Source: RyanKing999/iStock/Getty images.

The pandemic thrust contactless payments into mainstream status in the US, transforming them from a niche payment option to the top driver of in-store volume. Visa Inc.’s data illustrates this trajectory: in 2017, less than 1% of the company’s domestic face-to-face transactions were contactless. By fiscal 2022, that figure had surged to 28%, and as of the second quarter of fiscal 2025, it has surpassed 60%. This shift is not simply behavioral — it is reshaping cardholder engagement, portfolio economics and competitive positioning.

In this blog post, we leverage data from a study conducted by S&P Global 451 Research, alongside card network disclosures, to assess the state of contactless payments in the US. We explore the business case for card issuers and outline how emerging tap-based innovations will shape the next wave of consumer engagement.

The Take

Contactless has crossed the tipping point in the US — it is now the dominant way Americans pay in person, and well on its way to ubiquity. The technology is not only a cardholder convenience, but also infrastructure for driving portfolio growth and value-added cardholder experiences. For issuers, the business case rests on three pillars: incremental spend growth, cardholder engagement and ecosystem expansion. Issuers that treat contactless as a core strategic lever — not just a feature — will be best positioned.

Contactless adoption accelerates

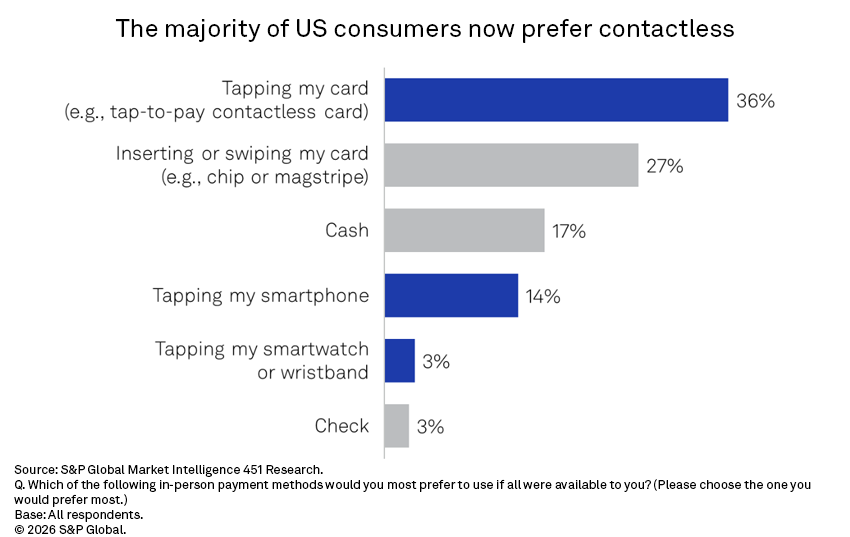

According to a study conducted by S&P Global 451 Research, a majority of US consumers (53%) now prefer contactless for in-store payments, with that preference climbing to 65% among Generation Z respondents. Notably, it is tap-to-pay cards that are anchoring this behavior: more than twice as many consumers indicate that tapping their card is their preferred way to pay (36%) versus using a mobile wallet (14%) or a wearable (3%). This underscores that while wallets are growing, cards remain the primary driver of contactless engagement.

That said, a multichannel contactless strategy is imperative. Digital wallets are gaining real traction, with 51% of US consumers having used one in-store at least once in the past 90 days, up sharply from 38% in 2021. Gen Z is leading the way — 87% report recent in-store wallet usage, up from 58% just four years ago.

Within wallets, Apple Pay dominates: 42% of wallet users tapped with Apple Pay in the past 90 days, compared with 28% for Google Pay and 13% for Samsung Pay. Among Gen Z, Apple Pay’s leadership is even more pronounced, with 57% usage, dwarfing Google Pay (23%) and Samsung Pay (13%). For financial institutions, tap-to-pay cards remain the foundation of contactless adoption and cardholder loyalty, but digital wallet enablement — particularly Apple Pay — is increasingly essential to capturing younger consumers and sustaining relevance across channels.

The contactless business case

Perhaps most tellingly, contactless is translating into quantifiable opportunity. According to our research:

- Heightened engagement. More than four in five (82%) cardholders who have been issued a contactless card have used it at the point of sale. What’s more, consumers who receive a contactless card actively shift spending onto it. One in three consumers say that being issued a contactless card has resulted in that card being used more frequently than their non-contactless cards. For Gen Z, that figure rises to 51%, demonstrating a clear top-of-wallet impact. According to Visa, for US debit users, contactless is resulting in two additional transactions per card per month and an additional $70 in spending per card per month. For issuers, this equates to a tangible lift in spending per active card.

- Cash displacement. Eighty percent of contactless payment users report having used a contactless method for a purchase they would have made with cash in the past, with 55% doing so three or more times in the past month. For issuers, that means new interchange revenue streams in categories historically underpenetrated by cards, such as quick-service restaurants, convenience stores and transit.

- Expanded merchant acceptance. Contactless-only acceptance is becoming more prevalent thanks to tap-to-phone capabilities being pushed by card networks. Visa’s Tap to Phone offering, which allows merchants to accept payments directly on NFC-enabled smartphones, has seen 200% year-over-year growth globally and nearly 30% of participating sellers are small businesses new to card acceptance. For issuers, that means fresh spending opportunities in markets that have historically relied on cash.

Consumer interest signals next era of contactless innovation

While contactless payments at the physical point of sale have now achieved critical mass, a new wave of tap-based innovations is extending the same trusted experience into digital contexts. These innovations aim to reduce friction in online checkout and accelerate wallet adoption, while capitalizing on consumer comfort with tapping.

- Tap to confirm (authentication). Consumers are increasingly open to authenticating digital purchases with a simple card tap on their phone. Overall, 32% of consumers say they are very interested in this capability. That figure rises significantly among younger cohorts — 48% of Gen Z and 49% of Millennials — underscoring the generational shift toward intuitive, mobile-first security. For issuers and merchants, tap to confirm offers stronger fraud protection and could help mitigate false declines via streamlined step-up authentication.

- Tap to provision (wallet onboarding). A nontrivial barrier to digital wallet adoption has been the manual process of entering card details. Tap to provision addresses this pain point directly by letting consumers add a card to a wallet with a single tap. Interest levels mirror those seen in authentication: 32% overall express strong interest, rising to 54% of Gen Z and 49% of Millennials. Market adoption is also accelerating — over 275 Visa issuers now support tap to provision globally, nearly doubling participation in the past quarter. This momentum signals a strong appetite among issuers to simplify onboarding and secure top-of-wallet placement.

Related experiences being discussed by Visa and Mastercard Inc. include tap for peer-to-peer payments, tap to activate card and even digital tap to pay (e.g., tap card against mobile device to execute online purchase). For issuers, embedding tap-based flows not only strengthens wallet adoption and engagement, but also creates differentiation in a crowded market.

Recommendations for card issuing banks

Contactless payments have become a defining feature of the US payments landscape. Consumer adoption is accelerating, particularly among younger generations, and issuer strategies are increasingly built around tap to pay as a driver of growth, preference and engagement. For banks — especially smaller institutions that have lagged in contactless issuance — the imperative is clear: prioritize contactless now and prepare for the next wave of tap-enabled innovation that will define the future of payments. We recommend:

- Accelerate contactless card issuance. Ensure that all new cards are contactless-enabled and proactively reissue legacy portfolios.

- Market contactless benefits clearly. Reinforce top-of-wallet positioning through campaigns highlighting convenience, speed and security.

- Prioritize Apple Pay enablement. Given Apple Inc.’s dominant share overall, especially among younger consumers, issuers must ensure seamless wallet integration.

- Support merchant expansion. Partner with acquirers to push tap-to-phone acceptance among small businesses. Promote merchant return on investment (e.g., faster checkouts, incremental sales) to encourage adoption.

- Explore emerging contactless use cases. Consider collaboration with Visa/Mastercard on pilots that reduce digital onboarding friction and online checkout abandonment.

- Measure and optimize. Track metrics such as incremental activation, spend lift and merchant penetration. Deploy data to continuously refine approach and identify high-value consumer segments.

Want insights on fintech trends delivered to your inbox? Join the 451 Alliance.