Generative AI, a form of artificial intelligence capable of creating “net new” text, images, data and videos, has gained significant attention in the financial industry. With OpenAI’s launch of its chatbot, ChatGPT, many banks and fintechs have started exploring the potential of this technology. In a recent custom 451 Research survey, 74% of fintechs strongly agreed that GenAI will have a transformative impact on the industry in the next five years. This blog post explores the various use cases of GenAI in fintech, including fraud prevention, customer service and employee productivity.

Enhancing fraud prevention

GenAI has the potential to revolutionize fraud prevention in the financial sector. Lucinity, an Iceland-based fintech, leverages generative AI to support compliance teams. Its copilot, Luci, extracts insights from customer data to generate a comprehensive picture of individuals and transactions. This helps compliance personnel quickly identify suspicious activities and generate detailed reports for regulators. By automating these processes, GenAI reduces the heavy lifting from workflows, improves efficiency and upskills new hires. Moreover, generative AI can assist banks and fintechs in remaining compliant with changing regulations by summarizing complex regulations and extracting obligations. This aims to reduce the burden and cost of compliance, while ensuring adherence to regulatory requirements.

Elevating customer service

AI-based chatbots have become common in customer service, but generative AI takes it a step further. Klarna, a “buy now, pay later” giant, believes that GenAI can transform customer service interactions. By making chatbots more intuitive and conversational, banks and fintechs can provide a better customer experience. This allows customer service staff to focus on more complex queries that require a human touch. For example, Annerie Vreugdenhil, chief commercial officer of personal and business banking at ING, mentioned that the company uses GenAI to generate instant summaries of products. This enables agents to focus on the client rather than clicking through multiple screens to find relevant information. The use of GenAI-powered assistants, such as Finn by neobank bunq, further enhances customer service by providing personalized assistance and support.

Boosting employee productivity

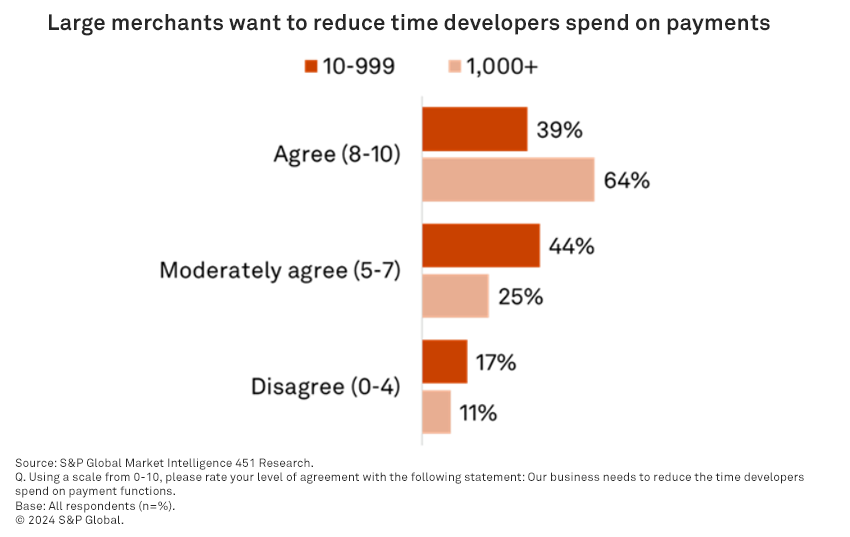

GenAI can also enhance employee productivity in the financial industry. For instance, spend management startup Brex collaborated with OpenAI to create a conversational tool that surfaces corporate spending insights, budgets and benchmarking data. This enables finance professionals to easily access information and make informed decisions. By deploying plain language, employees can receive answers to specific requests, such as real-time data queries, without the need for coding. This not only saves time, but also empowers employees to focus on higher-value tasks. Additionally, GenAI can help developers by providing summarized documentation and specific information, reducing the time spent on payment functions. Stripe, for example, allows developers to present queries within its platform, and receive relevant information from GenAI-powered tools. According to a 451 Research survey, 64% of merchants with 1,000-plus employees agree that their business needs to reduce the time developers spend on payment functions.

Conclusion

Generative AI holds immense potential in the fintech industry, particularly in fraud prevention, customer service and employee productivity. Although it complements human capabilities, concerns regarding data privacy, bias, accuracy and reliability must be addressed. Banks and fintechs must navigate these risks carefully to fully harness the transformative power of GenAI. By embracing its capabilities, the financial industry can optimize operations, enhance customer experiences and drive innovation. The adoption of GenAI in fintech will lead to a more secure, efficient and customer-centric financial ecosystem.

Want insights on fintech trends delivered to your inbox? Join the 451 Alliance.

Notice and Disclaimer: Some of the content in this 451 Alliance blog was generated by artificial intelligence. Although the content of the blog is reviewed by human subject matter experts, S&P and its affiliates cannot and do not guarantee that it (including any content generated by artificial intelligence) is without errors, omissions, inaccuracies, biases, inconsistencies, or contains outdated information. You should independently verify the content before using it. S&P and its affiliates do not accept any responsibility or liability for any decisions you make, or for your reliance on, or use of the content, which is entirely at your own risk.