Cloud services providers, referred to in the industry as hyperscalers, are continuing to be the primary drivers behind the datacenter industry, taking up much of the space coming online globally.

Typically, leasing space in a third-party datacenter is a quicker and less expensive alternative for cloud and content providers in comparison to developing their own facilities, so it comes as no surprise that cloud providers gravitate toward leased datacenter space, fueling wholesale demand for the industry.

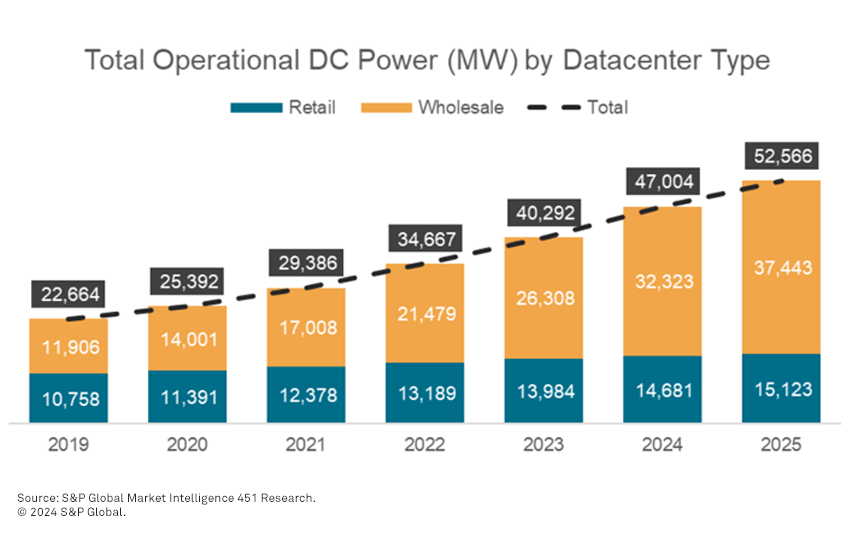

New datacenter builds are now continuously being announced, with hyperscaler demand in mind, resulting in record levels of growth for the entire datacenter market. In the 2019-2025 timeframe, wholesale datacenter developments are expected to account for 88% of the total new leased datacenter capacity. It is projected that total wholesale leased operational power will make up the vast majority of the total installed base of leased datacenter capacity globally at about 71% or 37,000 MW worldwide, according to 451 Research’s Leased Datacenter Retail vs. Wholesale report, published in September.

Head in the clouds

The boom seen in wholesale developments globally is partly due to the COVID-19 pandemic. Big-name cloud providers such as Google, AWS and Microsoft Azure saw increases in demand for their services, and had to expand rapidly to cater to their end users.

In 2023, another factor emerged that is likely to accelerate growth: artificial intelligence. Now popularized using OpenAI tools, AI adoption is expected to require hyperscalers to further expand their infrastructure across multiple markets, which has driven wholesale datacenter providers to announce a new wave of datacenter developments. Widespread AI adoption is still in its early days, and the technology’s true impact on demand for datacenter space will likely only be discernible in a few years. However, it has been the source of much optimism among the largest datacenter players, with some providers pointing to hyperscale deals becoming progressively larger in capacity across several markets in the last 12-18 months. We expect to see continued strong wholesale demand going forward.

What is a wholesale datacenter?

Demand for leased datacenter capacity can typically be divided into two main segments — wholesale and retail — depending on how much capacity clients require.

Wholesale datacenter capacity is usually sold in cells or pods (i.e., individual rooms), typically from 500 KW to 2 MW, although it can range upward to 100 MW in size. This capacity is often leased by large-scale cloud and information technology (IT) firms. Tenants may choose to lease space that has power and cooling equipment already set up, or they can lease a shell and add their own power and cooling equipment.

Retail capacity, by comparison, is typically sold by the rack and in smaller amounts (up to 1 MW in size), and includes power, cooling, network connectivity, and sometimes services such as remote hands and monitoring.

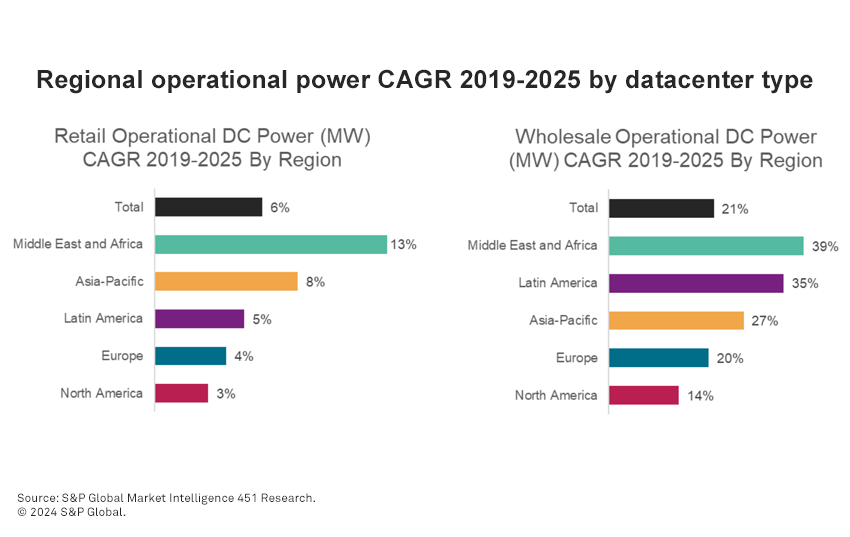

451 Research’s Leased Datacenter Retail vs. Wholesale report found that, as of September 2023, wholesale global datacenter capacity was set to grow at a compound annual growth rate (CAGR) of 21% between 2019 and 2025. By year-end 2025, total wholesale capacity is expected to reach nearly 37,000 MW worldwide. By comparison, the industry’s retail segment has grown at a slower pace, with an 6% CAGR. It is expected to total 15,000 MW in capacity by late 2025.

Regional breakdown

When looking at the regional level, the difference is even more pronounced in some areas of the globe. The Middle East and Africa lead the pack with the largest growth rates for the wholesale datacenter space, with an expected CAGR of 39% between 2019 and 2025. The region is set to grow from 83 MW in wholesale datacenter capacity in 2019 to 610 MW by year-end 2025. The region also leads in retail growth, with a 13% CAGR between 2019 and 2025, growing from 207 MW in 2019 to 426 MW by year-end 2025.

When looking at the wholesale-retail split for the planned datacenter capacity at a regional level, North America will see the largest percentage of new datacenter capacity built for wholesale, with 94% overall or 4,470 MW set to come online between 2019 and 2025. Latin America will follow close behind, with 92% of its total capacity added from 2019-2025 estimated to be wholesale, for a total of 444 MW. Asia-Pacific will have 86% of new capacity built for wholesale, or 14,533 MW. This is a massive amount, driven by strong demand from cloud providers throughout the region, accounting for 64% of global wholesale new capacity added.

Want insights on datacenter trends delivered to your inbox? Join the 451 Alliance.