The wireless industry remains one of the most competitive consumer technology battlegrounds. Our latest survey on the topic gives us a snapshot of the current battle among service providers for new subscribers.

This article represents the findings of a March 2021 survey of approximately 2,200 primarily North American respondents from the 451 Alliance’s Leading Indicator panel focused on the latest trends in smartphones and wireless providers.

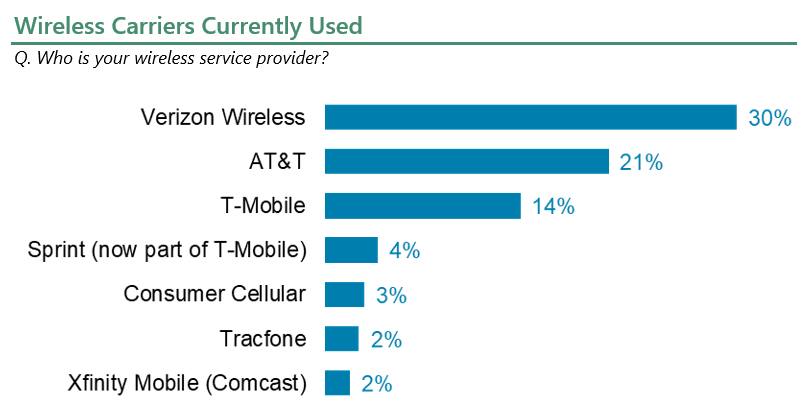

Verizon Wireless (30%) stands above all other providers in the current customer base according to the survey. AT&T (21%) and T-Mobile/Sprint (16%) remain the other heavyweights in the industry. Since the demographics of the panel lean toward older, higher-income respondents, it is important to note that this means there is a larger proportion of post-paid wireless subscribers, which is where Verizon exceeds other carriers.

Breaking down respondents by income level reveals a couple interesting tidbits of data. While Verizon, AT&T and T-Mobile/Sprint are the top providers across both higher (>$125,000) and lower (<$125,000) income households, there are some differences with the next tier of providers. Most notably, Consumer Cellular is used twice as much by lower-income households (4%) as higher-income ones (2%). Also, Tracfone is used in an even higher ratio by lower-income households (4%) compared to higher-income ones (1%). Both economy services appear to be successfully navigating the confines of their target demographics.

Switching gears to performance metrics, one of the most important aspects of consumer-facing services is customer satisfaction. Impressively, half (50%) of T-Mobile subscribers say they are very satisfied with the provider. Not only does this reading outperform Verizon (39%), but it’s also twice as high as the ratings for AT&T (23%) and Sprint (22%). Obviously, the Sprint numbers will change as those subscribers are integrated into T-Mobile over time, but it’s a big key in the battle against Verizon and AT&T for subscribers. Being able to offer what consumers believe to be the best customer experience is paramount in trying to not just reach the top, but also stay there.

![How satisfied are you with your current wireless service provider? [Very Satisfied]

How likely is it that you will change wireless service providers within the next 90 days? [Very/Somewhat Likely]](https://blog.451alliance.com/wp-content/uploads/2021/05/NI-052121-02.png)

As such, it’s no surprise that T-Mobile has the lowest churn rate as well, with only 2% of current subscribers saying they are very or somewhat likely to switch providers within the next 90 days. Verizon (8%) is the only other provider in single digits. AT&T (11%) and Sprint (16%) could lose the most subscribers compared to other carriers. Again, it’s worth noting that as Sprint is folded into T-Mobile, we should see improvements in the opinions of the Sprint subscriber base. It’s also likely that many of the Sprint defectors are proactively switching over to T-Mobile, prior to any internal merging of the two subscriber bases.

Finally, T-Mobile (35%) is set to gain the largest share of respondents who plan to switch providers in the next 90 days. AT&T (12%) and Verizon (7%) lag way behind. However, it’s hard to tell exactly how much of the move from Sprint to T-Mobile is propping up that percentage, if at all.

Regardless, T-Mobile’s advertising blitz over the last few years seems to have succeeded in changing the perception of the company in comparison to rivals Version and AT&T. Importantly, T-Mobile appears to be backing it up with strong customer satisfaction ratings. While only 8% of total wireless subscribers plan to possibly switch providers over the next quarter, if T-Mobile keeps grabbing the highest proportion of them, it will slowly chip away at the leaders.

Want insights on consumer technology trends delivered to your inbox? Join the 451 Alliance.