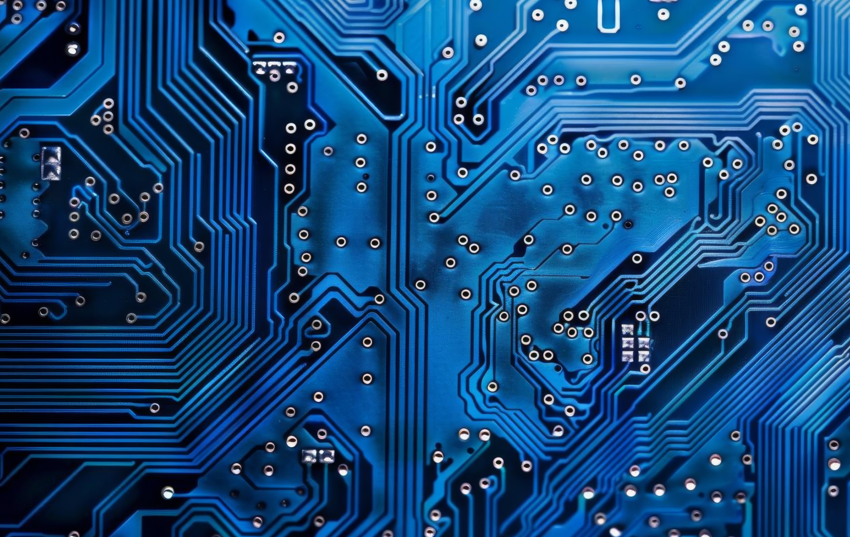

Emerging metaverse platforms and technologies tracked by S&P Global Market Intelligence were back in the black in the third quarter as the consumer and commercial software segments both took significant strides, driving revenue up 5.5% year over year to an estimated $4.39 billion. The result snapped a four-quarter streak of year-over-year declines for the segment.

The Take

Metaverse-leaning video games such as Roblox Corp. and Epic Games Inc.’s Fortnite are entering a new growth phase as improved creation tools and content-expansion projects ramp. Look for Lego Fortnite to make a significant impact on revenue in the months ahead. We are also seeing generative AI light up new metaverse revenue opportunities in the form of automated visualization tools. This is a relatively small market, but will likely grow as AI becomes more capable and pervasive. Interface hardware remained a pain point in the third quarter, with many consumers still waiting for next-generation headsets.

Context

S&P Global Inc. defines the metaverse as the long-term vision for the next phase of the internet, which will feature a single, shared, immersive and persistent 3D virtual space where humans and machines interact with one another and with data, enhancing the physical world as much as replacing it.

Our quarterly revenue tracker is built on a historical annual data set tracking augmented- and virtual-reality headsets; metaverse-leaning video game experiences; commercial spending on metaverse applications such as digital twins; and emerging opportunities around advertising, e-commerce and other revenue streams. To guide those figures into quarterly allocations, we use data from publicly reporting companies exposed to the metaverse, including Accenture PLC, Roblox Corp., Meta Platforms Inc., Microsoft Corp. and Sony Group Corp.

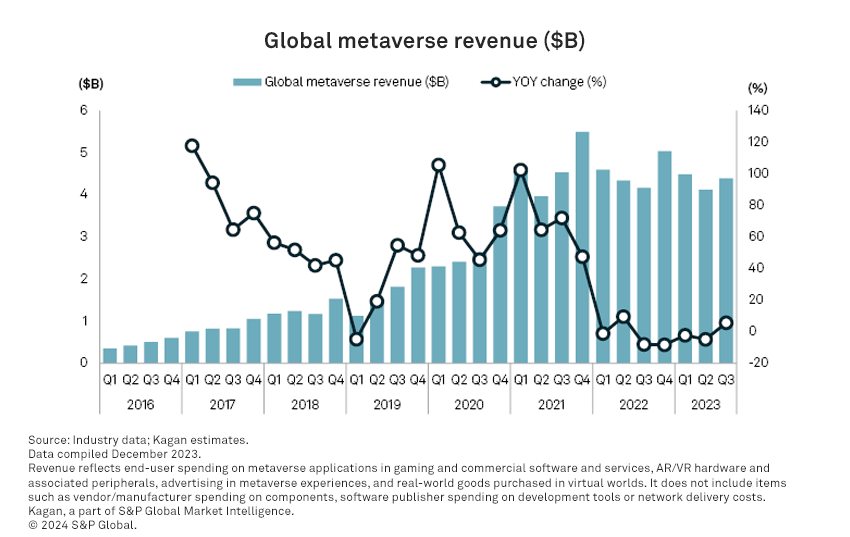

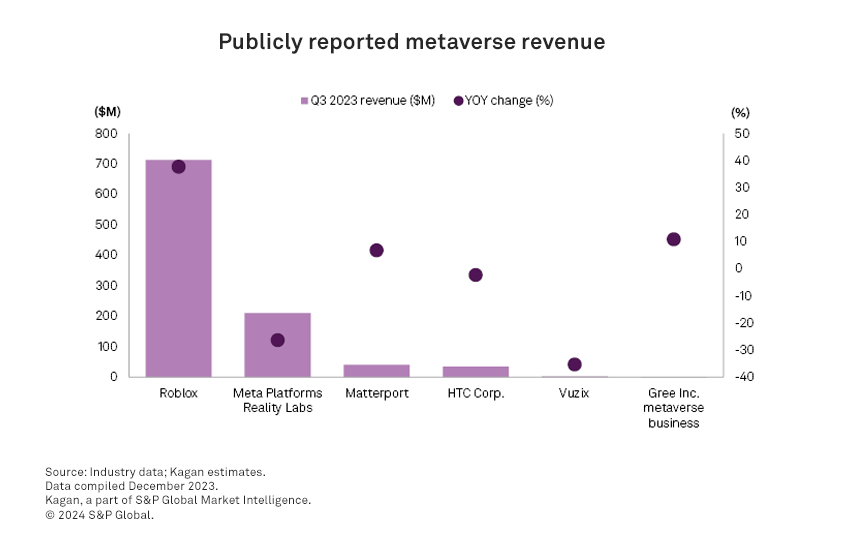

Kagan estimates third-quarter metaverse gaming revenue grew 18.4% year over year to $1.46 billion, the biggest step forward for the segment since the fourth quarter of 2021. Roblox was the primary driver with a staggering 37.8% year-over-year increase in revenue to $713.2 million. The company continues to execute on expanding into new geographic markets and demographics. It launched on PlayStation consoles in October, giving it an additional catalyst in the fourth quarter.

The fourth quarter will also include a dramatic update to Fortnite, including the addition of Lego Fortnite, which is the fruit of a $1 billion investment from Kirkbi Invest A/S and Sony, made in October 2022. Lego Fortnite is a collaborative experience resembling Minecraft, and will include Lego versions of skins and other assets from the base Fortnite Battle Royale Mode.

Our metaverse estimates include a growing component of Fortnite revenue as its users increasingly engage with disparate game modes, making it more of a metaverse-style experience and less of the narrowly defined shooter experience that fueled its initial ascent.

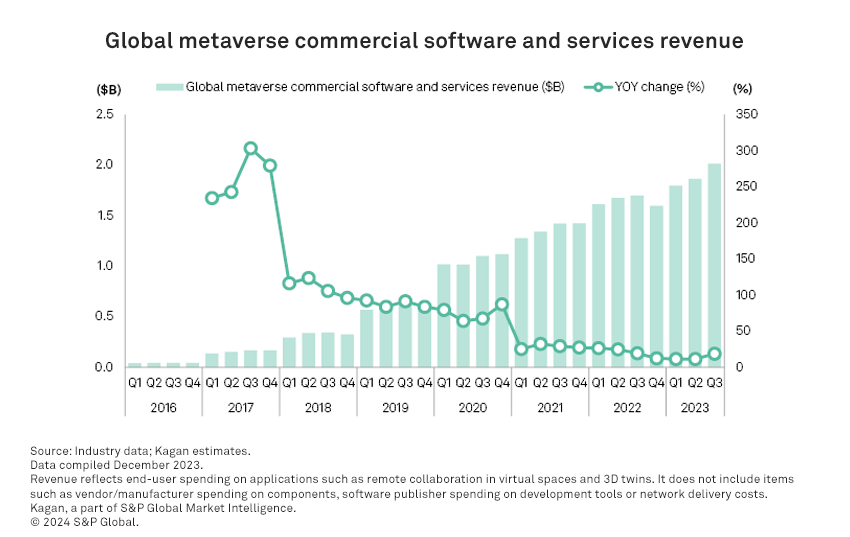

We estimate commercial metaverse software and services revenue grew 18.6% year over year to $2.01 billion. The growth driver in this segment is the emerging class of generative artificial intelligence applications, such as automated production of assets for 3D virtual spaces.

We see the rising tide of artificial intelligence-focused hardware, such as NVIDIA’s DGX series, as an indication that enterprise and industrial operations are embracing these new technologies for workflow automation and simulation.

Metaverse-leaning applications are just a small piece of the overall AI picture, but their contribution is enough to move the needle in our metaverse tracker. We do not count AI-accelerated hardware revenue in this data set, but some metaverse software and services will leverage this hardware to drive revenue.

We can begin to see a sliver of the impact artificial intelligence is having in the metaverse through publicly reporting spatial data company Matterport Inc. In June, the company claimed that its AI-enhanced Genesis platform will produce digital twins more efficiently, augmenting the company’s sales pitch. Matterport revenue grew 6.8% year over year to $40.6 million.

On the industrial side, companies such as Arvizio and Taqtile Inc. have announced that AI-enhanced visual inspection systems will be added to their augmented-reality workflow stacks.

Elsewhere in the commercial space, Siemens reported growing orders for electronic design automation, a segment that provides design and simulation services for electronic systems. This success was partially offset by a decline in its short-cycle industry automation business. We allocate a fraction of Siemens’ overall digital transformation business to our metaverse estimates.

Metaverse interface hardware revenue fell an estimated 26.5% year over year to $880 million as demand for an aging fleet of augmented- and virtual-reality headsets declined. Meta, HTC Corp. and Vuzix Corp. all reported declining revenue driven by lower headset and smart glasses sales.

The segment has an opportunity to return to growth in the fourth quarter as the Meta Quest 3 started shipping in October. The new headset is smaller and lighter than the Quest 2, and comes equipped with robust pass-through cameras. The new cameras offer users a video feed of the world around them with superimposed digital imagery.

This puts the device solidly into mixed-reality territory (merging VR and AR capability), which is a key element of Apple Inc.’s $3,500 Vision Pro device due in 2024, with Apple using the term “spatial computing” for the same combination of the two approaches to immersive digital content.

Meta’s Quest 3 advertising campaign shows headset users learning to play piano on a real piano and playing with virtual Lego bricks on a real coffee table. The catch is that the Quest 3 will cost consumers $500, a big markup from the Quest 2’s launch price of $300. Demand generated by a new feature set and a sleeker design could easily be offset by the increased asking price.

Our estimates for advertising, e-commerce and other opportunities continue to be relatively nonmaterial, with each registering less than $50 million in revenue per quarter. We are monitoring Roblox’s push into display and video advertising. Roblox’s scale, popularity and structure offer the best testbed yet for advertising in 3D virtual spaces. Roblox’s campaign into advertising is still in its early days, but the company says it generated only $30 million of revenue from branded virtual items and ad spending through the first nine months of 2023, less than 2% of total company revenue.

Want insights on AI trends delivered to your inbox? Join the 451 Alliance.