The 451 Alliance’s May IT Spending survey found higher planned spending on laptops and desktops compared with the previous survey in May. Meanwhile, tablet purchasing remains stagnant.

Business PC Demand

Corporate spending plans for laptops (48%; up 14 points) and desktops (18%, up 3 points) in the fourth quarter are showing upticks compared with our previous survey in May. These findings are in-line with the quarter-over-quarter uptick seen in overall IT spending that we explored in a recent member report. The increase in both device types is likely due to pent-up demand as some companies waited to see how the pandemic would shake out. The larger uptick in laptops specifically is a sign that organizations have decided to lean into providing employees with equipment that allows them to work from anywhere as needed.

Smaller companies show much lower spending plans for laptops (36%) and desktops (14%) compared with larger companies (71% and 23%, respectively). Larger companies have more flexibility to update the devices their employees need. With that said, both groupings are showing increases in planned spending compared with last quarter, which is a good sign for smaller organizations.

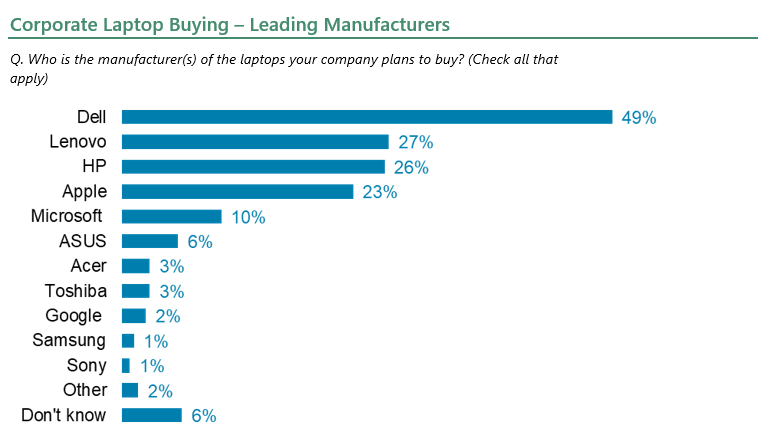

Dell (49%) remains the top laptop choice by companies, maintaining its lead over all other manufacturers. Lenovo (27%), HP (26%), Apple (23%) and Microsoft (10%) are the only other manufacturers with double-digit demand. Interestingly, each of these top bands is showing an increase in purchase intent compared with last quarter. The improved spending environment is being spread across multiple vendors’ products.

In terms of desktop purchasing, Dell (48%), HP (30%), Apple (15%) and Lenovo (12%) remain the leading manufacturers. Like with laptops, the survey is picking up improvements in demand for each of these vendors. It’s actually quite interesting to see an increase in spending on desktops, considering the higher mobility of the workforce due to the pandemic. A likely reason for this revolves around organizations that still need to maintain an in-office presence, thus they are outfitting employees with updated equipment after delays in spending due to the pandemic.

Business Tablet Demand

Business tablet buying plans are unchanged compared with last quarter’s survey. These findings are somewhat surprising, as tablets are the only corporate device category tracked in our survey not showing improvement compared with previous results. It’s been generally assumed that making employees more mobile meant giving them tablets, but based on the results discussed above, it looks like companies are providing laptops (and potentially smartphones) for better mobility instead of tablets.

The survey shows much higher tablet purchasing for larger companies (>250 employees; 13%) compared with smaller companies (<250 employees; 7%). Larger companies, which generally have more flexibility than smaller ones, are able to keep employees up to date with the resources they need, while smaller companies tend to make do with what they already have in place.

Apple continues to hold a commanding lead among companies planning to buy tablets. Like corporate smartphone purchasing, Apple is firmly in the top spot. Microsoft and Samsung remain distantly behind Apple, yet have their own spirited competition to stay ahead of the next tier of manufacturers. Over the last year, they’ve flip-flopped each other, and this jockeying for position will likely continue for the foreseeable future, but for now their positioning is unchanged compared with our previous survey.

Want insights on business technology trends delivered to your inbox? Join the 451 Alliance.