Source: Comstock/Stockbyte/Getty images.

US bankers have a favorable outlook on loan growth over the next year amid a volatile economic outlook caused by the Trump administration’s tariff policies and persistent doubts whether borrowing activity will rebound in the second half of the year, according to S&P Global Market Intelligence’s second-quarter 2025 US Bank Outlook Survey.

The Take

Almost 79% of the respondents forecast loan growth over the next 12 months. Concerns about credit quality on commercial real estate loans, personal automobile, and one- to four-family mortgage rose sequentially. Half of the respondents are expecting recession within the next year.

Optimistic outlook on loan growth

Among those surveyed, 78.6% expect loans to grow at their institution over the next 12 months, up from 75.2% in the year-ago survey.

Respondents expecting total loans to grow 5% or more increased to 22.3% in the second quarter, up from 17.1% a year earlier.

Analysts slashed their 2025 loan-growth forecasts in April as banks reported that increased macroeconomic uncertainty was interfering with clients’ ability to make plans. Bank stocks have since recovered with some executives giving a more favorable economic outlook.

Credit quality concerns

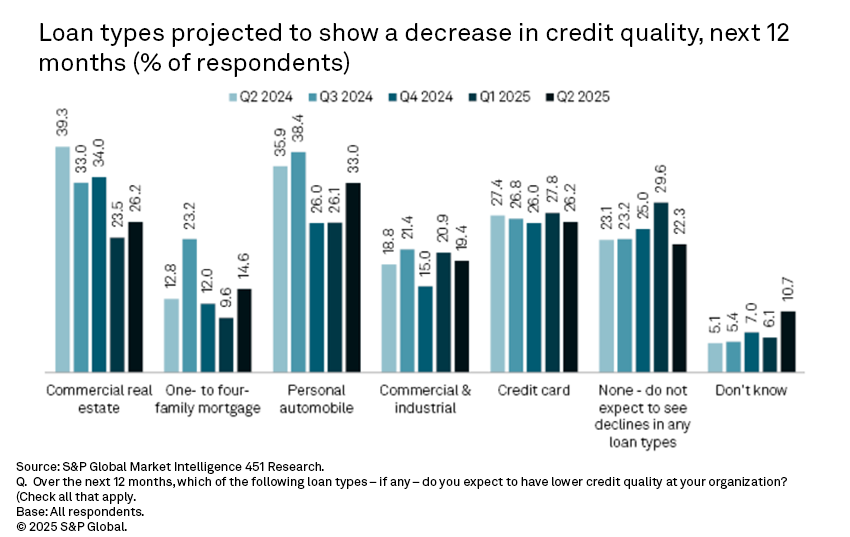

The proportion of respondents expecting deterioration in commercial real estate loans was 26.2%, a slight increase from 23.5% a quarter earlier but down from 39.3% a year earlier.

Meanwhile, credit quality concerns regarding personal auto loans and one- to four-family mortgage loans also increased sequentially.

The proportion of bankers who expect deterioration in personal auto loans rose to 33.0% in the second quarter from 26.1% in the first quarter, while those expecting one- to four-family mortgage loans to wane increased to 14.6% in the second quarter, compared to 9.6% in the previous quarter.

While US banks’ net interest margins are forecast to expand, earnings growth could be limited in the second half of 2025 as the lagging impact of tariffs weighs down on consumers, pushing delinquencies higher.

Economic outlook

Among those surveyed, 45.0% assessed a moderate to high level of economic instability since the Trump administration took office and quickly began enacting new policies.

Meanwhile, 47.8% expect a recession in the US within the next year.

According to analysts at Keefe Bruyette and Woods, the extent of the bank stock crash in April was on par with the decline in 2019, when markets were concerned about a cyclical downturn, but falls short of the carnage that occurred in episodes like the pandemic.

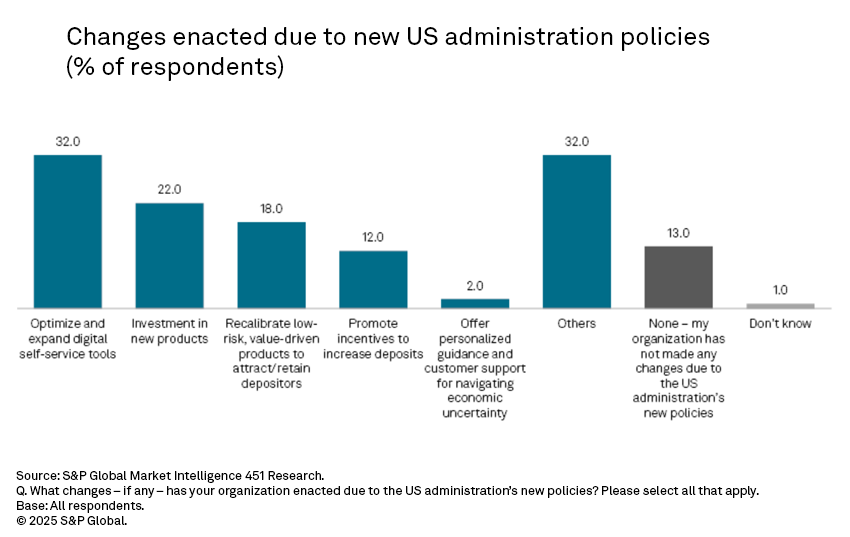

In line with the economic uncertainties brought by the new policies of the Trump administration, 32.0% of the respondents said that their organization optimized and expanded digital self-service tools, while others started investing in new product offerings and the recalibration of low-risk, value-driven products to attract and retain depositors.

Deposit stress testing

As the prospect of deposit runs became prominent in 2023, federal financial regulators urged banks to update their contingency funding plans more frequently as market conditions change, noting that “the events of the first half of 2023 have further underscored the importance of liquidity risk management and contingency funding planning.”

Stress testing for deposit outflows is one way in which banks could preemptively plan to find additional funding in light of unexpected withdrawals, but awareness of “deposit stress testing” was varied among survey respondents.

Among the respondents that answered the question, 27.6% did not know if their institution conducted deposit stress tests, while 13.3% of respondents said their institution did not conduct deposit stress tests. Among those companies that did conduct a stress test, 18.1% had a 30-day deposit outflow assumption of 10% to 14%, while 17.1% had a deposit outflow assumption of less than 5%.

M&A outlook

The proportion of respondents that indicated their institution was either “somewhat” or “very” likely to pursue acquiring another company over the next 12 months was 39.6%, while the proportion of bankers that thought their institution is likely to sell was 8.9%.

US bank M&A activity is expected to have a resurgence in the second half of 2025 as a result of improved dealmaking conditions, which can prompt banks to enter into multiple merger agreements per year.

Want insights on fintech trends delivered to your inbox? Join the 451 Alliance.