Source: David/Business/Adobe Stock.

As we look ahead toward 2026, we find that the payments industry is on the cusp of a transformative shift with the anticipated rise of non-human buyers — autonomous or semi-autonomous agents conducting transactions on behalf of consumers and organizations. This evolution, known as agentic commerce, is poised to reshape how transactions are conducted, presenting both opportunities and challenges for organizations involved in the payment ecosystem.

From concept to commercialization

In 2025, agentic commerce moved beyond the proof-of-concept stage, transitioning to pilot-scale commercialization. Key industry players such as Visa Inc. and Mastercard Inc. have already launched API programs — Visa Intelligent Commerce and Mastercard Agent Pay — to support the development of this new ecosystem. Additionally, Stripe and OpenAI’s introduction of the Agentic Commerce Protocol has provided a framework for enabling payments in agentic environments, which has been adopted by other major players like PayPal and Worldpay.

These initiatives highlight the industry’s commitment to building the necessary infrastructure to support non-human buying, setting the stage for significant changes in the payments landscape by 2026.

The role of PSPs and ecosystem integration

Payment service providers (PSPs) are expected to play a crucial role in the evolution of agentic commerce. By prioritizing partnerships with AI platforms, PSPs can position themselves as differentiated partners, helping organizations extend their business into this dynamic new sales channel.

To effectively serve organizations in this evolving landscape, PSPs will need to invest in the following:

- Robust fraud and dispute frameworks tailored to agent buying

- Advanced identity and credential management systems

- Network token support

As commerce activity diversifies across AI platforms, payment orchestration platforms may become essential for merchants to manage their agentic commerce operations effectively.

Challenges for card issuers and merchants

The rise of agentic commerce presents several challenges for card issuers and merchants. AI platforms are increasingly influencing spending decisions, with the potential for autonomous agents to engage in dynamic card rotation. This means optimizing card usage for rewards, cost and acceptance in real time, which could disrupt traditional top-of-wallet advantages and affect interchange revenues.

Merchants, on the other hand, may leverage AI intelligence to steer payments toward lower-cost account-to-account rails, further pressuring traditional payment methods.

Addressing fraud and identity management

With the emergence of rogue agents, new fraud vectors and dispute complexities are inevitable. This necessitates updated liability frameworks and advanced fraud and dispute management systems tailored to agentic commerce. Identity and credential management will likely also become increasingly important, requiring investments in advanced systems to ensure secure and efficient transactions.

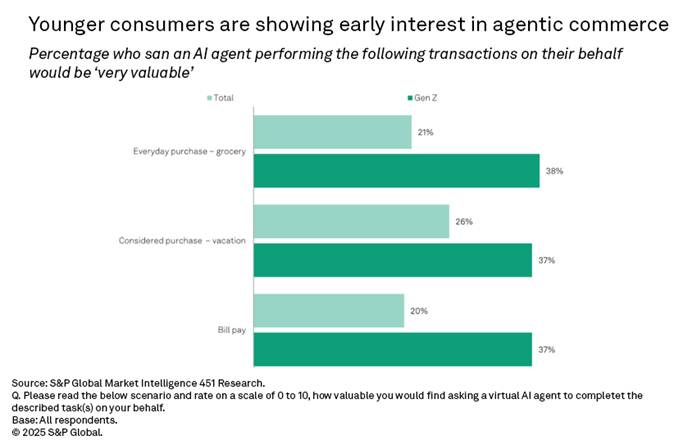

Consumer interest and the risk of cutting out intermediaries

Consumer interest in agentic commerce is already evident, particularly among younger demographics like Generation Z. According to S&P Global Market Intelligence 451 Research, a significant percentage of Gen Z consumers find the concept of AI agents handling transactions such as grocery shopping, vacations and bill payments to be very valuable.

However, the development of AI platforms’ branded wallets, potentially leveraging technologies like stablecoin, poses a risk of removing direct engagement with traditional payment systems. This could lead to a shift in how transactions are processed and the roles that traditional payment intermediaries play.

As the payments industry prepares for a rise of non-human buyers, organizations must adapt to the evolving landscape of agentic commerce. By embracing partnerships, investing in robust frameworks and addressing new challenges, they can position themselves to thrive in this transformative era.

Want insights on AI trends delivered to your inbox? Join the 451 Alliance.