Source: Chris Ryan/OJO Images/Getty images.

After nearly three years of flat to negative spending intentions on IT products and services, small and medium-sized enterprises (SMEs) are experiencing a turnaround in their overall IT spending sentiment. According to a study conducted by S&P Global Market Intelligence 451 Research, this renewed interest is likely to persist in the near term, driven by a focus on essential investments such as information security and artificial intelligence.

SME IT budget trends for 2025

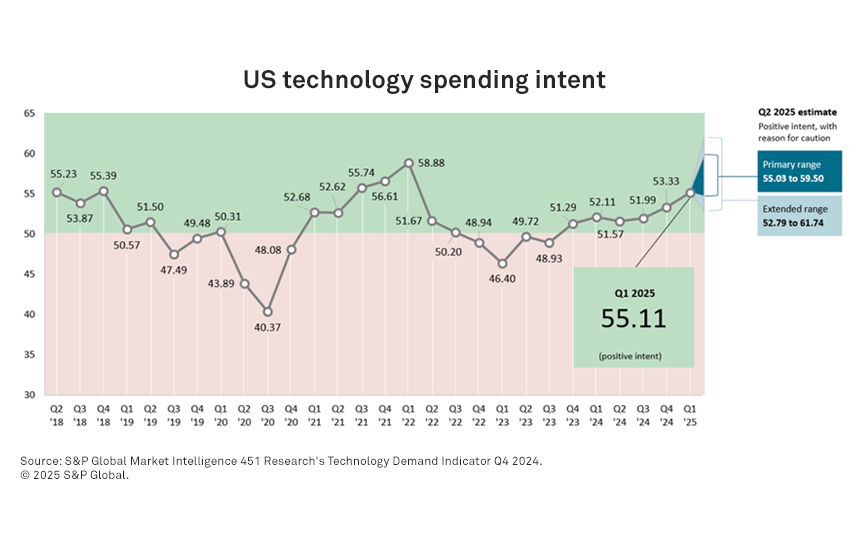

The sentiment around SME IT budgets remains positive, with organizations who consider themselves digital transformation leaders shaping the narrative. Digital Transformation leaders report a robust outlook, emphasizing the importance of essential IT investments over discretionary spending. According to S&P Global Market Intelligence 451 Research’s Tech Demand Indicator, which includes data points from studies conducted with small-medium-sized organizations, the Q1 2025 Tech Demand Indicator score was 55.1. The Q1 2025 Tech Demand Indicator score reflects a positive sentiment, is the strongest since Q1 2022, and is expected to improve further in the second quarter.

However, SMEs are exercising caution with non-essential expenditures. Discretionary spending sentiment has dropped sharply from -1 to -15, indicating a preference for prioritizing essential IT investments amid economic uncertainties.

SME IT spending sentiment compared to large organizations

While SMEs maintain a positive IT spending sentiment (+4), large organizations show a slightly lower sentiment (+2). Despite this, large organizations remain more bullish on discretionary spending, with a sentiment of +12 compared to -15 for SMEs. This disparity underscores the challenges smaller organizations face in keeping pace with larger counterparts, particularly in key areas like cybersecurity, AI, and cloud adoption.

Key drivers of IT spending

Information security and AI are at the forefront of IT spending for SMEs. Both areas are expected to see significant investments, with 30% of SMEs planning to increase spending in these domains. Cloud infrastructure/services and data analytics follow closely, with 25% of SMEs indicating increased spending intentions.

Among digital transformation leaders, AI stands out as the primary focus, with 46% prioritizing it, followed by infosec and cloud services at 31% each. These organizations are also more optimistic about their IT spending sentiment, reporting a bullish outlook for the second half of 2025.

Generative AI adoption

Generative AI is gaining traction among SMEs, with 53% focusing on spending in this area. SMEs show a preference for cost-effective open-source models, with 20% inclined towards these solutions compared to 6% of large organizations. While commercially licensed pre-trained models are the most common, SMEs are less likely to develop custom models in-house, with only 10% opting for this approach.

Automation and risk management priorities

Automation remains a key priority for SMEs, with 40% focusing on using technology to automate routine tasks. AI and machine learning are instrumental in implementing these automation initiatives. Additionally, improving risk management, including cybersecurity, compliance, and system reliability, is a significant focus for 37% of SMEs.

Information security spending is set to increase, with SMEs concentrating on data security, network security, and email/messaging security. However, some SMEs lag in areas like fraud prevention and SIEM/analytics, highlighting a need for further investment in these critical security technologies.

Outlook for SME IT investments

Despite economic challenges, the outlook for SME IT investments remains strong, with a focus on essential areas like AI and infosec. Digital transformation leaders among SMEs are particularly optimistic, reporting a bullish IT spending sentiment for the second half of 2025.

This insight is brought to you from the Tech Demand Indicator. To get regular highlights from the TDI and to contribute to future insights, join the 451 Alliance.

This content may be AI-assisted and is composed, reviewed, edited and approved by S&P Global in accordance with our Terms of Service.