As enterprise IoT (internet of things) deployments mature, so do attitudes toward IoT-enabling vendors and technologies, as seen in 451 Research’s Internet of Things, The OT Perspective, Vendor & Technology Decisions 2023 survey. Enterprises are inching away from capital expenditure (capex)-driven IoT deployments, moving to as-a-service operational expenditure (opex) consumption first, with outcome-based approaches still having limited impact. IT departments continue to be major IoT influencers and budget holders — especially for the infrastructure, platforms and applications that enable mission-critical IoT use cases. At the same time, operational technology (OT) and line-of-business stakeholders have put business process metrics and improvements at the center of enterprise IoT initiatives. Perhaps more than any other type of IT innovation, enterprise IoT cannot exist in a “technology for technology’s sake” bubble — it must deliver business value or it will wither on the proof-of-concept vine.

The Take

There is no faster path to an IoT argument than asking who will pay for it. 451 Research surveys have consistently pointed to the IT department as the biggest IoT influencer and budget holder — in large part because enterprise IoT requires a significant technology investment to get things off the ground. We see this again in our latest survey. This is not to minimize the role of operations or line-of-business influencers at all; at the end of the day, IoT insight and process improvements flow to their bottom and top lines, as in all technology projects. The best advice we can give is to get both sides to the table early, and engaged, to ensure projects not only get off the ground properly but deliver required — or even better, eye-opening — results. On the technical front, the IoT sector is maturing as well, with relatively new technologies such as 5G IoT, as-a-service infrastructure and AI/machine learning (ML) leading enterprise deployment priorities, while the technology rated most impactful — autonomous robotics — may be the most cutting edge of all. In short, even as the IoT market matures, new technologies promising new critical capabilities continue to drive innovation.

Summary of findings

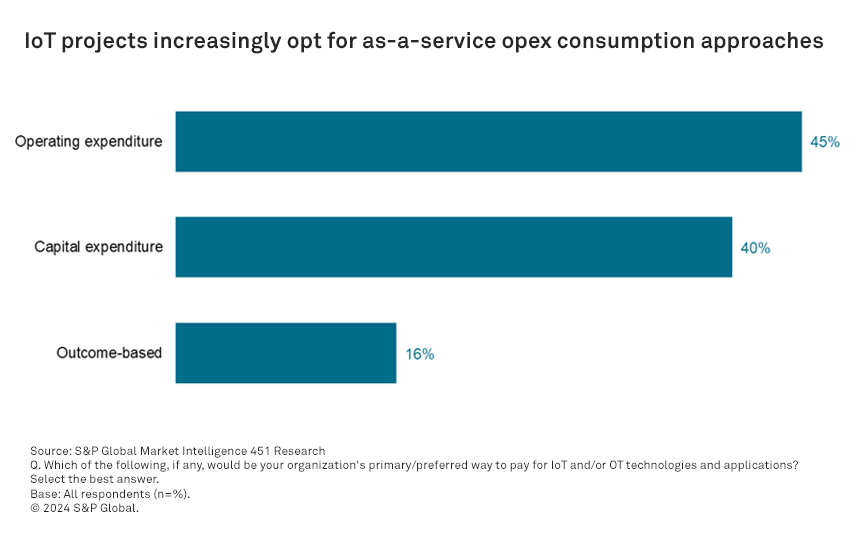

Enterprises that are deploying IoT prefer paying vendors via opex, an endorsement of growing vendor emphasis on delivering IoT and edge as a service. The largest percentage of respondents (45%) prefer to consume IoT and OT technologies as opex, while 40% opt for more traditional capex buy/lease arrangements. While OT vendors have a history of selling their wares via the successful delivery of business outcomes, just 16% of respondents say they prefer outcome-based purchasing for their IoT projects — a recognition that IoT spending, especially when it comes to IoT enabling purchases, continues to fall more to IT/tech versus OT/line of business. To that same end, 45% of respondents cite IT as the primary IoT buying decision-maker, compared with 29% for OT and another 7% for line of business. As we will see later, IT’s influence over technology choices does not mean that business requirements go unconsidered.

Digital infrastructure approaches tilt toward software as a service (SaaS) and platform as a service (PaaS), indicating enterprise interest in quicker, less complex IoT deployments with jump-start help from vendor partners. A slim majority of respondents describe themselves as either digital infrastructure “integrators,” leveraging PaaS (32% of respondents) or digital “consumers,” preferring a SaaS approach (23%). In both cases, the advantage to enterprises is the ability to speed IoT projects by consuming ready-made or relatively easy-to-assemble applications. That said, about half of respondents prefer to take tools in hand, with digital infrastructure “owners” deploying largely on-premises (23% of respondents), edging out digital infrastructure “builders” that consume IaaS, typically from cloud providers (21%).

Enterprises appreciate low price points and best-of-breed technology from their vendors, as well as the ability to deliver IoT-enabled business outcomes. With IT leading the buying decisions, IoT purchasers rank cost (the top choice, by 74% of respondents) and best-of-breed technology (70%) as the top two factors impacting their vendor choices. The next most significant factor? Delivering business outcomes (cited by 60%). That ranking reflects what we saw earlier: IT is choosing vendors via traditional considerations such as price and technical features; however, those decisions are increasingly being impacted by business considerations as well, which all stakeholders must keep in mind if IoT implementations are to succeed.

5G, as-a-service models and AI/machine learning lead enterprise IoT technology priorities — moving the sector into a new phase. Each of these technologies represents a leap forward or sea change for enterprise IoT. 5G, in the plans of 65% of respondents over the next 12 months, provides lower latency, greater ubiquity and, in most cases, higher speeds, as well as significant futureproofing. As a service (cited by 59% of respondents) and AI/ML (45%) offer new paradigms for IoT implementations: simplified deployment and consumption for the former, increased intelligence and proactive execution for the latter.

With 5G IoT a high priority, and new iterations coming this year (i.e., 5G Reduced Capability, or RedCap), it is critical for providers to understand the reasons for enterprise interest. When asked about the most critical factors for deploying 5G-based IoT connectivity, 65% of respondents cited high network availability, followed by greater speed (64%) and enhanced network security (60%). It is instructive to think about those as general-purpose 5G improvements — that is, wider availability and better resilience are a network operator five-nines benefit, applicable to most telco services (as is better security compared with at-times vulnerable Wi-Fi networks), while greater speeds are a natural progression as networks evolve. 5G IoT benefits that are more often touted as unique benefits are appealing to smaller numbers of respondents — including massive scalability (cited by 39% of respondents), integrated edge compute (38%), network slicing (30%) and ultra-low latency (just 21%). What to make of that? Straightforward 5G improvements appeal broadly. More meaningful improvements impact niche use cases, but some more critically: Support for massively scalable IoT or very low-latency roundtrips are make-or-break for applications including truly ambient IoT and autonomous operations.

Want insights on IoT trends delivered to your inbox? Join the 451 Alliance.