Global positioning services, once only used by consumers for navigation, have morphed into a slew of location-based services on recent generations of smartphones. A wide variety of applications are designed to access a user’s location to provide a better experience. But that also means they are able to track and store an additional type of personal data.

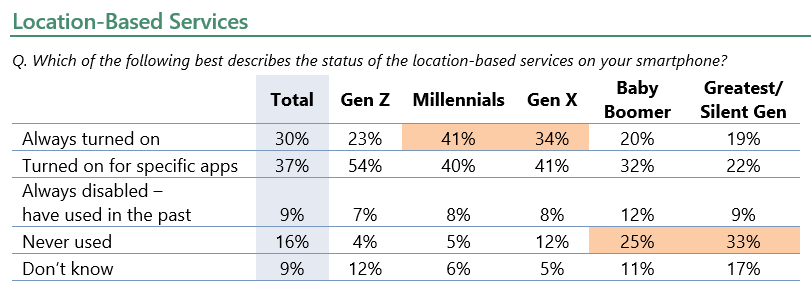

The 451 Alliance’s Q1 2021 connected customer survey looked at current attitudes toward location-based services. The survey found 30% of respondents always have location-based services on, while another 37% turn them on for specific apps only. Millennials (41%) and Generation X (34%) have the highest percentages of respondents who have these services always on, while Baby Boomers (25%) and the Greatest/Silent Generation (33%) have the highest percentage saying they’ve never used them.

When asked why they don’t use them, respondents cited privacy (56%), security (49%) and no need (43%) as the top reasons. As with many other digital technologies, fears over what data is being collected and how it’s being used are of paramount importance to consumers. So far, the contextual touchpoints these services have helped augment along the customer journey are not enough to completely assuage the trepidation many consumers still feel.

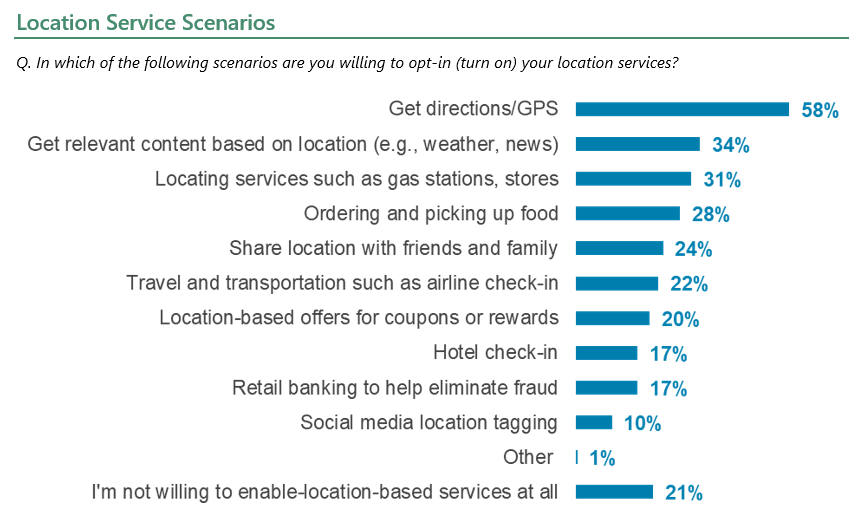

Similarly, these fears surrounding data collection are part of the reason why our data shows a very slim margin between respondents who would (43%) opt into COVID-19 contact tracing that used phone location data to identify and contact individuals, compared to (41%) who said they would not. Now let’s look at the specific scenarios where respondents are willing to turn on location services. Getting directions/GPS (58%) is by far the scenario where respondents are most comfortable. This makes sense because navigation is one of the broadest use cases for mobile technologies.

Related use cases are the next most popular scenarios, with getting relevant content based on location like weather or news (34%), and locating services such as gas stations or stores (31%). It’s likely no coincidence that the top consumer uses for location data have almost nothing to do with discretionary purchasing, which probably explains why many of consumers who have these services turned off feel they have no need for them, and why others still do it to avoid advertising.

Of course, as we would expect, there are wide differences by generation. Going beyond the top scenarios mention above that cut across all ages, younger generations are much more comfortable with using their location data for ordering and picking up food, location-based offers for coupons or rewards, and social media location tagging. Given the very nature of these services, there are no areas where older generations outperform younger ones; yet when it comes to travel and transportation services like airline check-ins, there is less of a differential between age groups.

Want insights on consumer technology trends delivered to your inbox? Join the 451 Alliance.