Source: Mint Images/Mint Images RF/Getty images.

Thus far, 2025 has been a year of mixed signals. In January, Microsoft Corp. paused development on its facility in Mount Pleasant, Wisconsin. In February, it was reported that Microsoft canceled 200 MW of AI datacenter-related leases, and then in April a large-scale pause was observed regarding expansions, including sites in Ohio, Wisconsin and North Carolina, where development had been underway. This came as Microsoft announced, and later doubled down on, that it would spend about $80 billion on AI datacenters in 2025. Following the April headlines, much of the panic they caused seems to have been unwarranted: Development has reportedly restarted in Mount Pleasant, and grading work at the Ohio parcel started in June. But nothing still in North Carolina. As one might guess, there are several things playing out at once.

The Take

Many worried that Microsoft’s pause on datacenter development was a sign of overbuilding and that demand would not continue to rise as projected. The months since the pause, however, have only indicated increased demand. Looking back, late in 2024, we began hearing of tensions in the OpenAI-Microsoft relationship, then the Mount Pleasant datacenter project, which was very late stage and said to be for OpenAI, was paused. As the tensions between the companies became more public, so did the observations of slowdowns and pull-backs, until April, when Microsoft commented that yes, there were customer changes that the company was responding to, and challenges in some markets.

To that point, many of Microsoft’s paused projects are in grid-constrained markets with long lead times for interconnection. Despite all this, Microsoft has continued to spend on servers and made unprecedented purchases of carbon-removal credits. The other hyperscalers are increasing capital expenditure for datacenters and other AI infrastructure. Our analysis suggests that all projections point to continued spending and building when and where capacity is available.

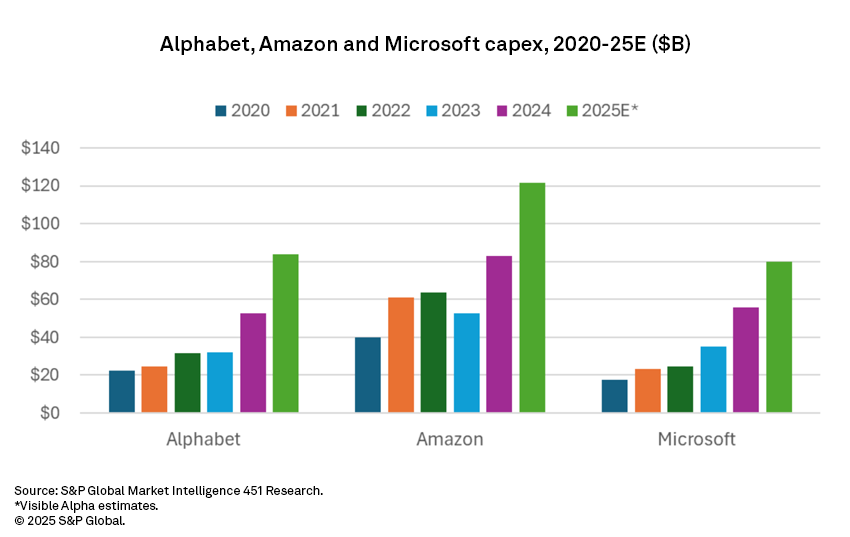

Hyperscale spending

Analysis of the hyperscalers does not point to a slowing down of production. Microsoft’s total capex for its fourth quarter of 2025 (April-June) was $24.2 billion, up 27% year over year. The company predicts this will grow to $30 billion in the next quarter. Microsoft CFO Amy Hood noted that, “Due to the timing of delivery of additional capacity in H1, including large finance lease sites, we expect growth rates in H1 will be higher than in H2.” This may indicate that we will soon see a continuation of construction as capacity is delivered. She also noted that, “More than half our spend was on long-lived assets that will support monetization over the next 15 years and beyond. The remaining spend was primarily for servers, both CPUs and GPUs, and driven by strong demand signals.” The company notes that, even with the increased spending and installation of CPUs and GPUs, demand continues to increase.

In February, Amazon.com Inc. said it planned to boost capex to more than $100 billion in 2025, after spending $83 billion in 2024. The increase was attributed to AI. In Q1 2025 earnings, AWS capex for the quarter ($24.3 billion) was slightly below that for Q4, but the firm noted that capacity constraints were impacting revenue, and that the firm is on track to spend $100 billion for the year. Furthermore, President and CEO Andy Jassy said, “As fast as we actually put the capacity in, it’s being consumed.” Q2 saw an even greater increase in capex to $31.4 billion. If this trend continues, capex will exceed the $100 billion estimate. In the latest earnings call, AWS CFO Brian Olsavsky said, “We will continue to invest more capital in chips, datacenters and power to pursue this unusually large opportunity that we have in generative AI. … AWS continues to be the primary driver as we invest to support demand for our AI services and increasingly in custom silicon, like Trainium, as well as tech infrastructure to support our North America and international segments.”

Early in the year, Alphabet Inc. said it planned to spend $75 billion on AI buildout in 2025, almost 30% higher than market expectations. The latest earnings reports show that this has increased to $85 billion. The company expects that this will further increase in 2026. It is on track, as Q1 capex was $17.2 billion and Q2 rose to $22.4 billion. The back end of the year should see continued expenditure as capacity comes online. In the earnings call for Q2 2025, Alphabet CFO Anat Ashkenazi said, “The vast majority of our capex was invested in technical infrastructure, with approximately two-thirds of investments in servers and one-third in datacenters and networking equipment.”

Meta Platforms Inc. announced in its April earnings that it was boosting capex, mainly due to AI, to $64 billion-$72 billion for the year, up from its previous estimate of $60 billion-$65 billion. The most recent earnings provide a slight increase to this estimate to $66 billion-$72 billion. Capex for the first two quarters of the year hit over $40 billion, exceeding 2024’s total expenditure of $39.23 billion. The company’s CFO, Susan Li, explained that being a leader in AI infrastructure will be a “core advantage,” and expects those investments to increase significantly in 2026. In July, Mark Zuckerberg said the company plans to spend “hundreds of billions of dollars” on datacenters and AI. Meta has also been particularly aggressive in bringing new infrastructure online quickly. The company is setting up hurricane-proof tents at new facilities to speed up lead times, in addition to building its own power plants in certain locations.

Even those beyond the Mt. Rushmore of hyperscalers have announced increased spending. While Oracle Corp.’s capex does not include datacenter construction, the company said in June, “Oracle will build more cloud infrastructure datacenters than all of our infrastructure competitors combined.” Apple Inc. also expects a substantial capex growth due to “the company’s focus on AI,” according to the company’s Q3 earnings call. Overall, the major hyperscalers all said in their most recent earnings that they were planning to continue to spend on AI infrastructure.

If spending is up, and these companies are all essentially saying they can’t build fast enough, why pause some builds?

A case study of North Carolina

Microsoft has nearly 2,000 acres of land in North Carolina, where development was halted in April 2025. The sites are spread across Catawba and Person counties and include a 219-acre development north of Conover, where land is graded and prepared for at least four large buildings. A second site spans 160 acres in Newton and is also graded with visible footprints for four datacenter buildings. The largest developed swath sits adjacent Apple’s Maiden Campus on 292 acres and has the foundations laid for four buildings and room for more. Microsoft also owns a 1,350-acre plot of land near the Virginia border in Person County; this site has no visible development.

Microsoft is not the only tech company to pause a large-scale project in North Carolina. Apple has gained approval for a large campus near Research Triangle Park in Raleigh, but paused the project in June of 2024, prior to any construction efforts. Apple says it is still committed to the project, but expects the timeline to be pushed back by four years. The company, however, recently completed a $175 million expansion on its Maiden campus that did not begin until well after its pause in 2024. There have also been announcements about future expansion plans in Charlotte. Amazon also announced a $10 billion investment to develop datacenters in North Carolina this year, indicating that the state is still a desirable location.

This all seems to point to external issues. Providers in the state have noted long lead times for interconnection from Duke Energy Corp., in some cases long enough for development to be abandoned and moved to another state. Apple’s Maiden campus is 100% powered by renewable energy using biogas fuel cells, two 20-MW solar arrays and direct clean energy purchases. It has also been at the site since 2009 and has all the necessary infrastructure in place. This may explain why it was able to move forward with a significant expansion at that site but remain paused in another. Google, too, is expanding its campus in Lenoir, where it has been since 2007. This campus has four separate substations on the property already. In Microsoft’s January 2025 earnings call, Hood noted the company was in a “pretty capacity-constrained place.” She went on to highlight the land purchases over the last three years and suggest that capacity will be closer to balancing with the land purchases by June.

While this would not explain other paused projects, it is fair to say that many markets are seeing similar constraints. Ohio, near Columbus, is becoming a location where companies are building out their own power plants behind the meter to power datacenters. Meta, PowerConneX (EdgeConneX) and Vantage Data Centers (via AlphaStruxure) are seeking or have gained approval for large gas plants to power datacenters in the Columbus area. Each of the plants has a planned capacity of greater than 200 MW. Again, all this points to the lengths companies are having to go to in order to bring projects online in a relevant time frame, as well as the challenges being faced in different markets that could force a slowdown, beyond customer fluctuations mentioned above.

Want insights on datacenter trends delivered to your inbox? Join the 451 Alliance.