Source: Gail Shotlander/Stock Photos/via Getty Images.

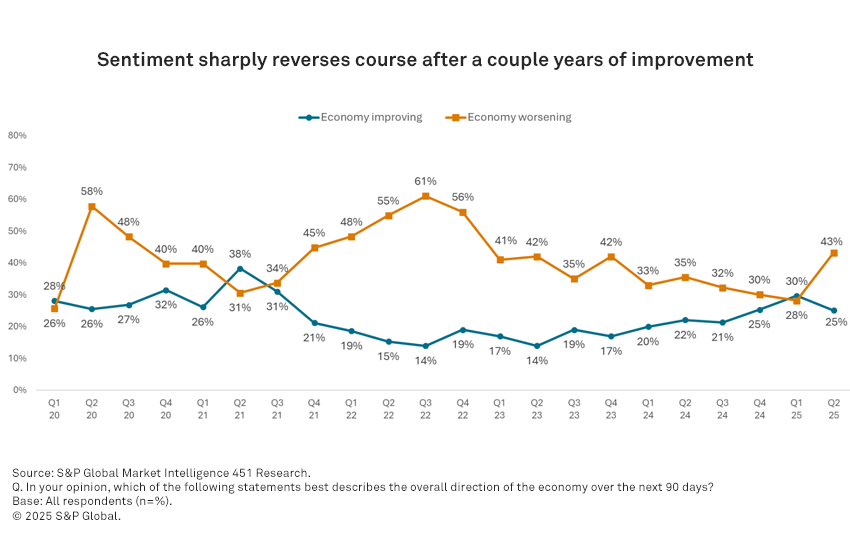

As we navigate through 2025, the landscape of consumer sentiment and spending has taken a notable turn. 451 Research, a part of S&P Global Market Intelligence recently conducted a survey which looks at factors such as overall consumer spending plans, categories seeing the most spending and threats to household finances, as well as consumer confidence in the economy and the impact of tariffs. The results from this survey reveal a sharp decline in consumer confidence, a reversal from the gradual improvements seen over the past two years.

Declining consumer sentiment

According to the study conducted by 451 Research, a part of S&P Global Market Intelligence, 43% of consumers now believe that the overall direction of the economy will worsen in the next 90 days, marking a significant 15-percentage-point increase compared to the first quarter of 2025. This shift in sentiment is the most substantial quarter-over-quarter change since Q2 2020, highlighting growing concerns among consumers about economic stability.

The impact of tariffs on consumer sentiment

One of the primary contributors to this decline in sentiment is the implementation of new tariff policies by the current US administration. A staggering 78% of respondents anticipate that these tariffs will lead to increased costs for consumer items. The sectors most affected include groceries (75%), consumer electronics (60%), automobiles (59%), and durable goods for the home (54%). Consumers are bracing for the worst, fearing that these policies will exacerbate inflation, which remains a significant concern for many.

Inflation as a top economic threat

Inflation has emerged as the foremost economic threat to personal finances, with 50% of respondents identifying it as a major concern. This worry is compounded by fears surrounding tariff policies (32%) and energy prices (24%). The ongoing pressure from inflation is leading consumers to tighten their spending plans, with 69% stating that the cost of living is driving them to reduce expenditures at a higher rate than in 2024.

Consumer spending plans on hold

Reflecting this cautious sentiment, consumer spending plans appear to be on hold. Our survey reveals that 25% of respondents plan to spend less over the next 90 days, while only 17% intend to increase their spending. This results in a net spending sentiment of -8, which is only slightly worse than the previous quarter. Most respondents (54%) expect their spending to remain unchanged, indicating a wait-and-see approach as they navigate the uncertain economic landscape.

Conclusion

As consumers grapple with the implications of tariffs and inflation, their confidence in economic recovery has waned. Findings from the 451 Research, a part of S&P Global Market Intelligence survey suggests that a significant portion of the population is adopting a cautious stance, prioritizing stability over spending amidst growing economic uncertainties. It remains to be seen how these factors will evolve in the coming months, but for now, consumers are clearly in a “wait and see” mode, reflecting the complexities of the current economic environment.

Want insights on consumer technology trends delivered to your inbox? Join the 451 Alliance.

This content may be AI-assisted and is composed, reviewed, edited and approved by S&P Global in accordance with our Terms of Service.