In the 451 Alliance’s November 2021 IT Spending survey, we asked corporate respondents about the latest trends in smartphones. The results provide insight into their companies’ smartphone purchasing plans, current usage and customer satisfaction.

Planned Smartphone Purchasing

Similar to the slowing momentum in the overall IT spending environment, the survey finds overall planned smartphone purchasing (22%) is also moving sideways with a slight 1-point drop compared with the previous quarter. These results are a reminder that business device buying is part of larger technology spending plans, and thus are strongly influenced by what happens at the top of the budget funnel.

The bigger purchasers of smartphones for employees continue to be larger companies (>250 employees; 37%), which is unchanged compared to last quarter. This compares with only 12% of smaller organizations (<250 employees), which is down compared to previously. While spending by larger companies generally outpaces that of smaller ones, when budgets start to tighten, smaller companies usually tighten the quickest.

Apple (76%) continues to enjoy tremendous corporate demand, regardless of the fluctuations in overall purchasing plans – and even the fluctuations in manufacturer-specific planned purchases – solidifying its position as the top smartphone manufacturer for businesses, according to our data.

Samsung (38%) remains a distant second, with Google (9%) and the rest even further behind. Another notable result of tightening budgets is the drop off in demand for less prominent manufacturers as buying interest becomes more focused on the leading brands.

Among specific models, the iPhone 13 series dominates the Apple smartphones that companies plan to buy, led by the main iPhone 13 model. Demand for the iPhone 13 Pro (26%) is also solid, followed by the iPhone 13 Pro Max (16%) and iPhone 12 (10%). Importantly, 35% of respondents don’t know which models their company will purchase. The phones that this group ultimately buys will have a material impact on the final tallies for iPhone model demand.

Current Business Smartphone Usage

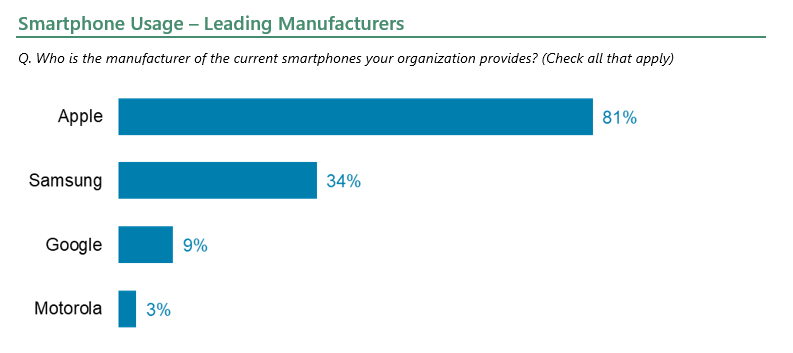

The number of companies providing smartphones to their employees (44%) is little changed compared with the previous survey in August, which is still a good sign for the potential of stability going forward. In terms of manufacturers, Apple (81%) remains the most popular brand, followed distantly by Samsung (34%). Google (9%) maintains it lead over Motorola, yet is still distantly behind the leaders.

A primary reason for Apple’s strong performance is its outstanding customer satisfaction ratings – and this quarter is no different. Current iOS users are more satisfied with their phones (95% very or somewhat satisfied) than users of their biggest rival platform, Android-powered phones (94%), although they are neck-and-neck in the current results.

Typically, we see Apple/iOS and Android fluctuate from quarter to quarter as new devices are released and already-in-use devices continue to age. Apple, for the most part, is seen as delivering the most consistent experience across different phones, which is what keeps it at the top of the market.

Want insights on business technology trends delivered to your inbox? Join the 451 Alliance.