Despite the enormous opportunity that the Chinese datacenter market presents, there are four important factors to keep in mind when investing in the world’s most populous country.

Some pertain to the restrictions that are placed on foreign providers, while others have to do with the types of workload deployments providers should choose. Whatever the case may be, there are nuances that providers need to understand in order to take full advantage of the Chinese datacenter market.

Data localization law

On June 1, 2017, the Chinese government announced a sweeping Cybersecurity Law restricting data movement and transfer throughout the country. Specifically, Article 37 of the Cybersecurity Law states that all business data on Chinese citizens collected within China must be stored on domestic servers.

Essentially, the law requires foreign companies to cooperate with Chinese providers, either through forming a joint venture or through the outsourcing of all network connectivity, in order to operate datacenter facilities.

The implementation of this law has drawn widespread criticism in the international community. Many foreign companies have cited concerns regarding intellectual property theft and the increasing cost to invest and construct facilities in China. On the bright side, foreign companies do not need to store data in government-owned datacenters, freeing them from government influence.

The Chinese government also recently announced that it is weighing a proposal to let US companies operate datacenters in designated free trade zones. While nothing is concrete yet, this move has the potential to encourage foreign expansion and investment throughout the country.

Government limiting construction in Tier 1 cities

Due to environmental concerns, the government is becoming increasingly restrictive when it comes to new datacenter construction in major Chinese cities such as Beijing, Shanghai, Guangzhou and Shenzhen.

In Beijing, for example, the local government restricts the construction of new facilities with design PUE (power usage effectiveness) of 1.5 or over within the city’s sixth ring road.

While this has forced many providers to put their urban expansion plans on hold, fortunately, building outside of major tier 1 cities is still very much welcome. In fact, the Beijing and Shanghai local governments have pushed for providers to relocate to more suburban or untested areas in order to ease the environmental burden of operating within the cities.

Moving forward, expect to see more datacenter activity on the outskirts of major cities, such as Zhangbei or Huailai outside of Beijing, and Fengxian or Hongqiao District outside of Shanghai.

Shift from hyperscale to enterprise deployments

Traditionally, colocation providers have preferred working with Chinese hyperscale companies like BAT (Baidu, Alibaba, Tencent) because of the massive capacity that they demand. At one point, colocation providers were so reliant on these three behemoths that they would set aside a large chunk of their available power in order to accommodate BAT’s power requirements.

However, many providers have begun to complain about the power grip that BAT has on the market. Because of their stature, BAT can command lower prices when leasing large amounts of space, leaving providers to choose between capacity and profit margins.

Because of the lower margins, many providers are choosing to decrease their dependence on hyperscale customers like BAT, instead diversifying their portfolio to include smaller enterprise customers. Companies across the board have stated that enterprise deployments generate 15-30% higher margins compared with hyperscale deployments.

While BAT will continue to play a big role in China’s colocation ecosystem in the future, it is evident that smaller enterprises are inching their way onto the scene.

Vast potential of Chinese market boosts

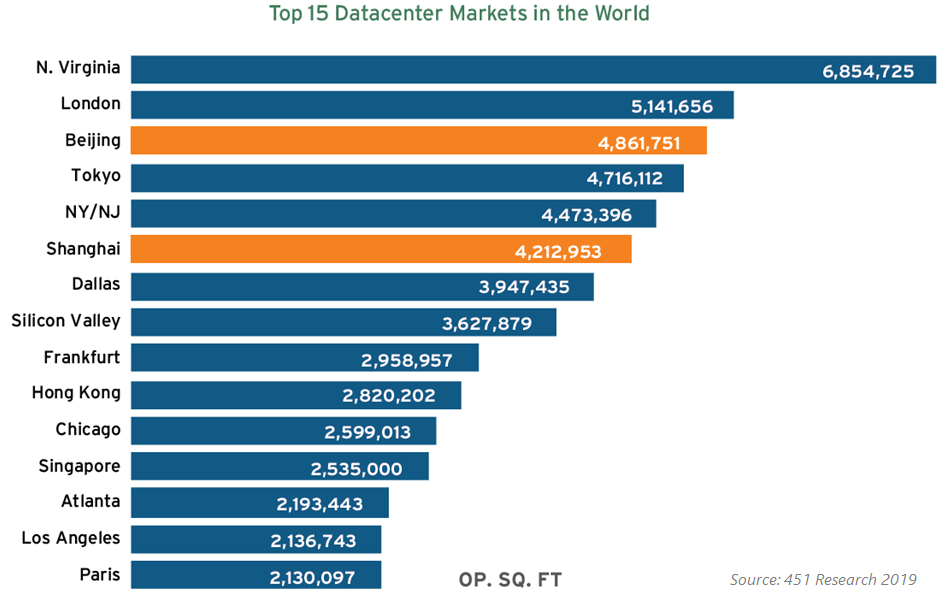

The Chinese datacenter market should continue to grow rapidly in the foreseeable future. China’s two largest cities, Beijing and Shanghai, are now two of the top 15 markets in the world.

Furthermore, internet penetration now stands at 55.8%, which is astounding given that internet connectivity has only been around since 1994. Cloud computing as a service also continues to grow exponentially in China, accounting for 21.6% of the entire APAC market and having a projected CAGR of 21% through 2022.

All these signs should point to increased investment and

activity in the market. However, datacenter providers and investors should keep

in mind that China is a country with a very different set of sociocultural norms,

as well as political rules and regulations. Therefore, it is important to have

the above points in mind when deciding whether to pursue this market.

Do you have your finger on the pulse of tech trends? Join the 451 Alliance for exclusive research content on industry-wide IT advancements. Do I qualify?