Last year’s survey saw a big drop in sentiment toward cryptocurrencies in the aftermath of the FTX collapse. Since then, overall sentiment has improved year over year, but still lags behind the level seen in 2022. Traditional investment vehicles, such as stocks and ETFs, continue to stand out as the top choices among self-directed investors. Bitcoin and ethereum are the most popular cryptocurrencies, while Charles Schwab remains the most used investing platform.

This Q1 2024 survey of self-directed investors from our Leading Indicator respondents focuses on the most popular types of investments and platforms, including the outlook for cryptocurrencies.

Summary of findings

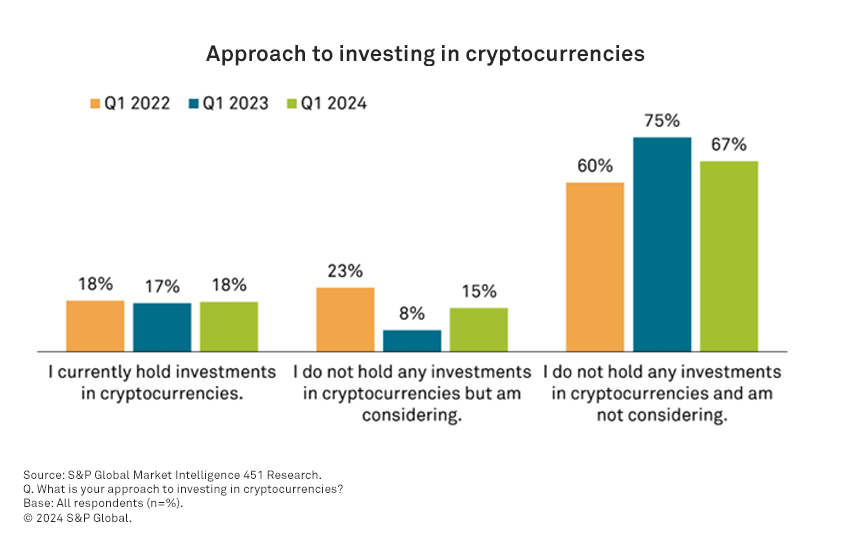

Interest in cryptocurrencies remains low. Our 2023 investing trends survey showed a steep decrease in respondents considering cryptocurrency investments amid the aftershocks of the FTX collapse. However, the current 2024 survey shows a moderate 7-point improvement among respondents who do not hold investments in cryptocurrencies but are considering (15%). While this is a positive sign, it’s still well below the 23% seen prior to the FTX debacle. Also up, but only slightly from last year, are the 18% (up 1 point) who say they currently hold crypto investments. As investors gain some confidence back, it’s important to note that that majority are avoiding the market altogether, with 67% of respondents saying they are not considering investments in cryptocurrencies.

Bitcoin and ethereum are most popular cryptocurrencies. Bitcoin (83%) and ethereum (73%) are the most-owned cryptocurrencies by respondents. They are far ahead of the next-closest coins, solana (21%) and cardano (17%), due at least in part to the much larger market caps the two leaders enjoy over the other cryptocurrencies.

No middle ground on cryptocurrency investing. Cryptocurrency has developed somewhat of a bad reputation. Among respondents who do not invest in cryptocurrencies, most (66%) say they do not trust it and 41% say prices are too unstable. Among respondents who have investments in cryptocurrencies, an overwhelming two-thirds (66%) feel it’s good for diversifying their portfolios, while 52% say it’s a good general investment to grow wealth.

Stocks and ETFs remain most popular investment vehicles. Similar to the previous couple of years, more than three-quarters (77%) of respondents say stocks and ETFs are the asset types that make up the biggest chunk of their self-directed investing portfolio. This is still more than double the allocations for mutual funds (35%), options and futures (25%), and bonds (24%). Cryptocurrency (14%) is the only other vehicle in double digits, but it remains well behind the others.

Charles Schwab remains the most used investment platform. Since last year’s survey, Charles Schwab has folded the TD Ameritrade brand into its own, but that doesn’t change the fact that they continue to be used by more than half of survey respondents currently engaged in self-directed investing (55% use mobile app; 52% use website). Fidelity comes in a strong second as it is used by one-third of respondents across its mobile app (33%) and website (34%). Another 18% use the combined E*TRADE and Morgan Stanley brands’ mobile apps and 17% using their websites. These results are largely in-line with last year’s survey, hinting at little churn among the top consumer investment firms.

Mobile investing apps are underutilized. Self-directed investors with higher discretionary income remain hesitant to fully embrace mobile apps, with only 34% of respondents saying they currently use mobile devices for investment-related activities. When asked why they don’t use mobile apps for investing, the top reason cited is the user experience (42%), followed by the fact that they simply have no need (37%) and security concerns (34%). These feelings are supported by the fact that customer satisfaction is higher with investment websites than investment mobile apps.

Want insights on consumer tech trends delivered to your inbox? Join the 451 Alliance.