Source: ColorBlind/DigitalVision/Getty images.

The majority of US bankers are bullish on deposit growth over the next year, according to S&P Global Market Intelligence 451 Research’s second-quarter 2025 US Bank Outlook Survey. While macroeconomic uncertainties linger as a result of President Donald Trump’s tariff policies, the positive sentiment reflects the banking industry’s favorable outlook on net interest income as deposit costs continue to drop.

The Take

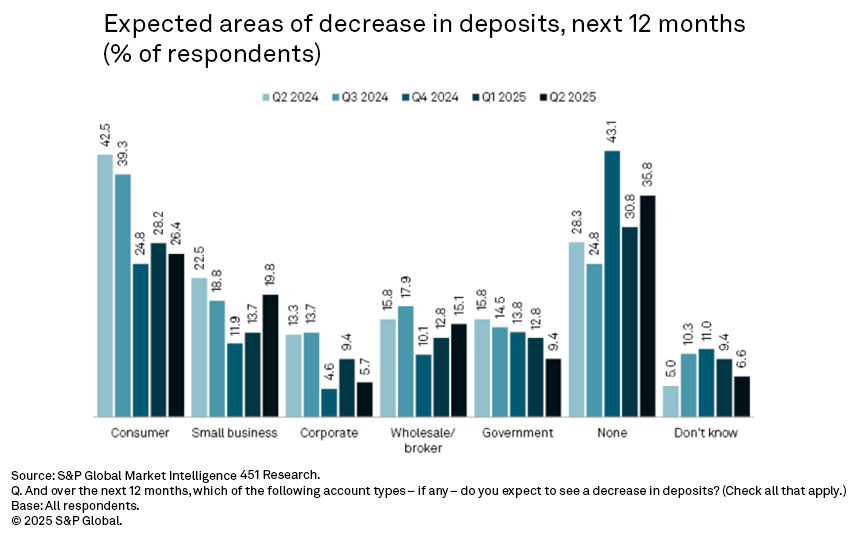

An overwhelming majority of 81% forecast deposit growth over the next 12 months. An increased proportion of respondents expect small business and wholesale or brokered deposits to contract over the next year. Deposit competition is expected to rise in their respective market areas over the next six months.

Bright outlook on deposit growth

S&P Global Market Intelligence 451 Research surveyed US banking industry professionals between June 3 and July 1 and found that 81.1% of the respondents expect deposits to grow at their institutions over the next 12 months, up from 76.1% in the first-quarter 2025 survey and the highest mark since the fourth quarter of 2022 survey.

The US banking industry recorded total deposit growth of greater than 1% on both an aggregate and median basis in the first quarter of 2025, surpassing loan growth, with the increase largely attributed to demand deposits.

Deposit composition outlook

The proportion of respondents expecting a drop in small business deposits at their institution over the next year increased sequentially by 6.1 percentage points to 19.8%. Similarly, survey participants expecting a decline in wholesale or brokered deposits rose 2.3 percentage points on a sequential basis to 15.1%.

The US banking industry scaled down brokered deposits in the first quarter of 2025 as US banks gained inflows of more attractive deposit categories. Reliance on overall wholesale funding increased sequentially, although it remained at the low end of the range over the last two years.

Interest rate outlook

The median expected interest rate on interest-bearing transaction accounts at the end of 2025 is 0.75%, while the median expected rate for savings accounts, including money market deposit accounts, is 1.75%.

Additionally, the median expected rate for a 1-year certificate of deposit at the end of 2025 is 3.25%.

Many US banks started aggressively trimming down deposit rates in the first quarter of 2025, following the Federal Reserve’s 100 basis point interest rates reduction in 2024.

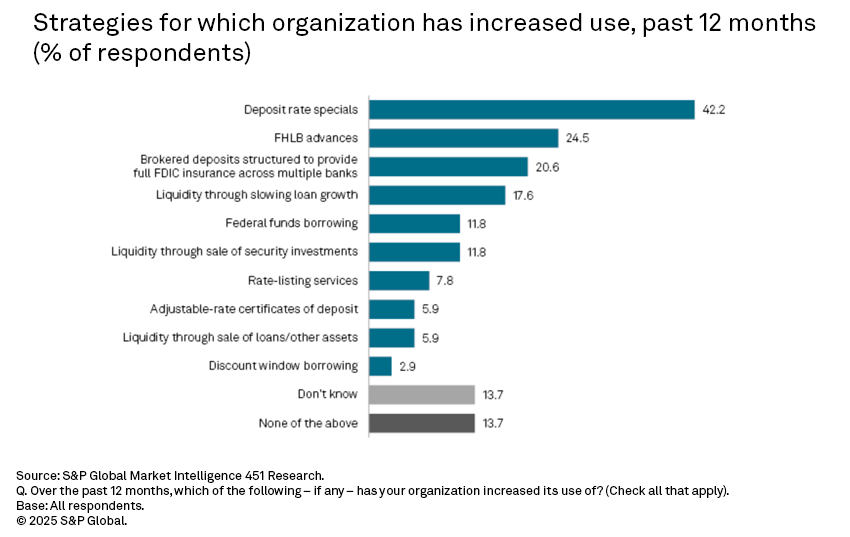

Funding

Among the respondents, 42.2% said that their organization had increased its use of deposit rate specials over the last 12 months, the highest percentage in any of the 10 options given for the question on liquidity and deposit sources. Meanwhile, 35.3%, also projected that their institution would increase its usage of deposit rate specials over the next 12 months, which was also the highest percentage among all options given.

Just shy of 25% of respondents stated that their institution had increased its usage of advances from the Federal Home Loan Bank system over the last 12 months, and 28.4% of respondents expected their institution would expand usage of FHLB advances over the next 12 months.

Deposit competition expected to heat up

Among those surveyed, 49.5% disclosed that competition for deposits in their market area increased over the past 12 months. Meanwhile, 50.5% of the respondents anticipate heightened deposit competition in their area over the next six months, while 42.9% expect it to remain the same.

According to Stephens analyst Terry McEvoy, some banks may face increased deposit competition as a result of the Federal Reserve lifting the $1.95 trillion asset cap imposed on Wells Fargo & Co.

Want insights on fintech trends delivered to your inbox? Join the 451 Alliance.