In the 451 Alliance’s August IT Spending survey, we asked corporate respondents about the latest trends in smartphones. The results provide insight into their companies’ smartphone purchasing plans, current usage and customer satisfaction.

Planned Purchasing

Similar to the improving overall IT spending environment, the survey finds an uptick in overall planned smartphone purchasing (22%; up 4 points) compared with the previous quarter. For context, this is also better than the 19% of companies planning to buy smartphones for their employees that we saw in August 2020. These results are encouraging, and signal that businesses are getting back to normal levels of spending on tools for their employees.

The bigger purchasers of smartphones for employees continue to be larger companies (>250 employees; 37%). This compares with only 14% of smaller organizations (<250 employees). While spending by larger companies still vastly outpaces that of smaller ones, buying plans for both groupings are up compared with last quarter.

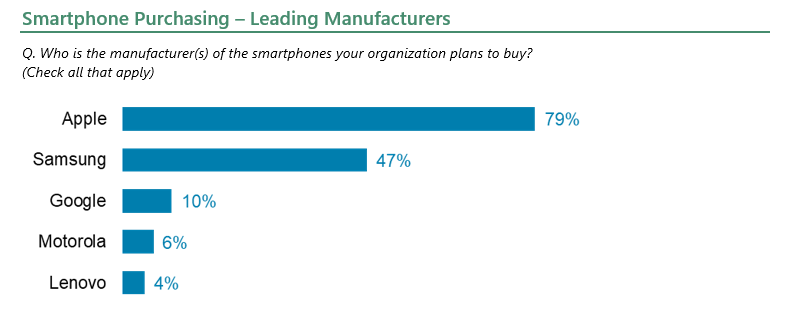

Apple (79%) continues to enjoy tremendous corporate demand, regardless of the fluctuations in overall purchasing plans – and even the fluctuations in manufacturer-specific planned purchases – solidifying its position as the top smartphone manufacturer for businesses, according to our data.

Samsung (47%) remains a distant second, but is showing improvement compared with our previous survey. Google (10%) and Motorola (6%) are far behind the leaders, yet maintain in stable positions. Simply put, while the specific percentages might fluctuate, there continues to be little overall movement within the corporate smartphone market.

Among specific models, the iPhone 12 (28%) is the top Apple smartphone that companies plan to buy. Demand for the iPhone 12 Pro (25%) is also solid, followed by the iPhone 12 Pro Max (14%) and iPhone 11 (12%). Importantly, 35% of respondents don’t know which models their company will purchase. The phones that this group ultimately buys will have a material impact on the final tallies for iPhone model demand.

For Samsung, the Galaxy S21 5G series (30%) are the most in-demand models. They are followed by the Galaxy Note20 5G series (13%), Galaxy S10 5G (13%) and Galaxy A-series 5G (11%). Just as with Apple, a large number of planned buyers are undecided at this time.

Current Usage

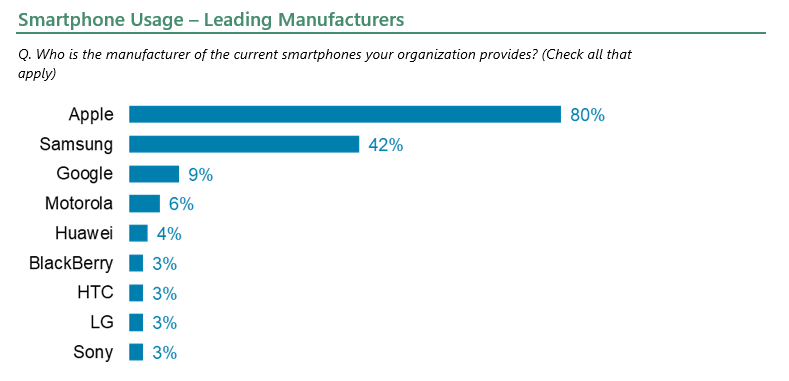

The number of companies providing smartphones to their employees (43%) is little changed compared with the previous survey in May, which is a good sign for the potential of stability going forward. In terms of manufacturers, Apple (80%) remains the most popular brand, followed distantly by Samsung (42%). Google (9%) and Motorola (6%) continue to flip flop, yet are still distantly behind the leaders. Notably, we are seeing improvements for Samsung and Google in current usage and planned buying compared with the previous survey.

A primary reason for Apple’s strong performance is its outstanding customer satisfaction ratings – and this quarter is no different. Current iOS users are more satisfied with their phones (98% very or somewhat satisfied) than users of their biggest rival platform, Android-powered phones (93%). Typically, we see Apple/iOS and Android fluctuate from quarter to quarter as new devices are released and already-in-use devices continue to age. Apple, for the most part, is seen as delivering the most consistent experience across different phones, which is what keeps it at the top of the market.

Want insights on business technology trends delivered to your inbox? Join the 451 Alliance.