A 451 Alliance survey of IT managers who have direct involvement with data platforms uncovered some data trends that might surprise you.

Who Are the Players?

At 451 Research, the term ‘data platform’ encompasses a number of related, but distinct, software platforms, including:

- Relational operational databases (e.g., Microsoft, Oracle, MySQL)

- Analytic databases, or data warehouses (e.g., Oracle, Microsoft, IBM)

- Big-data platforms (e.g., IBM, Cloudera, Oracle)

- NoSQL operational databases (e.g., MongoDB, Apache Cassandra, Oracle NoSQL)

The vendor examples in this list represent the top three in-use vendors for on-premises implementations, according to a 451 Alliance member survey.

In all cases, those platforms are available either as on-premises implementations or cloud-based as-a-service deployments.

Who is Winning?

Download report >>

In terms of popularity, relational operational databases and analytic databases (data warehouses) dominate, although big-data platforms and NoSQL databases are coming on strong, particularly among data-driven enterprises.

On-premises implementations currently dominate cloud-based deployments by a factor of 2:1 to 3:1, depending on the type of data platform. However, there is a steady trend toward cloud-based approaches, primarily due to perceived cost advantages (as well as elasticity and horizontal scalability). This shift is accelerating rapidly.

For example, in the data platform space, the share of on-premises noncloud deployments is expected to plummet from 61% to 40% over the next two years. Hybrid architecture will be the norm for the foreseeable future.

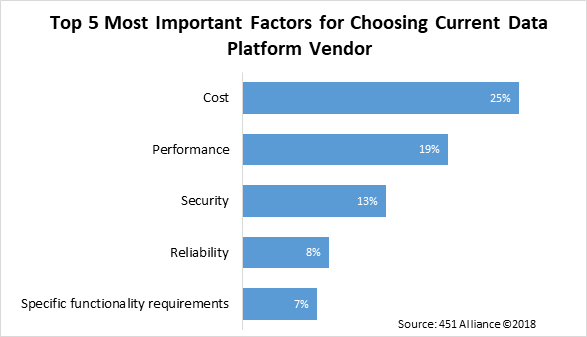

Vendor Selection Criteria

Cost is the leading factor for choosing a data platform vendor. It was cited by 25% of our survey respondents as the leading factor (see figure below), and by 62% as one of the key factors.

Performance (cited by 19% of survey respondents as the top factor in vendor selection) has become critical recently due to the explosion in the number of users that need access to the data platform (millions in some cases), the sheer amount of data to be captured and analyzed, new and proliferating data types/formats, and the complexity of in-depth analysis.

Security was cited by 13% of respondents as the most important vendor-selection criterion. In the context of data platforms, security encompasses functions such as encryption, authentication and authorization, to prevent data loss or ‘leakage.’

Despite renewed IT interest in open source alternatives (e.g., Apache Hadoop and Spark), only 3% of the survey participants said that open source was the primary vendor-selection criterion, and only 14% cited it as one of the key factors.

Vendor Landscape

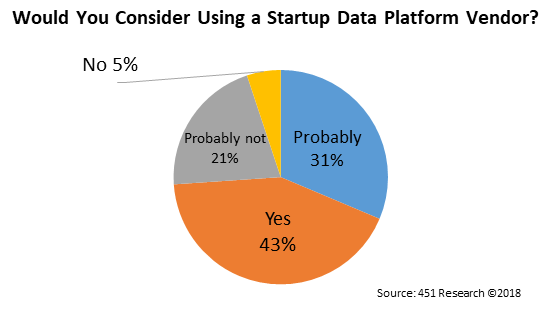

The IT behemoths (and a few open source alternatives) dominate the data platform vendor landscape. However, as IT leaders’ interest has shifted from traditional databases to more full-function platforms, several startups have entered the data platform market over the last few years.

Given the significance of data platforms, it’s somewhat surprising that the majority of IT managers (74%) would be willing to consider using a startup as their primary data platform vendor. The remaining 26% are unlikely to consider startups.

Given the significance of data platforms, it’s somewhat surprising that the majority of IT managers (74%) would be willing to consider using a startup as their primary data platform vendor.

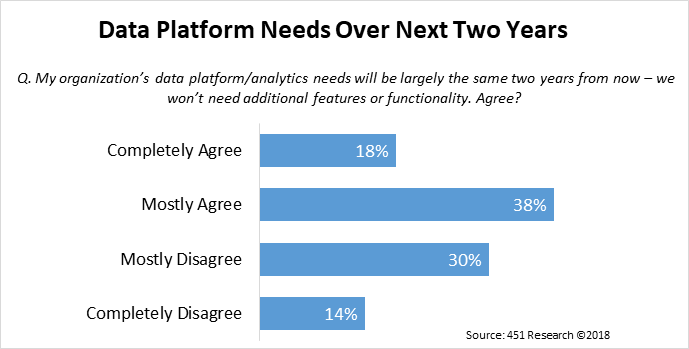

The functionality embedded in data platforms has evolved rapidly over the last few years. Vendors have improved the functionality of data platforms so much that the majority (56%) of IT managers are satisfied with the functionality and don’t anticipate needing new features in the next two.

Gating Factors to Adoption

Despite a surge of interest in data platforms, there are a number of gating factors that could retard adoption.

For IT managers, the top three gating factors are:

- Accessing and preparing data (cited by 19% of the respondents)

- Limited IT budget (19%)

- Data security/governance (17%)

Concerns about security and governance are most acute in the context of public-cloud-based implementations, although those concerns have been subsiding over the last few years.

A mere 6% of IT managers say that there are no barriers to adoption of data platforms.

Trends in Analytics Platforms

By far, analytics – including business intelligence – is the #1 use case for data platforms (particularly for enterprises that have formalized digital transformation strategies). Hence, the surge in interest in analytic databases as the foundation for data platforms.

Analytics platforms go beyond stand-alone analytics tools. They provide data management, BI and analysis, in addition to advanced functionality such as AI and machine learning.

We are finding that AI/ML are increasingly integrated into core features of analytics platforms, such as data ingest, processing, cleansing and transformation, in addition to analysis.

When asked about the primary benefits of analytics platforms, IT managers responded:

- Improved customer experience (50% of respondents)

- Improved operational efficiency (42%)

- Competitive advantage (39%)

What else can they do? Some IT managers implement emerging functionalities, such as OLAP for data lakes, natural language processing, natural language generation and prescriptive analysis.

Regardless of the type of data platform, common goals include reducing the number of point products and vendors, while dramatically improving the customer experience and engagement.

The 451 Alliance is an invitation-only think tank for IT executives, technologists, and tech-adjacent professionals. Do I qualify?