Source: Maskot/Maskot/Getty images.

US bankers expect tepid loan growth over the next year because of labor market wobbles, the impact of tariff policies taking hold and doubts on the underlying strength of the economy as inflation moves further away from the Federal Reserve’s 2% target, according to S&P Global Market Intelligence 451 Research’s third-quarter study focused on the outlook of US banks and thrifts.

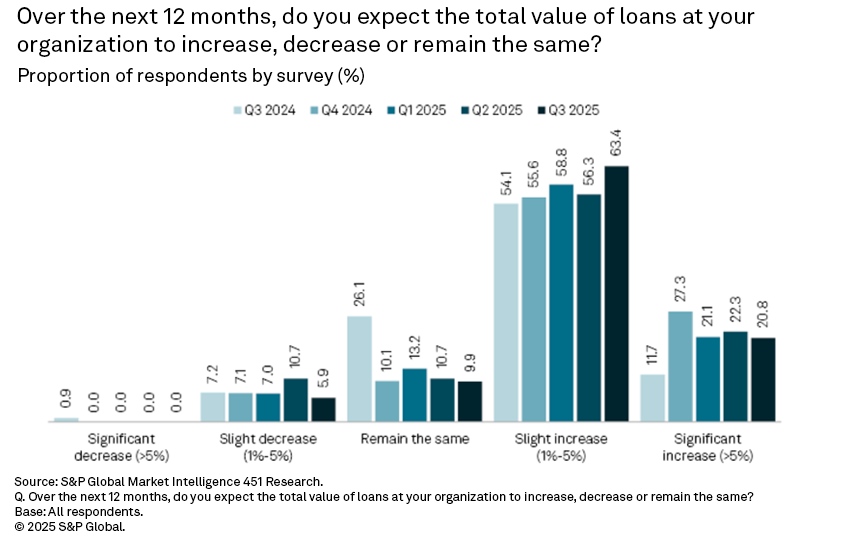

Bankers anticipate languid loan growth

Among those surveyed, 63.4% expect loans to have a minimal increase at their institution over the next 12 months, up from 56.3% in the second-quarter survey. Respondents expecting total loans to grow 5% or more decreased to 20.8% in the third quarter, compared to 22.3% in the previous quarter.

US banks reported firm but unspectacular loan growth in the third quarter. According to the bank executives, “borrowers remain somewhat cautious on the tariffs, which is holding back growth, while also waiting for lower rates.”

Mixed economic outlook

Among those surveyed, 35.1% assessed a moderate level of economic instability, higher than 32.0% in the second-quarter survey. Overall, 61.9% of the respondents think that the current economy is volatile, down from 67.0% in the previous quarter. Those that view the current economy as stable increased to 37.1%, compared to 32.0% previously. Despite the optimism, 58.3% anticipate a recession in the US within the next year, higher than 47.8% in the second-quarter survey. A soaring number of Americans are confronted with long-term joblessness that is increasing to the highest levels since the COVID-19 pandemic.

As a measure to prevent the US labor market from crumbling further, the Federal Reserve cut interest rates by another 25 basis points on Oct. 29. Fed officials may not be able to craft a policy forthwith as the monthly jobs report is indefinitely delayed and the collection of new data is on hold as a result of the federal government shutdown.

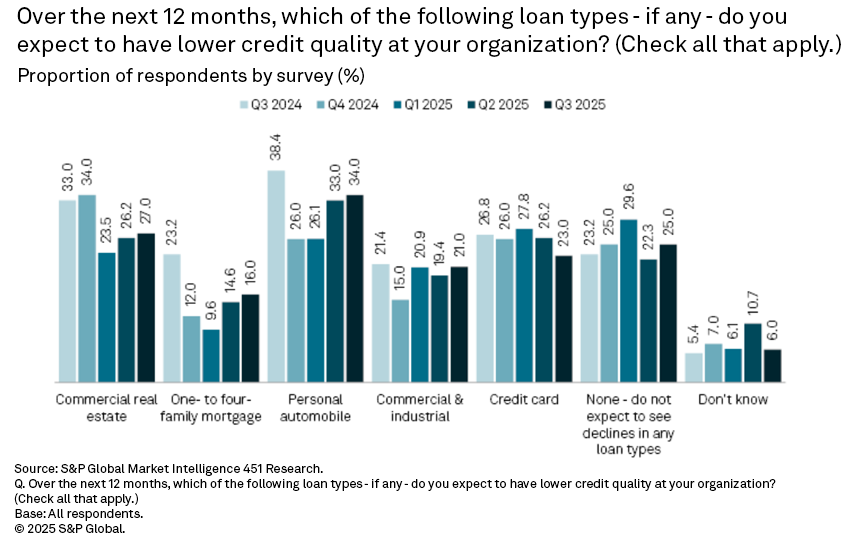

Credit quality concerns

Credit quality concerns on commercial real estate loans, one- to four-family mortgage loans, personal auto loans and commercial and industrial loans had a slight increase ranging from 0.8 to 1.6 percentage points sequentially. Meanwhile, the proportion of respondents expecting deterioration in credit card loans was 23.0%, down from 26.2% a quarter earlier. US banks’ third-quarter credit quality measures came in better than analyst expectations despite recent credit anxiety resulting from several one-off events.

Deposit stress testing

Among those companies that conducted a deposit stress test, 11.9% had a 30-day deposit outflow assumption of 10% to 14%, while 18.8% had a deposit outflow assumption of less than 5%. Stress testing for deposit outflows is one way that banks could preemptively plan to find additional funding in light of unexpected withdrawals as regulators continue to underscore the importance of liquidity risk management and contingency funding plans.

M&A outlook

The proportion of respondents who indicated their institution was either “somewhat” or “very” likely to pursue acquiring another company over the next 12 months was 37.9%, while the proportion of bankers who thought their institution is likely to sell was 13.7%. With the US bank M&A monthly deal value reaching its highest point in over six years, executives at multiple US banks expressed enthusiasm in making acquisitions, citing less stringent regulatory oversight under the Trump administration as one of the catalysts in the resurgence of dealmaking.

Want insights on AI trends delivered to your inbox? Join the 451 Alliance.