Source: Tetra Images/Tetra images/Getty images.

The majority of US bankers anticipate competition for deposits to intensify over the next six months, according to a study conducted by S&P Global Market Intelligence. Many US banks reduced deposit costs and improved their net interest margins in the third quarter as the Federal Reserve cut interest rates for the second time this year.

Deposit competition expected to heat up

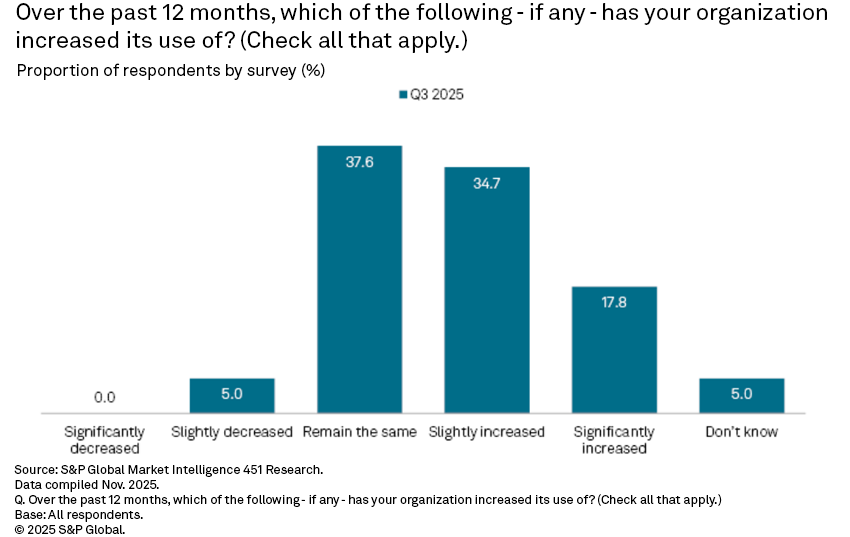

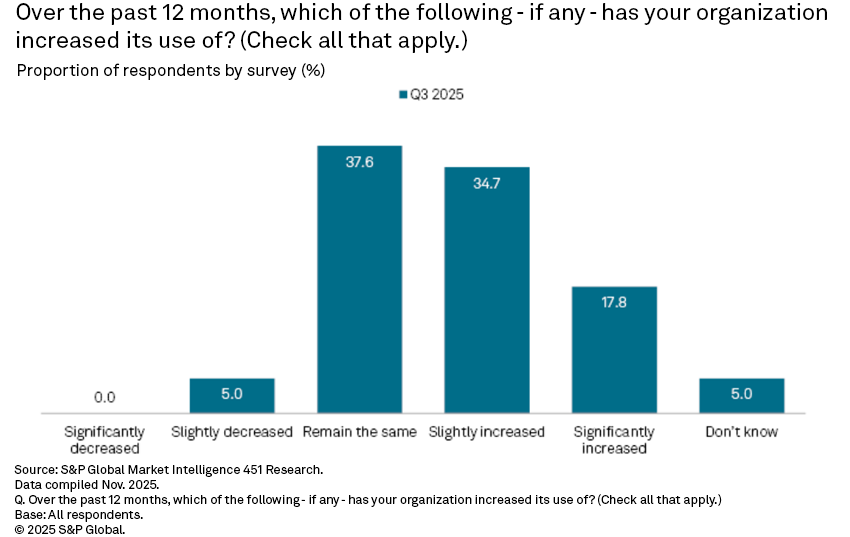

Among those surveyed, 56.4% of the respondents anticipate a heightened deposit competition in their area over the next six months, up from 50.5% in the second-quarter survey.

The proportion of respondents that disclosed an increased competition for deposits in their market over the past 12 months was 52.5%, higher than 49.5% in the previous-quarter survey. The US banking industry’s total deposits rebounded this year after a sluggish increase in 2024.

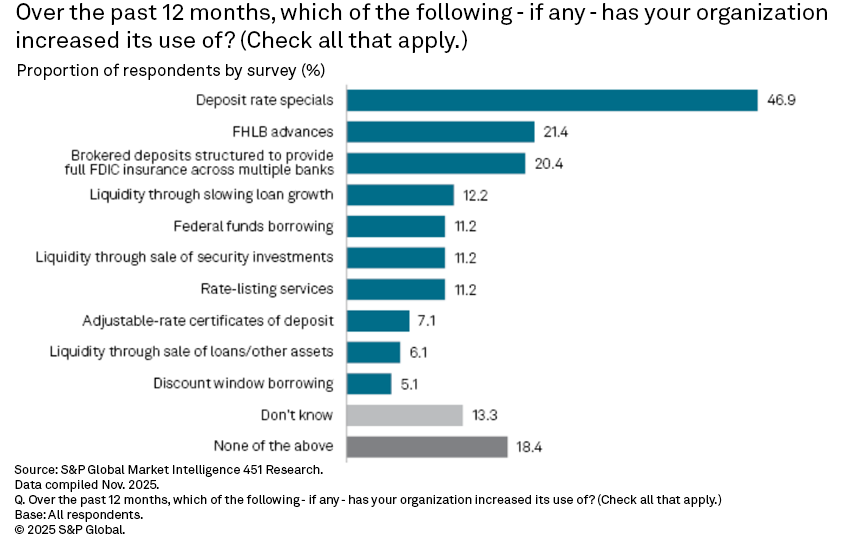

Funding

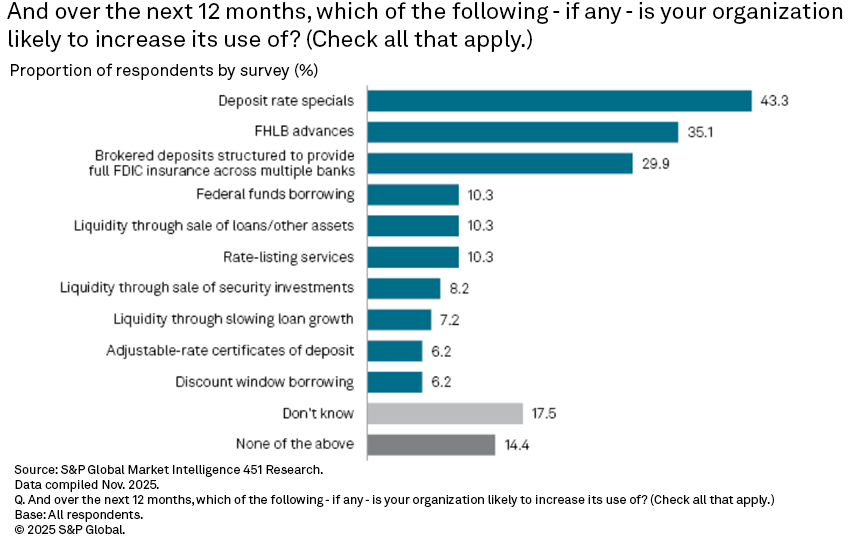

Among the respondents, 46.9% said that their organization had increased its use of deposit rate specials over the last 12 months, the highest percentage in any of the 10 options given for the question on liquidity and deposit sources. Meanwhile, 43.3% also projected that their institution would increase its usage of deposit rate specials over the next 12 months, up from 35.3% in the second-quarter survey.

Deposit growth outlook

As a result of the predicted fierce competition for deposits, the respondents expecting deposit growth at their institutions over the next 12 months decreased to 74.3%, compared to 81.1% in the second-quarter 2025 survey. Meanwhile, those that expect deposits to remain stagnant was 13.3%, up from 9.4% previously.

Banks strategize to attract depositors

While US consumers continue to spend, there is an increasing number of people in the US digging into savings to cover rising costs as the impacts of tariffs begin to manifest.

Among the bankers surveyed, 38.1% said their organization promoted incentives to increase deposits and recalibrated their low-risk, value-driven products, such as high-yield savings accounts, flexible personal loans, secured credits cards to attract and retain depositors. By comparison, 29.3% among those surveyed enacted those changes in the second-quarter survey.

Meanwhile, 36.1% optimized and expanded digital self-service tools that offer real-time financial insights, as well as personalized guidance and customer support for navigating economic uncertainty, higher than 28.3% of the bankers that offered these services in the previous quarter.

Deposit composition outlook

The proportion of respondents expecting a drop in consumer deposits at their institution over the next year increased sequentially by 4.1 percentage points to 30.5%.

The share of banks with less than $50 billion of such deposits fell to 25.3% in the second quarter from 35.2% in the first quarter of 2018. Meanwhile, regional banks are making progress in an effort to close the gap against the big three US banks’ dominant position in the consumer deposit market.

Interest rate outlook

The median expected interest rate on interest-bearing transaction accounts at the end of 2025 is 0.75%, while the median expected rate for savings accounts, including money market deposit accounts, is 1.75%. Additionally, the median expected rate for a 1-year certificate of deposit at the end of 2025 is 3.25%.

After keeping rates unchanged all year, Fed officials agreed to cut rates by 25 basis points in September and October, as part of an expected policy easing cycle into next year. However, the Federal Reserve and Chairman Jerome Powell may take a more “cautious stance” on the central bank’s interest rate policy until there is more clarity on the broader economy.

Want insights on fintech trends delivered to your inbox? Join the 451 Alliance.