Storage isn’t the most glamorous sector in IT, but it’s still one of the three key pillars of IT infrastructure, along with servers and networks. 451 Research recently surveyed IT professionals in the 451 Alliance about their opinions on storage vendors, purchasing criteria and plans. Here are some of the takeaways.

Dell EMC Still On Top

Not surprisingly, Dell EMC still rules the roost in storage. In the 451 Alliance study, 21% of the participants cited Dell EMC as their main storage vendor.

Overall, Dell EMC garnered high ratings in virtually every category, save a few recurring complaints.

One complaint is that – in large part due to a lot of acquisitions – the company’s profusion of products causes some redundancy.

As one IT manager put it:

“From a product positioning [standpoint], Dell EMC has too many storage products. They overlap, and they haven’t simplified the product line or unified support.”

Another complaint is high prices:

“We’re Dell EMC users, but we’re in the process of looking at some different vendors, including Pure [Storage]. We’ve been using the same supplier [EMC] for a long time, and it’s very expensive. So, we’re looking at alternative suppliers to get a better deal. And to put a little pressure on EMC.”

Trailing behind Dell EMC are the remaining storage stalwarts:

- Hewlett Packard Enterprise (cited by 11% of survey participants as their primary vendor)

- NetApp (10%)

- IBM (7%)

The only startup to crack the top 10 primary vendors was all-flash specialist Pure Storage (although at six years since its first commercial shipments – and about $1.4bn in annual revenue – it’s debatable whether Pure can be considered a startup).

AWS Ascends

What’s surprising is the continued ascendency of cloud providers into the upper echelon of storage providers.

For example, Amazon Web Services (AWS) was cited by 12% of the survey participants as their main storage vendor (putting AWS in the #2 spot), and Microsoft Azure was cited by 9%. About half of the enterprises currently use public cloud storage services.

AWS’s surge is due primarily to its low-cost storage platforms – most notably the object-based Amazon S3 and dirt-cheap Glacier secondary storage platform (pennies per GB, although actual pricing depends on a number of factors). Glacier is generally used for data that is rarely – if ever – accessed.

In addition to low cost and predictable billing, IT professionals like Amazon’s simplicity. As one survey participant said:

“[AWS storage] is like a spoon. It just works. You don’t really need to change what a spoon does . . . I can’t find any [vendor] that can meet the same requirements, pricing and reputation as their storage.”

Or as another IT pro put it:

“[With AWS S3], you set it and forget it. And there are no surprises when it comes to the billing.”

Another reason for the ascendancy of cloud providers is the addition of more storage services and architectures.

For example, vendors such as AWS have added NAS file sharing to expand their reach and augment their block and object storage services. 451 Research expects Amazon’s Elastic File System (EFS) to enable the company to further expand its position as a prominent storage provider.

Consolidation Reduces Complexity

For some time, enterprises have been trying to consolidate the number of storage vendors they use in order to reduce complexity. And they’re doing a good job: The average enterprise has only two to three primary storage vendors (2.2 on average), which is significantly less than only a few years ago.

“Five years ago, we decided to consolidate. We had a lot of legacy [hardware and software], a lot of vendors. It took a lot of effort to manage it, to manage contracts, pricing, etc. We needed to get to fewer vendors.”

However, there is a countervailing trend: price leverage. Enterprises often go with multiple storage vendors primarily to improve their bargaining clout and drive price competition. In fact, 58% of enterprises with a multi-vendor storage strategy do so in order to gain pricing leverage.

This trend is even evident in the backup/recovery arena:

“We have Commvault [Simpana], EMC Networker and Veritas NetBackup. We assessed what it would take to have a single backup application running from a single console. But management wasn’t too happy with the price point.”

In other words, it costs more to have fewer vendors!

Vendor Selection Criteria

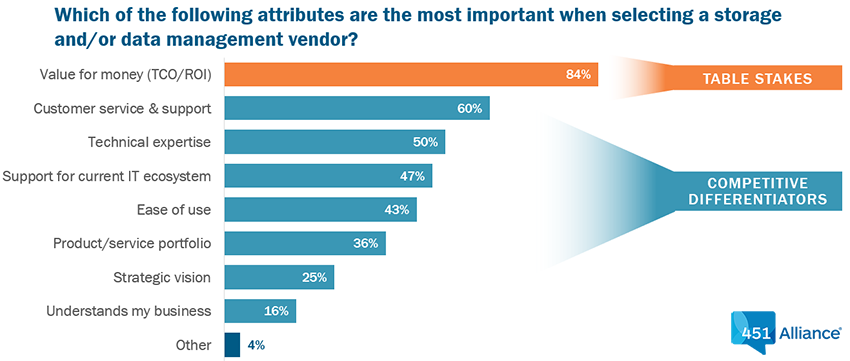

The importance of cost is evident in enterprises’ storage vendor selection criteria: ‘Value for the money (TCO/ROI)’ is by far the primary factor, cited by 84% of the survey participants (see Figure below).

IT’s emphasis on price is a key reason why perceived low-cost vendors (e.g., AWS and Veeam in the backup arena) score high in enterprise storage rankings (and is also a sign of maturity in the market).

Surprisingly, strategic vision ranked relatively low among users’ vendor-selection criteria, which is yet another sign of maturity in the storage space.

Do you have your finger on the pulse of tech trends? Join the 451 Alliance for exclusive research content on industry-wide IT advancements. Do I qualify?

One Reply to “What Do IT Pros Want From Their Storage Vendors?”

Comments are closed.