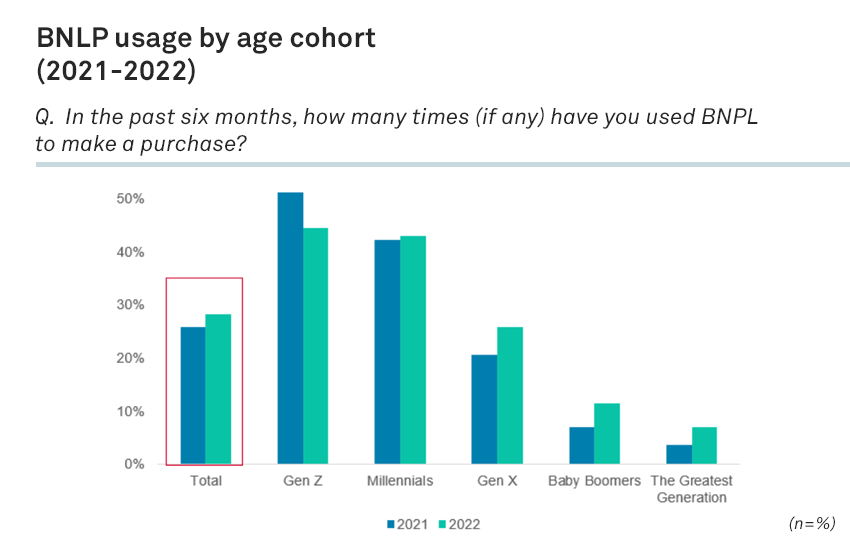

Consumers continue to value the flexibility BNPL offers. Over one-quarter (28.2%) of respondents said they used BNPL to make a purchase at least once in the past six months, up from 25.9% in 2021, according to our Quantifying the Customer Experience 2022 survey. Younger consumers remain the strongest BNPL users: 44.5% of Gen Z and 42.9% of millennials have used BNPL at least once in the past six months to make a purchase. Older generations have been wary of using BNPL, but are using BNPL more than they did the previous year: 11.4% of baby boomers used BNPL at least once in the past six months to make a purchase, compared with 7.1% in 2021, and 7.1% of the Greatest Generation did so compared with just 3.6% in 2021.

We anticipate consumer adoption will increase, given Apple’s inroads into BNPL with Apple Pay Later. Consider that Apple Pay (used by 29% of digital wallet users online and 34% in-store) is second to PayPal as the most popular digital wallet used by US consumers online, according to our Connected Customer, Disruptive Experiences 2023 survey.

While BNPL has expanded into new verticals like travel and healthcare, most consumers are using it for retail and home goods. Electronics/appliances, selected by 37.2% of BNPL users, are the most common purchases made using BNPL, followed by clothing or accessories (36.8%) and luxury goods (20.5%).

Merchant BNPL adoption is also strong and producing high returns on investment. According to a custom 451 Research 2022 survey of merchants in the travel, e-commerce, general retail, home furnishings, electronics, beauty/fashion and health/fitness verticals, 61% of US merchants surveyed currently offer BNPL, and another 31% are in the discovery/proof-of-concept phase or plan to offer it in the next 12 months. The top reasons US merchants are offering or considering offering BNPL are to increase revenue (68%), deepen customer loyalty (65%) and to stay competitive with peers (65%). Of the US merchants that currently offer BNPL, 84% say they have seen an increase in average order value since offering BNPL, 87% say they have seen an increase in conversions, 96% say they have seen an increase in customer acquisitions, and 91% say they have seen an increase in purchase frequency.

Challenges

Despite promising growth, macroeconomic pressures continue to plague the BNPL landscape. BNPL providers are battling rising interest rates that are squeezing margins, apprehensive investors are throttling funding, and consumers are slipping into default. Concerningly, we have found that one in 10 consumers, jumping to one in five for Gen Z, say they are rarely or never on time with their BNPL payments. Many BNPL firms have yet to achieve profitability despite demonstrating customer or revenue growth. Excessive cash flow burn led to the demise of Australian BNPL provider OpenPay, which fell into receivership in February. Klarna reported a 2022 full-year operating loss of approximately $1 billion and cut its work force by 10% in May 2022. To curb losses, many BNPL providers are deploying a variety of tactics, including tightening underwriting requirements (e.g., verifying funds in checking accounts through open banking), cutting costs by reducing workforce and diversifying their revenue streams (e.g., generating ad revenue, offering long-term interest-bearing loans).

High cost/fees are the greatest challenges merchants offering BNPL face, according to a custom 451 Research survey. BNPL fees typically range from 2%-8% plus a fixed fee in some cases, which can be higher than the average credit card discount rate (2%-3%). If BNPL providers raise their merchant fees to help protect their margins, some merchants might pursue lower-cost alternatives. Merchants could also offset increased costs by raising their prices, and we have found that 51% of US merchants that offered BNPL have already increased their prices to account for increased costs of BNPL. However, consumers may be reluctant to pay a higher price for using BNPL, which can negatively impact demand and nudge them toward alternatives, like credit cards.

Opportunities

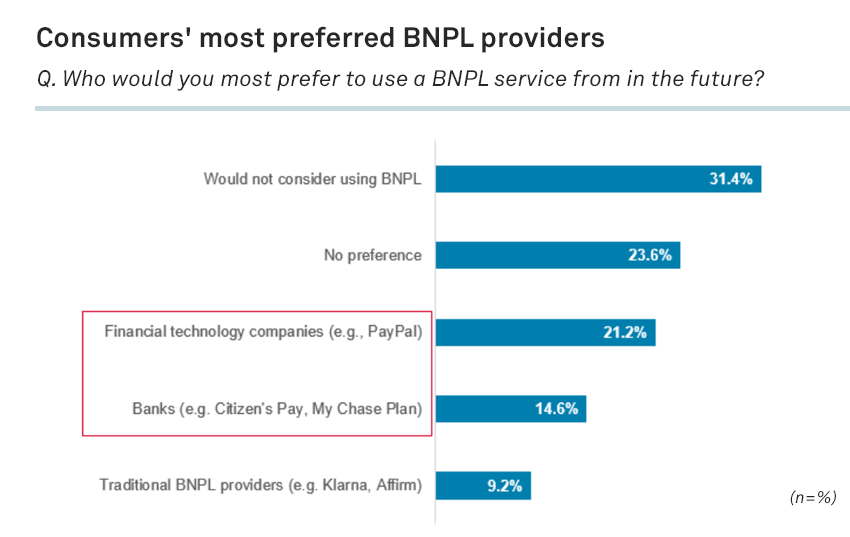

Providers that can lend off their own balance sheets and have a deep understanding of consumers’ financial health and payment histories should have an advantage over traditional BNPL providers. Banks and large financial technology companies have an opportunity to play a more prominent role as BNPL providers, considering their preexisting customer relationships and insight into consumers’ financial needs, and many fintechs and financial institutions have already expanded in the BNPL market. On March 28, Apple announced its Apple Pay Later launch, which will enable Apple Pay users to split purchases into four interest-free installments over six weeks. Apple’s debut into BNPL should help scale BNPL to most merchants that accept Apple Pay, and since it plans to lend off its own balance sheet, it may have an advantage right out of the gate over traditional BNPL providers. We have found that consumers actually prefer to use BNPL services from fintech companies (e.g., PayPal — 21.2%) the most, followed by banks (14.6%) and traditional BNPL providers (9.2%). About one-quarter (23.6%) had no preference.

It is also becoming easier for more players to enter BNPL due to fintechs like Galileo Financial Technologies, Jifiti and ChargeAfter serving up the infrastructure for banks, fintechs and merchants to offer custom BNPL options.

In addition to banks and fintechs offering BNPL, we see an opportunity for payment service providers (PSPs) to help orchestrate BNPL payments. Offering a variety of BNPL options enables merchants, banks and fintechs to better serve various customer segments and needs, and can help increase approval rates. We have found that, among the merchants surveyed that offer BNPL, 73% offer three or more types of BNPL payment models, with split pay (e.g., pay in four installments) being the most common. Furthermore, 53% of merchants that offer or are planning to offer BNPL say they prefer to work with multiple BNPL providers over a single BNPL provider, according to a custom 451 Research survey. However, building, maintaining and optimizing multiple BNPL integrations can pose a cumbersome challenge for merchants. Payment orchestration platforms can help streamline and optimize BNPL integrations, as can various PSPs. For example, dynamically presenting the most optimal BNPL option based on customer attributes can streamline the checkout experience for customers and help maximize approval rates for merchants. Examples of providers that offer access to multiple BNPL options through a singular integration include ACI Worldwide Inc. (ACI PayAfter), Apexx and Optty.

Want insights on fintech trends delivered to your inbox? Join the 451 Alliance.