As painful as the post-pandemic tech M&A slump has been, the market has found the bottom and is set to rebound sharply in 2024. That’s the prevailing view from dealmakers in 451 Research’s annual Tech M&A Outlook Survey, which included a near-record level of bullishness for activity as well as valuations in the beaten-down sector.

Taken together, the previous year’s survey and this edition represent the single largest swing in sentiment in the 20 years of surveying some of the busiest dealmakers in the tech M&A industry. Having presciently called the downturn in 2023, respondents to our Tech M&A Outlook Survey for 2024 are back with one of their strongest forecasts for dealmaking in the year ahead.

It’s a bust-to-boom reversal that — if it comes to pass — could see hundreds of billions of dollars’ worth of deal spending flowing back to an otherwise parched market.

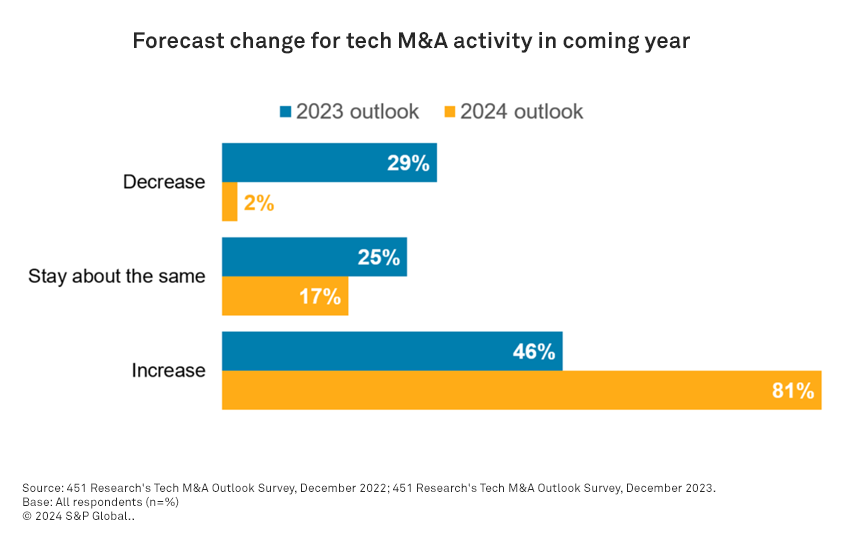

Fully eight of ten dealmakers anticipate activity across the tech M&A market accelerating in the coming year — a level of bullishness we haven’t seen in our surveys since the market was emerging from the devastating Great Financial Crisis. In the intervening decade, typically about two-thirds of respondents to our annual Tech M&A Outlook Survey have forecast an increase in acquisitions versus an eye-catching 81% that said that about 2024.

On the other side, just a single respondent projected that activity in 2024 would come in below 2023, when tech M&A spending — as measured by 451 Research — plunged to its lowest level in a decade. This year’s robust view was a sharp reversal from our prior survey, which saw a record level of three of 10 respondents bracing for a year-on-year contraction.

Headwinds abate

Broadly speaking, responses to this year’s Tech M&A Outlook Survey point to the tech M&A market pulling off what hawkish central bankers around the world have been trying to do with the overall economy: a soft landing.

Heading into 2024, dealmakers indicated in our survey that they are far less concerned with acquisitions getting derailed by the two components (growth and inflation) that determine the “landing” than they were a year ago. (Undoubtedly contributing to that improved outlook is the fact that US inflation when we were in market with our survey this year was roughly 3%, just half of the level during our previous survey period.)

In the most recent Tech M&A Outlook Survey, only about four of 10 said either inflation or the uncertain outlook for growth in the tech sector would weigh on their deals in 2024, down from the prior survey results of more than half (53%) that forecast inflation would hurt M&A activity and nearly two-thirds (63%) who said that about the slowing tech sector.

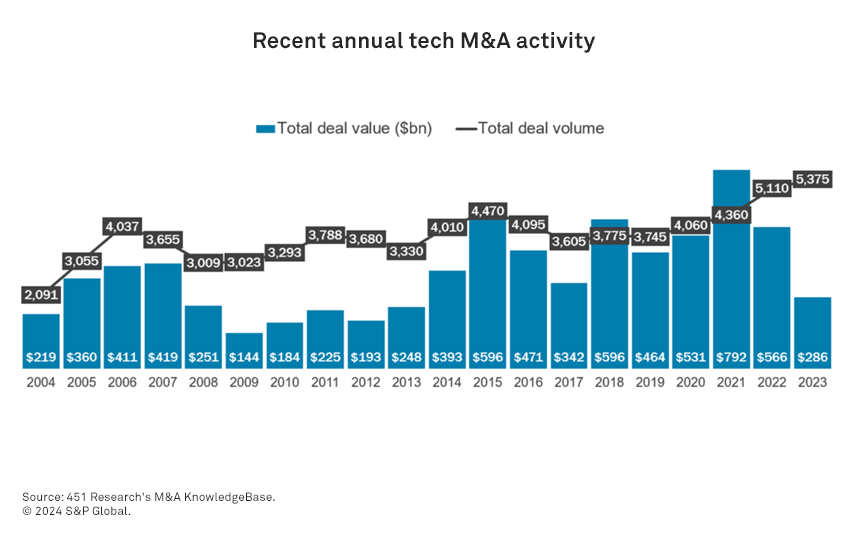

In other words, macroeconomic pressures aren’t expected to make the M&A process any harder than it has been, which is probably welcome relief for dealmakers after fighting headwinds in 2023. Last year saw the sharpest year-on-year contraction in tech M&A spending in the 20-year history of our M&A tracking.

Market leaders lead

If there is going to be a rebound in tech M&A this year, corporate acquirers are expected to lead the way back, according to a majority of survey respondents. Of those who voted for one of the two main buying groups, respondents were half again as likely to view corporate acquirers as “more competitive” than financial buyers in deal processes this year (specifically, about 60% selected corporates versus 40% for private equity firms).

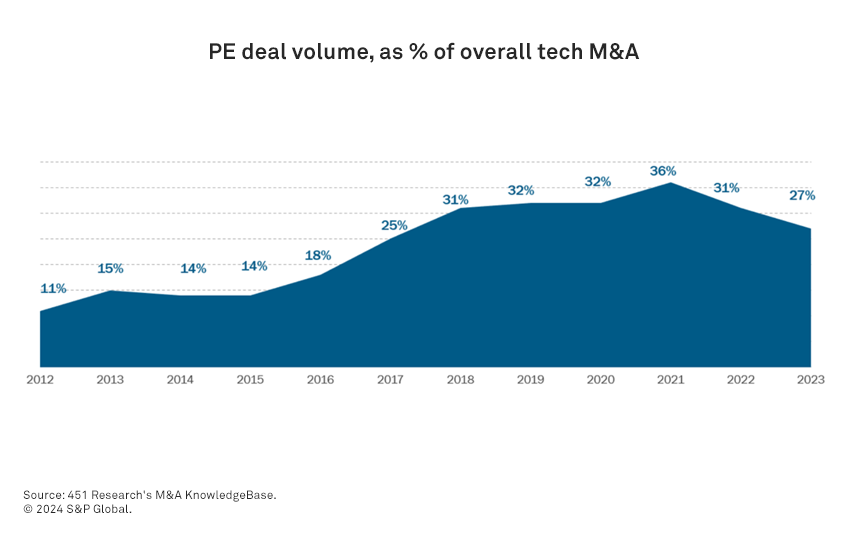

The 2024 forecast essentially predicts a continuation of the “market share” trends in deal volume at the two groups since central banks around the world started a sharp series of interest rate increases, which took away a key advantage that buyout shops enjoyed in financing transactions.

In terms of deal volume, corporate acquirers have stepped up as PE firms have retreated and retrenched, a trend our survey respondents expect to continue in 2024. According to our M&A tracking, financial acquirers accounted for a record 36% of all tech transactions in 2021 — that dropped to a six-year-low of just 27% in 2023.

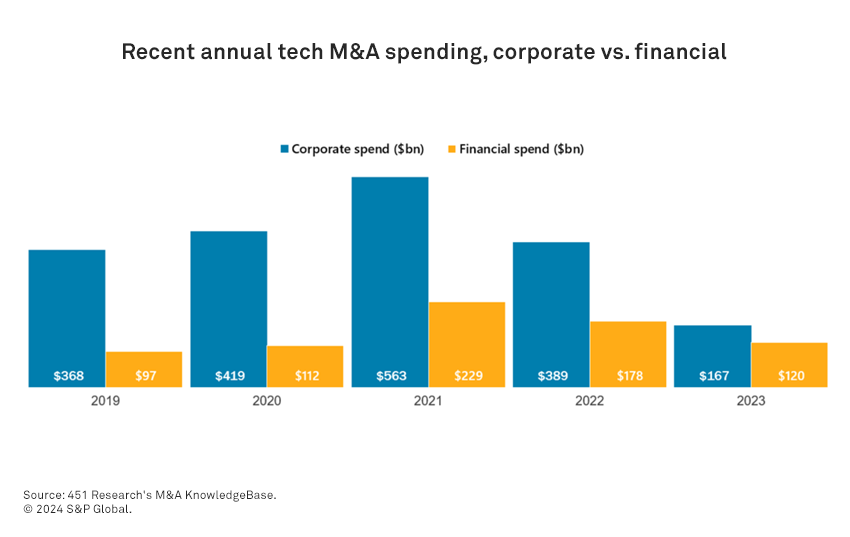

However, on the arguably more important consideration of acquisition spending, the return of corporate buyers is key to any recovery in M&A activity, particularly in deals valued in the billions of dollars. Their absence at the top end of the market was the main reason why the value of tech transactions in 2023, as tallied by our research, plunged by half compared with 2022.

Strategic acquirers, which have led activity since the first prints in the tech sector a half-century ago, typically spend two to three times more money than sponsors on deals in any given year. Last year, in contrast, strategic buyers barely outspent financial acquirers — and on one key big-dollar measure, actually fell behind.

In 2023, PE firms announced more transactions valued at $10 billion or higher than corporate acquirers, the first time that’s happened in the 20-year history of our M&A tracking.

Early on in 2024, just days after closing the survey, the two themes of strategic acquirers and blockbusters came together in a big way: Hewlett Packard Enterprises Co. announced the $12.81 billion purchase of Juniper Networks Inc., the serial acquirer’s largest-ever transaction.

Yet, as we noted, the significance of a blockbuster like HPE-Juniper extends far beyond just numbers — it can get into people’s heads. Confidence can be contagious. And when other companies hear, “Come on in, the water’s fine” from buyers at the top end of the market, they start to think more seriously about a splashy move of their own.

Valuation inflation

Looking at pricing for the expected deluge of deals in 2024, the picture appears evenly split: roughly half of dealmakers in our Tech M&A Outlook Survey forecast acquisition multiples ticking higher, while the other half anticipate 2023’s depressed valuations continuing into this year or even dropping. (Also backing up that middle-of-the-road projection is the fact that all respondents selected the “somewhat” modifier to their anticipated change in 2024, without a single “significant” change expected either up or down.)

Speaking of last year’s discounted deals — when, according to our M&A research, the prevailing multiple dropped two full turns from 2021’s record level back to roughly pre-pandemic levels — once again, our survey respondents accurately called the downturn.

A record two-thirds of dealmakers in the 2023 edition of our Tech M&A Outlook Survey predicted that valuations would come down. In contrast, as they turned to this year’s expected pricing, just 15% anticipated multiples coming down.

Sector smarts

By far, the trend that will be driving deals the most in 2024 is (what else?) generative AI, which easily outpaced the forecasts for a handful of emerging tech trends that we asked about in our Tech M&A Outlook Survey. While generative AI’s standing on the top of the podium probably wouldn’t have been a surprise, the magnitude of the outperformance is noteworthy. It is the highest-ranked trend we have ever asked about in our surveys.

According to our M&A research, the number of deal records mentioning “generative AI” (or a variation of the term) soared from just five transactions in 2022 to more than 110 in 2023.

Almost half (47%) of respondents said generative AI would have a “significant” increase in M&A activity this year, compared with just one in 20 respondents who said that about the other trends (observability, cloud native, DevOps, fintech). The other trends were far more likely — at least 10x more likely — to receive a forecast of a “slight” increase (rather than a more bullish “significant” increase) in dealmaking in the coming year.

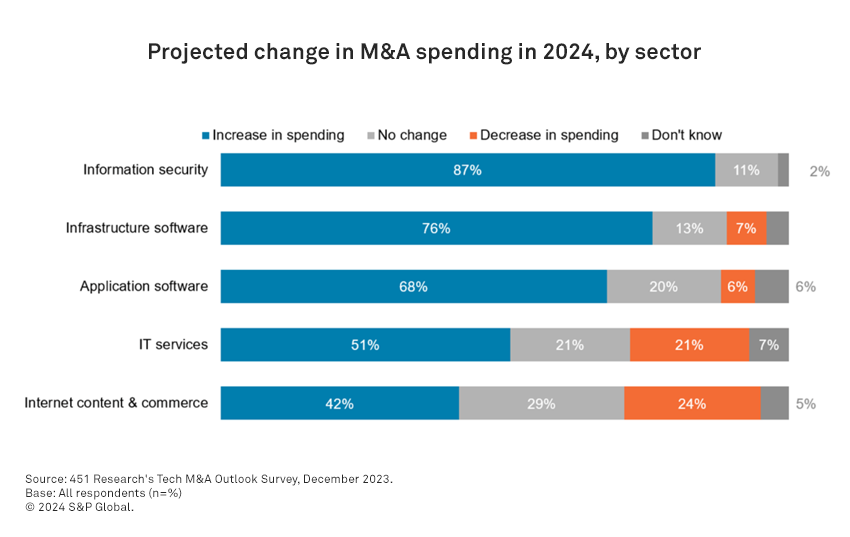

In terms of broader activity, a familiar name topped the forecast for busiest sector for dealmaking in the coming year: information security. Infosec, which tends to see the biggest IT budget increases in any given year, has headed the rankings in every Tech M&A Outlook Survey since we introduced the question more than a decade ago. For 2024, nearly nine of 10 respondents (87%) predicted an uptick in acquisition spending in the sector, while not a single person predicted a decline.

Following infosec, both infrastructure and application software registered significant increases in their outlooks for the coming year compared with the previous survey. The number of respondents who predicted more application deals as well as infrastructure transactions in 2024 jumped about 20 percentage points from their respective projections for 2023.

Do you have your finger on the pulse of tech trends? Join the 451 Alliance for exclusive research content on industry-wide IT advancements. Do I qualify?