Source: Oscar Wong/Moment/Getty images

The Fintech Meetup 2025 at the Venetian Resort in Las Vegas attracted over 5,000 participants, nearly doubling its 2023 attendance. Known for its technological focus, the event facilitated over 50,000 meetings via its app. Attendees included startups, large enterprises, venture capital firms, and financial institutions, with 270 sponsors such as FIS Inc., Visa Inc., and Mastercard Inc. The event featured over 150 exhibitors and numerous panel discussions.

Optimism for Banking as a Service (BaaS)

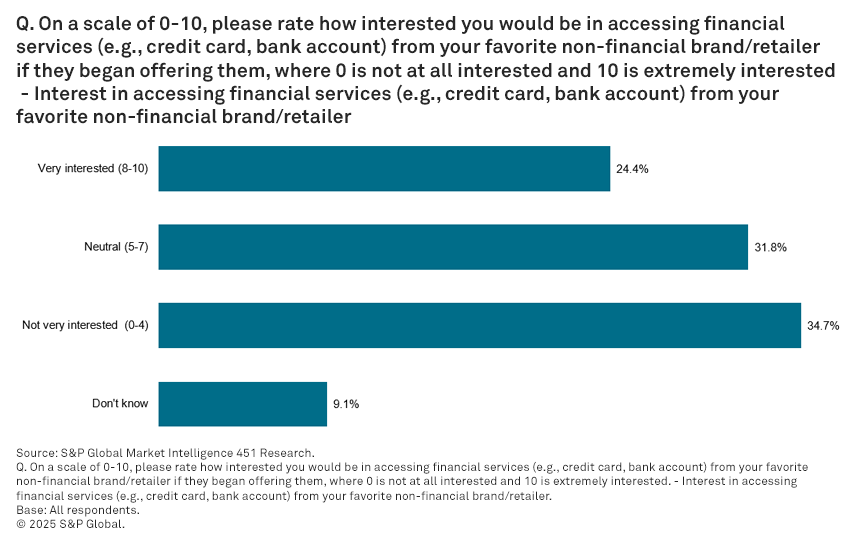

This year marked a shift toward cautious optimism for banking as a service (BaaS), despite previous regulatory challenges. BaaS offers significant advantages like expanded distribution, quicker market entry, and improved customer relationships, appealing to banks, fintechs, and consumers. A study conducted by 451 Research, a part of S&P Global Market Intelligence found that nearly one-quarter of consumers, and 37% of millennials, are interested in accessing financial services from non-financial brands. As BaaS continues to show its value, banks are seeking fintech partners that demonstrate compliance, emphasizing accurate record-keeping and fraud prevention.

At the event, companies such as Alloy, Bill.com, and JP Morgan Chase & Co. shared insights on operational transformations, highlighting the role of security and compliance in building trust. Synctera, FIS, Unit, and Treasury Prime discussed successful BaaS partnership models, showcasing the widespread impact of BaaS in the financial services landscape.

AI’s impact on financial services

Artificial intelligence (AI) remains a key driver of digital transformation in financial services. Fintechs are using AI to enhance efficiency, security, and customer engagement. The event highlighted AI’s diverse applications, including fraud detection, risk management, and credit risk assessment. Panels addressed AI’s potential as a revenue-generating tool, with insights from PayPal Holdings Inc. and the Federal Reserve Bank of Philadelphia.

Despite its benefits, AI faces regulatory challenges. Discussions emphasized the importance of robust data management and human oversight. Companies like Carrington Labs showcased AI in credit risk assessment, while others like Equifax Inc. explored AI in lending and identity verification. The event demonstrated AI’s growing influence, with applications ranging from back-office operations to customer-facing chatbots.

Innovation in B2B payments

The digital transformation of the CFO suite was a key focus, highlighting the importance of streamlining back-office operations for growth. Organizations are adopting AI and blockchain to automate accounts payable and receivable processes, enhancing transparency and control over spending. Vendors like Fundbox, Extend, and Brex showcased solutions for optimizing spending and cash flow. Brex emphasized its market momentum with a prominent billboard, and COO Camilla Morais discussed the convergence of software and fintech in B2B payments.

Payment providers like FIS and Stripe are expanding their reach, offering finance automation products. Despite the ongoing digital transformation, there is potential for further displacement of cash and checks, improved reconciliation, and enhanced cross-border transaction efficiencies.

Accelerating payment processes

The event emphasized the need for faster transactions and payment processes. While FedNow and TCH lead real-time payment networks in the US, other companies are innovating to compete. Visa Direct enables instant money movement for various use cases, while Tassat uses blockchain for real-time settlement and process automation.

Enhancing payment workflows and reconciliation processes is crucial for achieving greater speed and efficiency. Companies like Highnote, Bill.com, Veem, and Slope focus on streamlining these critical elements of the payment process.

This overview from Fintech Meetup 2025 highlights key themes and insights, emphasizing the ongoing digital transformation across the financial services industry. The event underscored the importance of leveraging technology to drive efficiency, enhance customer engagement, and foster resilience in a rapidly evolving landscape.

This content may be AI-assisted and is composed, reviewed, edited and approved by S&P Global in accordance with our Terms of Service.