The past year was a challenging one for the global economy and multiple sectors, with the IT industry being no exception. Issues deriving from supply chain disruptions, workforce retainment, high interest rates and shifts in demand have led to lower revenue and falling stock prices for IT firms. The leased datacenter industry was also susceptible to those changes, particularly as hyperscale customers made up increasingly larger amounts of their client base, rendering the industry more vulnerable to the issues faced by those larger technology firms.

This two-part blogpost includes the main trends 451 Research experts believe the datacenter industry will see in 2023. In Part 1 we’ll cover datacenter industry restrictions, sustainability, broader effects of inflation and supply chain disruptions, top industry customers and the evolving business and ownership models.

A rise in industry restrictions

The datacenter industry has faced higher levels of scrutiny by government entities and the general public, especially as it relates to the growth of large-scale datacenters in certain markets, and that trend will likely continue in 2023. Cities like Amsterdam, Ashburn, Beijing, Dublin and Frankfurt have all limited datacenter construction, typically due to concerns around the large amounts of electricity being consumed, water use, noise levels, pollution or the number of jobs being created. Datacenter providers have adapted and found ways to address those concerns, increasing energy efficiency in their facilities, reducing noise and diesel pollution and finding ways to contribute to the local community. Industry players will likely have to continue finding ways to deal with concerns by the government and the general public as more markets impose restrictions on datacenter growth.

All eyes on sustainability

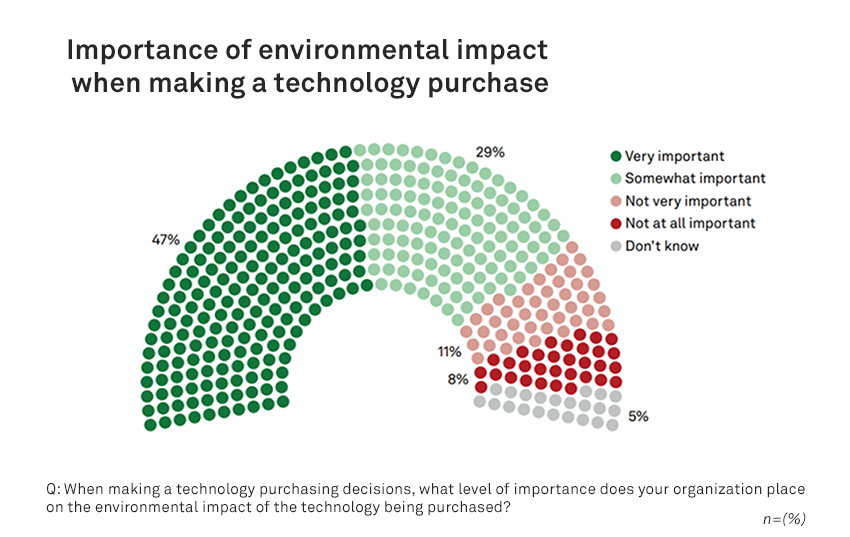

Sustainability is becoming a major factor for enterprise clients when choosing a datacenter provider, with nearly half of respondents recently surveyed by 451 Research highlight environmental impact as an important element considered when making technology purchasing decisions (see figure below). The datacenter industry has challenges ahead, especially as it relates to establishing sustainability metrics to standardize the practice and avoid “greenwashing”, an exaggeration of one’s sustainable practices. Providers will have to educate government agencies, customers and the general public on the industry’s sustainability efforts to offset any concerns about datacenters and their environmental impact.

Broader effects of inflation and supply chain disruptions

Datacenter pricing had been on a downward trend for the past ten years, particularly in the wholesale space, with industry providers using economies of scale as well as cost-effective approaches to construction and operation to achieve lower leasing prices. Since the COVID-19 pandemic, however, costs have risen due to factors like supply chain disruptions, construction challenges, labor shortages and higher energy costs. These issues were further exacerbated by the ongoing conflict in Ukraine, resulting in higher build costs and construction delays. Some of these higher costs will be passed on to customers in the form of price increases, although the extent of those increases, and their effect on the industry, is still difficult to discern. The result could be increased prices for associated services like cloud and managed services; it could even push cloud provider customers to own and operate more facilities themselves.

Cloud providers to remain top customers for the industry

Hyperscale customers such as public cloud providers and other large-scale IT firms have accounted for most of the demand behind leased datacenters in the past few years, taking up as much as 80% or more of datacenter space in some markets. Despite the economic challenges of the coming year, such as higher interest rates and higher build costs, we believe strong demand will continue, as enterprises around the world push for digital transformation efforts, including public cloud adoption. Cloud providers should continue growing particularly in new markets as they build their presence closer to end users, boosting the datacenter industry in those countries.

Changing business and ownership models

The leased datacenter industry has traditionally been segmented into four distinct business models: telecom-owned, retail, interconnection-focused (essentially a subset of retail) and wholesale. These subcategories were often quite separate and easy to distinguish yet are now overlapping more commonly. Traditional retail providers are looking to get their share of wholesale demand by adding large-scale space to their facilities, while wholesale providers add connectivity offerings and fill up small amounts of vacant space in their facilities with retail customers. Telecom providers are also more increasingly looking to make their facilities carrier neutral in order to be more appealing to customers. The datacenter sector is evolving, fostering significantly different business models different from the conventional ones previously observed in the industry.

Want insights on datacenter trends delivered to your inbox? Join the 451 Alliance.