Source: diyun Zhu/Moment via Getty images.

The venture capital industry needs the new new thing — artificial intelligence — to paper over lackluster returns from the last new thing. Competition for those deals, however, is pushing up prices, creating a hurdle for outsized returns.

Over the past two years, AI investments have propelled venture totals.

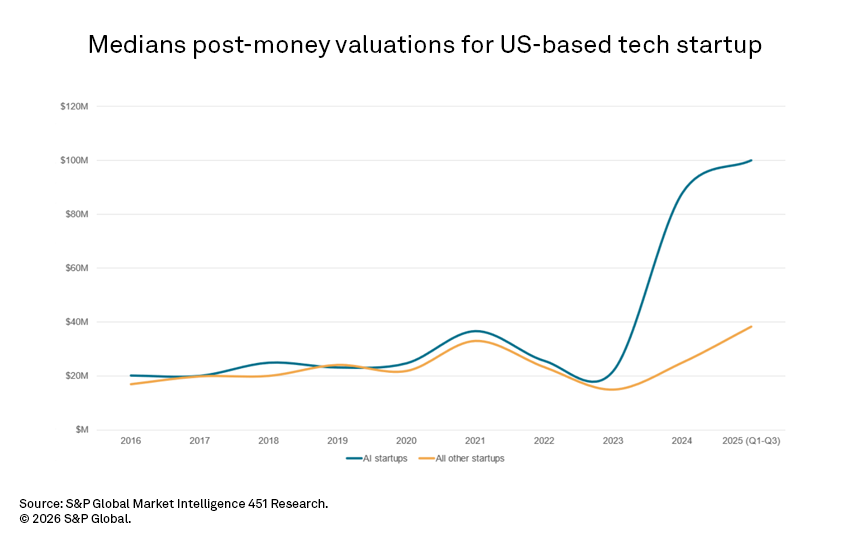

According to S&P Global Market Intelligence 451 Research, US-based tech startups raised $138 billion through the first three quarters of 2025, with a full 75% of that going into companies building AI technologies or products powered by those technologies.

With three months remaining, this year’s funding looks set to soar past the annual record ($142 billion) from 2021.

But the returns from that previous bull market haven’t yet materialized. And in the current one, there’s a higher bar to deliver them. After hovering around $20 million to $25 million for most of the prior decade, the median post-money valuation for tech startups has reached new heights. The typical AI investment commands a $100 million valuation this year, up from $88 million in 2024. Think of it this way — investors in a deal today will need an exit that’s four to five times larger to get the same return as an investment done at the end of the 2010s.

The VC industry’s predictions that AI will transform the modern economy could come true. But to make money from that revolution, they’ll also need an exponential increase in liquidity.

Want insights on AI trends delivered to your inbox? Join the 451 Alliance.