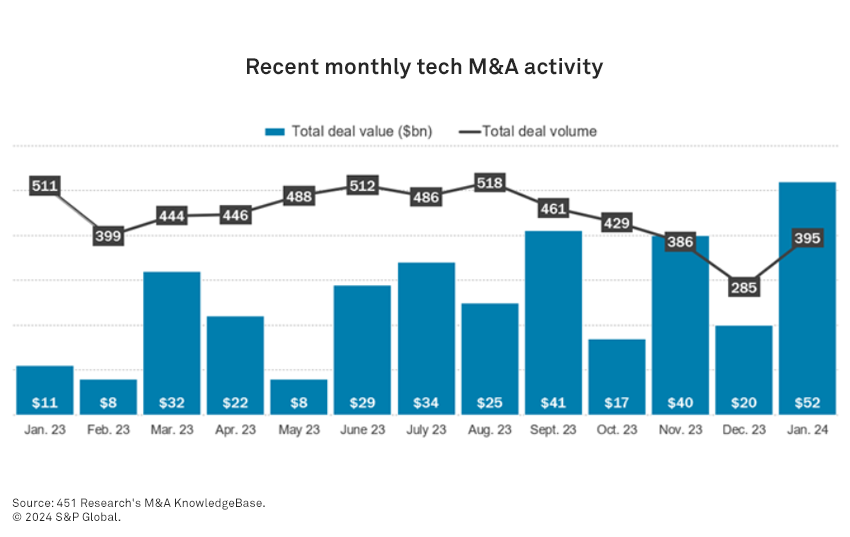

Buoyed by a pair of blockbuster prints, tech M&A spending in January rebounded to its highest monthly level in a year and a half. The multibillion-dollar purchases by big-name corporate buyers mark a splashy return by the acquirers that had been missing from the market during the post-pandemic downturn in dealmaking.

Buyers around the world handed out $52 billion for hardware, software and IT services companies in January, according to 451 Research. The strong early start to 2024 follows an unusually bullish forecast for activity in our Tech M&A Outlook survey.

- Spending on January deals came in at twice the average monthly tally in 2023, according to our M&A tracking.

Last month’s reacceleration was led by massive purchases by Synopsys Inc., Hewlett Packard Enterprise Co. and other corporate (or strategic) acquirers. In contrast, our data shows that the market’s other buying group — private equity, or financial acquirers — haven’t gotten their deal machines humming again yet in 2024.

- Strategic acquirers: Overall, this group was behind 18 of the 20 largest transactions in January in our M&A tracking, including all deals with an announced value of more than $150 million.

- Financial acquirers: Buyout shops accounted for only slightly more than one of every four (26%) tech transactions this month, down from more than one of three (36%) in full-year 2021, before interest rates started rising.

Of course, it’s too early to draw any conclusions about this year from a single month’s activity — even one that appears to be much more than “been down so long it looks up to me.” Nonetheless, having market leaders back leading the market will be the key for any recovery in the tech M&A market this year.

Corporate buyers typically account for about two-thirds of spending in our M&A tacking, with the remaining one-third coming from financial acquirers. Yet in 2023, they barely outspent PE firms, which was the main reason why the value of tech transactions announced last year plunged to its lowest level in a decade.

Do you have your finger on the pulse of tech trends? Join the 451 Alliance for exclusive research content on industry-wide IT advancements. Do I qualify?