TeraWatt Infrastructure, a company building out charging sites for commercial electric vehicles, recently announced a $1 billion funding round. The development is one of many signals that electrification for the commercial transportation industry is inching toward wider adoption. Enterprises in the sector have the dual drivers of saving money on fuel and overall energy costs, combined with meeting internal and external sustainability goals. However, significant hurdles remain, such as range anxiety and the extended time it takes to charge a vehicle.

The Take

The massive financing round for commercial EV charging firm TeraWatt, along with increasing private funding and commercial EV incentives built into the recent U.S. Inflation Reduction Act, (IRA) should help in overcoming the chicken-and-egg conundrum with commercial EVs: Organizations don’t want to buy them if the charging infrastructure isn’t robust, and real estate companies don’t want to build chargers unless there are enough commercial EVs on the road.

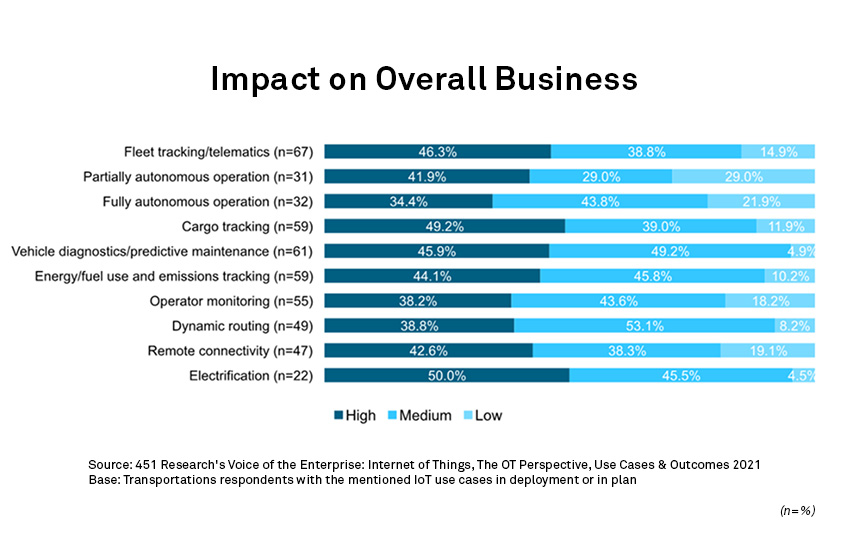

Electrification is the least popular IoT and digital transformation project for commercial transportation providers, according to 451 Research’s Internet of Things, The OT Perspective, Use Cases & Outcomes survey, with only one-fifth having deployed it or planning to in the next two years. However, it is also an IoT project that half of respondents said would have a high impact on their overall business, which is more than any other use case. That adoption-impact gap implies that commercial transportation firms realize how beneficial electrification can be, but have blockades in implementing it. Concerns about charging infrastructure for commercial EVs is one of the top hurdles.

Context

TeraWatt Infrastructure, a startup that just began operations last year, has secured a massive $1 billion round of funding as it looks to build out charging centers for commercial electric vehicles. The company is based in San Francisco and led by executives who were formerly with Google, SolarCity and Enel X. Top investors in the series A include Vision Ridge Partners, Keyframe Capital and Cyrus Capital.

It has properties in 18 U.S. states, located in key transportation corridors and logistics hubs. TeraWatt also recently signed a partnership with all-electric rideshare vendor Kaptyn to build out EV chargers for its fleets in California, Nevada and Florida. The company plans to use the new funding to increase staff and begin the buildout of commercial EV chargers at its various properties.

Why electrify?

Commercial transportation firms are coming to realize that electrifying their fleets has multiple benefits. Once in widespread production, electrification of commercial vehicles will allow enterprises to save on fuel and energy costs. Second, the resulting decarbonization of the industry will help those companies meet internal sustainability goals while complying with both voluntary and mandatory environmental goals from external government organizations.

The hindrances, however, are not trivial. The length of time it takes to recharge versus refuel, anxiety about the actual range of electric commercial vehicles, and the lack of available charging infrastructure are just a few of the substantial issues that — if not addressed — will have the adoption curve looking like a gentle upward hill instead of a steep mountain climb.

Moving a container of goods halfway across the world consumes a lot of fuel. Not only does that fuel cost money for the vendors transporting those loads, but it also creates tons of carbon dioxide that get emitted into the atmosphere. Those are the two main reasons why commercial transportation companies seek to electrify and decarbonize their fleets. Consumers now expect to click “buy” and see their order on the front stoop within 48 hours. This doesn’t happen via magic. The movement of a widget to a consumer’s residence is like the journey of a red blood cell from the heart to the fingertip, traveling via smaller and smaller passageways until it eventually reaches its destination.

In transportation, each year this journey happens more often and to more different places, at a more rapid pace. Freight transport is expected to increase 41% to 146,000 billion tons-kilometers by the end of this decade and jump 2.5x to 255,000 billion tons-kilometers by 2050, according to the Organisation for Economic Co-operation and Development’s (OECD) International Transport Forum.

That rise in freight volume will lead to a corresponding increase in carbon emissions, to the tune of 15% by 2050, according to OECD projections. Digging into the numbers reveals efficiency by transport mode. While maritime transport accounted for 70% of total freight volume in 2020, it only accounted for 17% of carbon emissions in freight transport. On-road freight, on the other hand, accounted for just 15% of volume in 2020 but 45% of emissions. Within road freight is an even more damning insight: urban deliveries. While they accounted for just 3% of all freight volume, they emitted 24% of all carbon.

The data provides a promising direction when it comes to the electrification and decarbonization of commercial transportation. The lowest-hanging fruit is electrifying and decarbonizing on-road freight transport — not only does it account for nearly half of all carbon emissions in freight transport, but it also is less efficient than other modes of transport in terms of freight transported per unit of carbon dioxide emitted. Additionally, if that electrification can happen in urban environments, that is exponentially more beneficial on a per-mile basis.

Hurdles and incentives to adoption

In addition to large amounts of private and public market funding that has been spent on electrifying commercial fleets, governments are offering incentives — and warning about future penalties — to encourage electrification. In August, the IRA was signed into law by U.S. President Joe Biden. It allocates $369 billion for climate spending and energy security. Credits for fleet electrification, electric vehicle supply equipment and individual tax credits for EVs are among the IRA’s allocations for the transportation sector.

To support a national network of reliable chargers, which is routinely cited as a barrier to adoption, the IRA raises the tax credit available for commercial entities that install chargers to either $100,000 or 30% cost per charger, whichever is less. The IRA also offers a tax credit of $40,000 for commercial EVs weighing more than 14,000 pounds, and a credit of $7,500 for commercial EVs under that weight limit. While the credits can be effective, there is debate about how effective they are compared with other incentive programs. Vouchers, for example, can offset the initial capital cost of buying EVs or chargers, rather than a back-end tax credit or rebate, thereby incentivizing businesses to take the leap toward incorporating EVs into their fleets.

Another hurdle has been the lack of supply of commercial EVs, especially in the medium- and heavy-duty categories. That too is poised to change in upcoming years, as all of the major trucking manufacturers — Daimler Truck AG, Freightliner, Peterbilt, Volvo Trucks, etc. — have heavy-duty EVs available now or will in the near future.

Other hurdles remain. Charging and battery technology must advance so that recharging times at least come within striking distance of the time it takes to refuel a gasoline or diesel engine — currently, most heavy-duty EV trucks take 90 minutes to charge to 80%. Range anxiety also continues to be a challenge, as most heavy-duty EV truck makers advertise a range of roughly 250 miles.

We expect commercial trucking firms to slowly begin mixing EVs into their fleets of vehicles to benefit from these incentives and avoid future EV mandates. So-called back-to-base scenarios (where the EVs start and end each day at — and don’t stray far from — a designated company charging location) are the most attractive and have the most deployments today, as they mitigate range anxiety. As battery technology improves and the EV charger infrastructure gets more built out, electric commercial vehicles will voyage farther and farther from home.

Want insights on smart car technology and automotive industry trends delivered to your inbox? Join the 451 Alliance.