Source: © Marco Bottigelli/Moment via Getty Images.

Despite worries about a potential recession, the data from a recent Macroeconomic Outlook survey conducted by 451 Research, a part of S&P Global Market Intelligence, indicates a surprising improvement in consumer spending. This blog post aims to shed light on the evolving landscape of consumer behavior.

Key consumer spending trends

The top three consumer spending trends that were found in the recently conducted study are as follows:

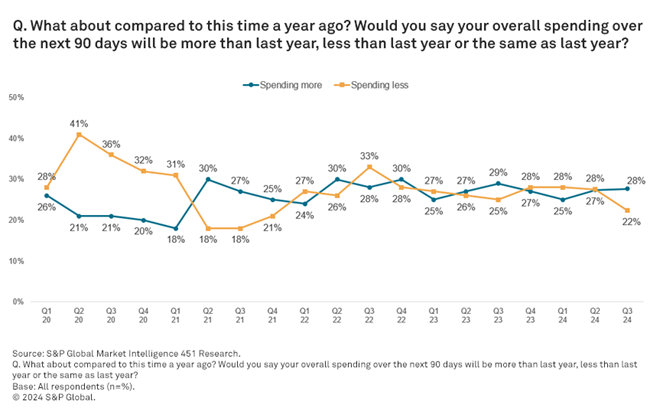

- Improvement in spending plans: A notable 28% of survey respondents plan to spend more in Q3 2024 compared with Q3 2023, versus 22% saying they will spend less. This marks a net +6% (spending more minus spending less), which is the strongest reading since Q3 2021 and represents a 7-point improvement over Q2 2024, the largest quarter-over-quarter jump in nearly two years. This uptick suggests that consumers continue to roll with the punches despite economic uncertainties.

- Inflationary pressures felt at the consumer-level: In recent months, inflation has begun to cool, with prices not rising as sharply. This is evident as 53% of survey respondents reported spending more than expected in the past 90 days, a 5-point reduction from Q3 2023. However, 67% of those planning to spend less on discretionary items cite increased cost of living as the top reason, up 6 points from the previous year. This indicates that, while inflation is easing, it still significantly impacts consumer behavior.

- Stable consumer sentiment: Sentiment toward the economy remains relatively stable, with 32% expecting it to worsen and 21% expecting improvement, resulting in a net -11 sentiment score. This shows a gradual improvement since the start of the year, driven mainly by higher-income households. This stability is crucial as it suggests that consumers are not overly pessimistic, which can help sustain economic activity.

Spending plans vs. actual spending

While there is an improvement in spending plans, much of the expenditure is directed toward household necessities, leaving less for discretionary purchases. Categories such as groceries (+39), energy/utilities (+21), health expenses (+11) and housing (+11) have seen the most significant increases in spending. This trend underscores the prioritization of essential items in household budgets.

On the other hand, discretionary categories like travel/vacation and automobiles show slight improvements, indicating that consumers are beginning to allocate some funds towards non-essential items. However, sectors like movie theaters (-11), sporting events (-7) and restaurants (-6) are still experiencing reductions, reflecting cautious consumer behavior in these areas.

Economic sentiment by income group

There is a noticeable disparity in economic sentiment between income groups. Higher-income households (earning more than $100,000 per year) are more optimistic, with 33% expecting economic improvement, compared with 15% of lower-income households (earning less than $50,000 per year). This disparity highlights the uneven impact of economic conditions across different income brackets, with higher-income individuals feeling more secure and potentially more likely to spend.

Job loss fears and employment sentiment

Employment sentiment has remained stable, with 44% of respondents worrying about job loss and 32% not worried at all. This lack of volatility in employment sentiment is crucial for consumer psychology, as it favors stability over surprises. A stable job market helps maintain consumer confidence, which is essential for sustained economic activity.

Conclusion

In conclusion, despite ongoing concerns about an economic downturn, consumer spending is demonstrating year-over-year improvement. The easing impact of inflation has led to more optimistic spending plans, although a significant portion is still allocated to essential household needs. These trends highlight the importance of monitoring how different income groups are navigating these changes. As we move forward, understanding these dynamics will be crucial for anticipating future consumer behavior and economic conditions.

Want insights on consumer technology trends delivered to your inbox? Join the 451 Alliance.

This content may be AI-assisted and is composed, reviewed, edited and approved by S&P Global in accordance with our Terms of Service.

Want to participate in future research studies on macroeconomic trends and get the results delivered to your inbox? Join the 451 Alliance.