Environmental, social and governance-themed investment is one of the fastest-growing segments in asset management because investors are keen to pour money into organizations and bond issuers that align with their ESG concerns.

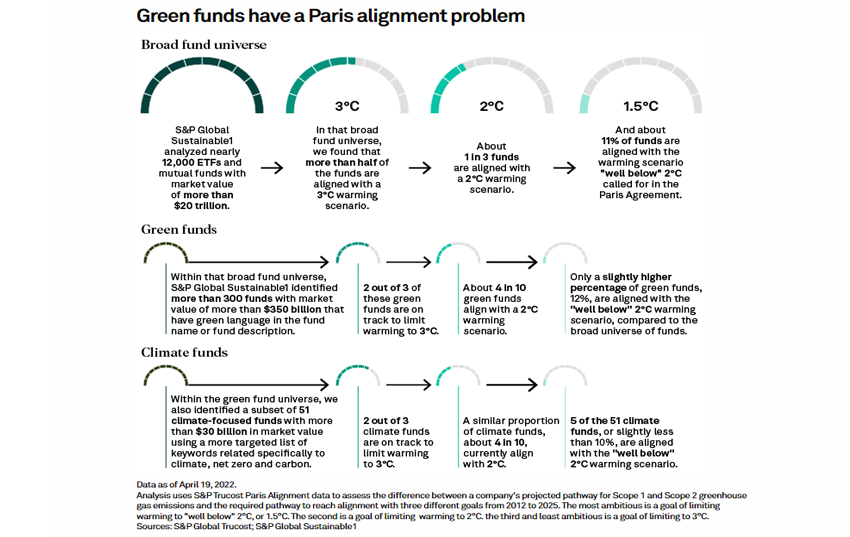

However, only 12% of green funds are on track to meet the global climate goals of the Paris Agreement, according to a study by S&P Global Sustainable1. Across a universe of nearly 12,000 equity mutual funds and exchange-traded funds tracked, about 11% — nearly the same proportion — are expected to meet the goal to limit global warming to “well below” 2 degrees C.

Far off the mark

Within the broad universe of funds, an analysis by S&P Global Sustainable1 identified over 300 funds representing more than $350 billion in market value that use green or environmental language in their fund names or to describe their investment objectives. A subset of 51 climate-focused funds using more targeted terms related to climate, net zero and carbon was further identified.

The study was not intended to measure whether the funds were mislabeled or misleading, but rather to estimate how effective organizations would be at meeting their emissions targets.

The analysis was carried out by overlaying S&P Global Trucost Paris Alignment data, which covers more than 17,000 companies, on the fund holdings to assess the funds’ warming trajectory. This data sums actual Scope 1 and Scope 2 greenhouse gas emissions from 2012 to the most recent available historical data and then forecasts emissions through 2025. Budget alignment is calculated per $1 million invested, to put the budget in perspective relative to the size of the portfolio’s total market value.

Fund alignment

Sustainability-minded investors tend to see an organization’s alignment with 1.5 degrees C or 2 degrees as a proxy for a robust environment strategy that could help to lower carbon emissions. The underwhelming findings of the study show that most of these funds have a wide misalignment with the Paris Agreement goal, despite the eco-friendly or climate-conscious messaging that may be perceived by the investors.

Underperforming targets

Limiting the rise in global temperature to about 1.5 degrees above pre-industrial level is, in theory, the primary goal of any net-zero or climate-focused commitment.

However, about 33% of green funds — over 100 funds representing close to $120 billion in market value — are set to overshoot the 3-degree warming scenario. One-third of the climate-specific funds — 17 out of 51 — are expected to exceed 3 degrees. Overall, 46% of funds from the broad universe are expected to overshoot the 3-degree warming mark.

The green funds are slightly better positioned in terms of market value. A greater share of green fund market value is aligned with the target range of either 1.5 degrees C or 2 degrees.

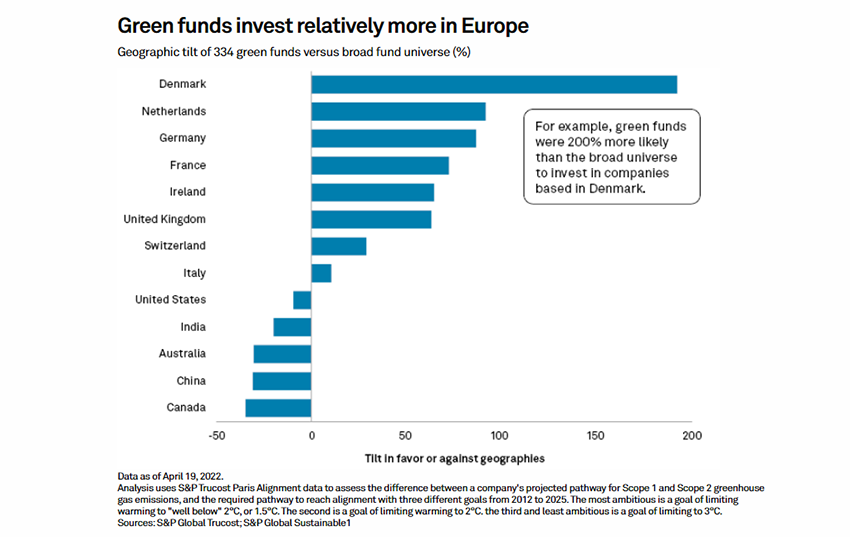

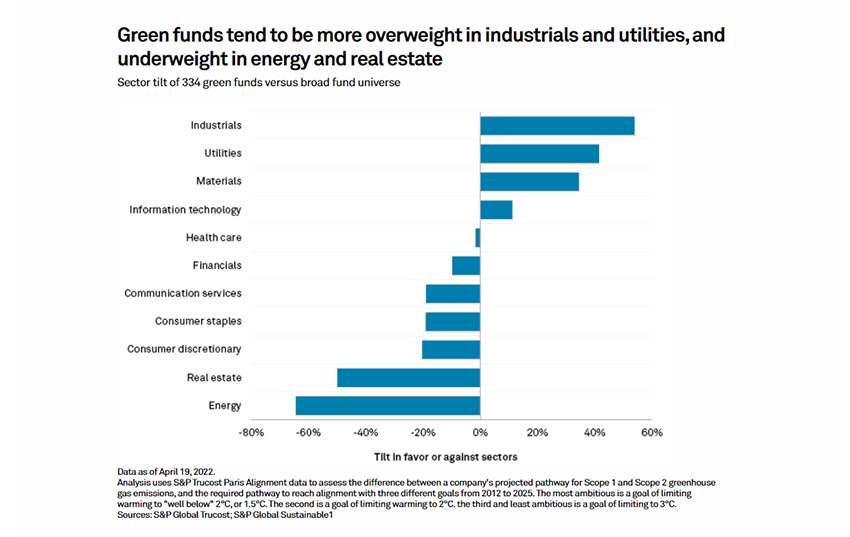

The green funds also tend to have more exposure to Europe, less exposure to China, Canada and the U.S. Most of the green funds are weighted more toward organizations in the technology, materials, utilities and industrial sectors, with less exposure to energy and real estate sectors.

Across the broad universe of funds, a greater share of market value is aligned with 3 degrees C or above 3 degrees. In the narrower set of climate funds, market value is better aligned with 2 degrees C, even though more than 20% of market value is set to exceed 3 degrees.

Green credentials

A regression analysis shows that the emissions budget performance of green funds is statistically different from that of the broad fund universe. In the 1.5-degree warming scenario, for example, the median green fund is over budget by 116 tons of CO2e per $1 million invested, whereas the median of the broad fund universe is over budget by 212 tons of CO2e per $1 million invested — almost twice as much.

A sustainable outlook

A promising finding from the study shows that dozens of funds in the S&P Global Sustainable1 are under budget in all three warming scenarios. Furthermore, many misaligned funds are only slightly over budget: 116 of the over-budget funds in a 1.5-degree scenario are off by less than 100 tons of CO2-equivalent per $1 million invested.

The takeaway from this study remains that green funds are still more closely aligned to the Paris Agreement goals than the broad universe of funds. But there is still a long way to go before firms make good on their green promises.

Want insights on ESG trends delivered to your inbox? Join the 451 Alliance.